Form911 SP Rev 5 Request for Taxpayer Advocate Service Assistance and Application for Taxpayer Assistance Order Spanish Version 2022

What is the Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version

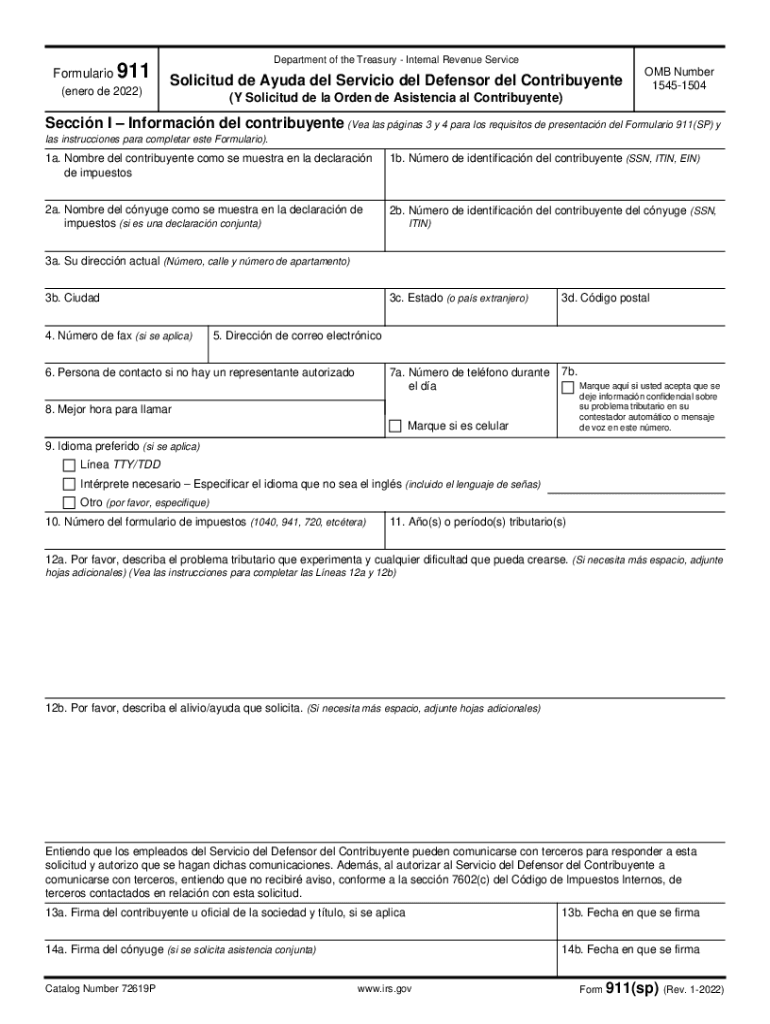

The Form911 SP Rev 5 is a crucial document designed for individuals seeking assistance from the Taxpayer Advocate Service (TAS) in the United States. This form allows taxpayers to request help in resolving issues with the Internal Revenue Service (IRS) that have not been addressed through normal channels. The Spanish version of this form ensures that Spanish-speaking taxpayers have equal access to these important services. It serves as both a request for assistance and an application for a Taxpayer Assistance Order, which can provide immediate relief in certain situations.

How to use the Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version

Using the Form911 SP Rev 5 involves a straightforward process. First, ensure that you have the correct version of the form, which is available in Spanish. Next, fill out the form with accurate and complete information regarding your tax situation. This includes details about the issues you are facing with the IRS and any previous attempts to resolve them. After completing the form, submit it to the appropriate TAS office. You can find the submission address on the form itself. It is important to keep a copy of the submitted form for your records.

Steps to complete the Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version

Completing the Form911 SP Rev 5 involves several key steps:

- Obtain the latest version of the form in Spanish.

- Provide your personal information, including your name, address, and contact details.

- Clearly describe the issue you are facing with the IRS.

- Detail any prior communications or attempts to resolve the issue.

- Sign and date the form to certify that the information provided is accurate.

Following these steps carefully will help ensure that your request for assistance is processed efficiently.

Eligibility Criteria

To be eligible for assistance through the Form911 SP Rev 5, taxpayers must meet certain criteria. Generally, the form is intended for individuals who are experiencing significant difficulties with the IRS, such as delays in processing their tax returns, issues with tax debts, or other unresolved tax matters. Additionally, taxpayers must demonstrate that they have made reasonable efforts to resolve their issues through standard IRS procedures. This form is specifically designed to assist those who feel that their problems have not been adequately addressed by the IRS.

Required Documents

When submitting the Form911 SP Rev 5, it is important to include any relevant documentation that supports your request for assistance. This may include:

- Copies of correspondence with the IRS regarding your issue.

- Tax returns for the years in question.

- Any notices or letters received from the IRS.

- Proof of identity, such as a driver’s license or Social Security card.

Including these documents can help the Taxpayer Advocate Service better understand your situation and expedite the assistance process.

Form Submission Methods

The Form911 SP Rev 5 can be submitted through various methods to accommodate different preferences. Taxpayers can choose to send the completed form by mail to the designated TAS office. The mailing address is provided on the form itself. Alternatively, some TAS offices may allow for in-person submissions, providing an opportunity for direct interaction with TAS representatives. It is important to check the specific submission guidelines for your local TAS office to ensure proper handling of your request.

Create this form in 5 minutes or less

Find and fill out the correct form911 sp rev 5 request for taxpayer advocate service assistance and application for taxpayer assistance order spanish version

Create this form in 5 minutes!

How to create an eSignature for the form911 sp rev 5 request for taxpayer advocate service assistance and application for taxpayer assistance order spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version?

The Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version is a specialized document designed to help Spanish-speaking taxpayers request assistance from the Taxpayer Advocate Service. This form ensures that individuals can effectively communicate their needs and receive the necessary support in their preferred language.

-

How can I access the Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version?

You can easily access the Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version through the airSlate SignNow platform. Simply navigate to our document library, where you can find and download the form for your use.

-

Is there a cost associated with using the Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version?

Using the Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version through airSlate SignNow is part of our subscription service. We offer various pricing plans that are cost-effective and designed to meet the needs of businesses and individuals alike.

-

What features does airSlate SignNow offer for the Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version?

airSlate SignNow provides a range of features for the Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version, including eSigning, document sharing, and secure storage. These features streamline the process, making it easier for users to complete and submit their forms efficiently.

-

How does the Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version benefit users?

The Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version benefits users by simplifying the process of seeking taxpayer assistance. It ensures that Spanish-speaking individuals can articulate their issues clearly, leading to faster resolutions and better support from the Taxpayer Advocate Service.

-

Can I integrate the Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version with other tools?

Yes, airSlate SignNow allows for seamless integration of the Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version with various business tools and applications. This integration enhances workflow efficiency and ensures that all your documents are easily accessible.

-

What support is available for users of the Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version?

Users of the Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version can access comprehensive support through airSlate SignNow. Our customer service team is available to assist with any questions or issues you may encounter while using the platform.

Get more for Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version

- Eeo 1 form pdf 100103334

- Aadl seating clinic referral form

- Herbalife order form 327648551

- Michigan mini tort sample letter form

- Church offering counting form

- Sound linkage pdf form

- Oxford casino win loss statements form

- Alberta consent excluding corporate income tax stakeholders use this form to grant consent to release their account information

Find out other Form911 SP Rev 5 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form