Form911 Sp Rev 3 Request for Taxpayer Advocate Service Assistance and Application for Taxpayer Assistance Order Spanish Version 2024-2026

Understanding the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version

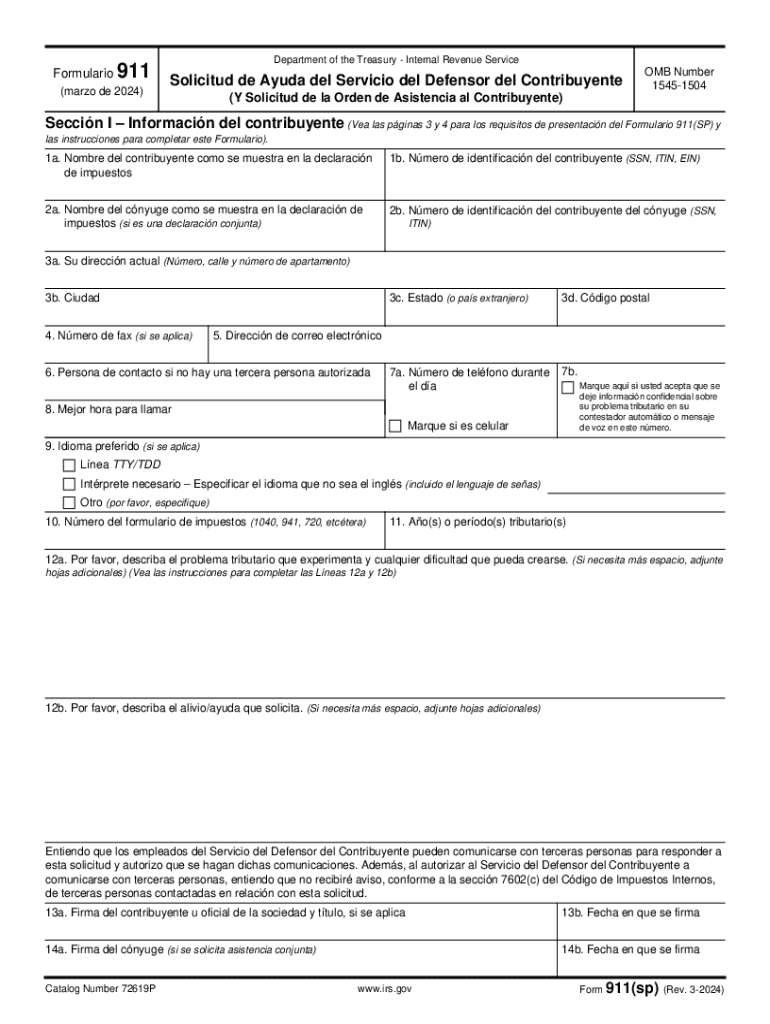

The Form911 sp Rev 3 is a crucial document designed to assist taxpayers in the United States who are facing difficulties with the Internal Revenue Service (IRS). This form allows individuals to request assistance from the Taxpayer Advocate Service (TAS), a resource available to help taxpayers navigate complex tax issues. The Spanish version of this form ensures that Spanish-speaking individuals have access to the same support and resources as English-speaking taxpayers, promoting inclusivity and understanding in the tax process.

Steps to Complete the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version

Completing the Form911 sp Rev 3 involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary personal information, including your name, address, and taxpayer identification number. Next, clearly outline the issues you are experiencing with the IRS. Provide detailed explanations of any correspondence you have had with the IRS regarding your case. Be sure to sign and date the form before submission. This thorough approach helps the Taxpayer Advocate Service understand your situation and provide the appropriate assistance.

How to Obtain the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version

The Form911 sp Rev 3 can be obtained directly from the IRS website or through local IRS offices. For those who prefer a digital format, the form is available for download in Spanish, allowing for easy access and completion. Additionally, community organizations and tax assistance centers may also provide copies of the form, ensuring that all taxpayers have the opportunity to seek the help they need.

Eligibility Criteria for the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version

To be eligible for assistance through the Form911 sp Rev 3, taxpayers must demonstrate that they are experiencing significant hardship due to IRS actions. This may include issues such as delays in processing tax returns, difficulties in obtaining refunds, or challenges in resolving tax disputes. The Taxpayer Advocate Service aims to assist those who feel they have nowhere else to turn, making this form an essential resource for affected individuals.

Required Documents for the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version

When submitting the Form911 sp Rev 3, it is important to include any relevant documentation that supports your request for assistance. This may include copies of previous correspondence with the IRS, tax returns, and any notices received from the IRS. Providing comprehensive documentation helps the Taxpayer Advocate Service assess your situation more effectively and expedites the assistance process.

Form Submission Methods for the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version

The Form911 sp Rev 3 can be submitted through various methods. Taxpayers may choose to mail the completed form to the appropriate Taxpayer Advocate Service office, ensuring that it is sent to the correct address based on their location. Alternatively, some offices may allow for in-person submissions. It is advisable to check the latest guidelines on submission methods to ensure compliance and timely processing of your request.

Create this form in 5 minutes or less

Find and fill out the correct form911 sp rev 3 request for taxpayer advocate service assistance and application for taxpayer assistance order spanish version

Create this form in 5 minutes!

How to create an eSignature for the form911 sp rev 3 request for taxpayer advocate service assistance and application for taxpayer assistance order spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version?

The Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version is a specialized document designed to help Spanish-speaking taxpayers request assistance from the Taxpayer Advocate Service. This form simplifies the process of obtaining help with tax-related issues, ensuring that language barriers do not hinder access to necessary support.

-

How can I access the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version?

You can easily access the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version through the airSlate SignNow platform. Simply navigate to our document library, where you can find and download the form in Spanish, ready for your use.

-

Is there a cost associated with using the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version?

Using the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version through airSlate SignNow is part of our cost-effective eSigning solution. We offer various pricing plans that cater to different business needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version?

airSlate SignNow provides a range of features for the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version, including easy document editing, secure eSigning, and real-time tracking. These features enhance the user experience and streamline the process of submitting your request.

-

Can I integrate the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version with other applications?

Yes, airSlate SignNow allows for seamless integration of the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version with various applications. This ensures that you can manage your documents efficiently and keep your workflow organized across different platforms.

-

What are the benefits of using airSlate SignNow for the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version?

Using airSlate SignNow for the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the process, allowing you to focus on what matters most—getting the assistance you need.

-

How secure is the Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version on airSlate SignNow?

Security is a top priority at airSlate SignNow. The Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version is protected with advanced encryption and secure access controls, ensuring that your sensitive information remains confidential and safe throughout the signing process.

Get more for Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version

Find out other Form911 sp Rev 3 Request For Taxpayer Advocate Service Assistance And Application For Taxpayer Assistance Order Spanish Version

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application