Establishing secure connection…Loading editor…Preparing document…

We are not affiliated with any brand or entity on this form.

How to Avoid Tax Scams and Protect Your Finances 2024-2026

be ready to get more

Create this form in 5 minutes or less

Find and fill out the correct how to avoid tax scams and protect your finances

Versions

Form popularity

Fillable & printable

4.8 Satisfied (37 Votes)

4.8 Satisfied (2329 Votes)

Create this form in 5 minutes!

How to create an eSignature for the how to avoid tax scams and protect your finances

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

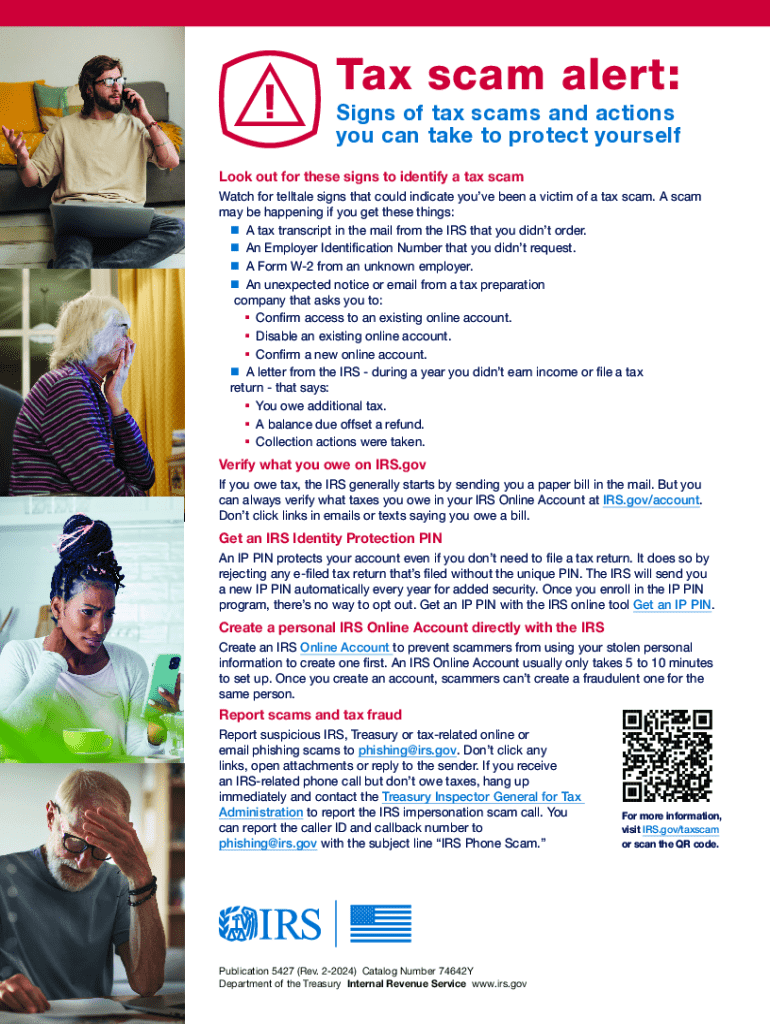

What are the best practices on how to avoid tax scams and protect your finances?

To avoid tax scams and protect your finances, always verify the legitimacy of any communication you receive regarding taxes. Use official IRS channels for inquiries and be cautious of unsolicited emails or phone calls. Additionally, consider using secure e-signature solutions like airSlate SignNow to ensure your documents are safely handled.

-

How can airSlate SignNow help in protecting my financial documents?

airSlate SignNow provides a secure platform for sending and eSigning documents, which helps protect your financial information. By using advanced encryption and authentication methods, you can ensure that your sensitive documents are safe from unauthorized access, thus aiding in how to avoid tax scams and protect your finances.

-

What features does airSlate SignNow offer to enhance document security?

airSlate SignNow offers features such as secure cloud storage, audit trails, and customizable access permissions. These features are designed to enhance document security and help you understand how to avoid tax scams and protect your finances by ensuring that only authorized individuals can access your sensitive information.

-

Is airSlate SignNow cost-effective for small businesses looking to avoid tax scams?

Yes, airSlate SignNow is a cost-effective solution for small businesses. With flexible pricing plans, it allows businesses to manage their documents securely without breaking the bank. This affordability is crucial for small businesses aiming to learn how to avoid tax scams and protect their finances.

-

Can I integrate airSlate SignNow with other financial software?

Absolutely! airSlate SignNow integrates seamlessly with various financial software, enhancing your workflow. This integration can help streamline your processes and contribute to how to avoid tax scams and protect your finances by ensuring that all your documents are securely managed in one place.

-

What benefits does eSigning provide in relation to tax documents?

eSigning with airSlate SignNow provides a fast, secure, and legally binding way to handle tax documents. This not only speeds up the process but also reduces the risk of fraud, helping you understand how to avoid tax scams and protect your finances effectively.

-

How does airSlate SignNow ensure compliance with tax regulations?

airSlate SignNow is designed to comply with various tax regulations, ensuring that your eSigned documents are legally valid. By using a compliant eSignature solution, you can better understand how to avoid tax scams and protect your finances, as it minimizes the risk of errors and legal issues.

Get more for How To Avoid Tax Scams And Protect Your Finances

Find out other How To Avoid Tax Scams And Protect Your Finances

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

be ready to get more

Get this form now!

If you believe that this page should be taken down, please follow our DMCA take down process here.