Form 433 F Sp Rev 7 CollectionInformation Statement Spanish Version 2024-2026

What is the Form 433 F sp Rev 7 Collection Information Statement Spanish Version

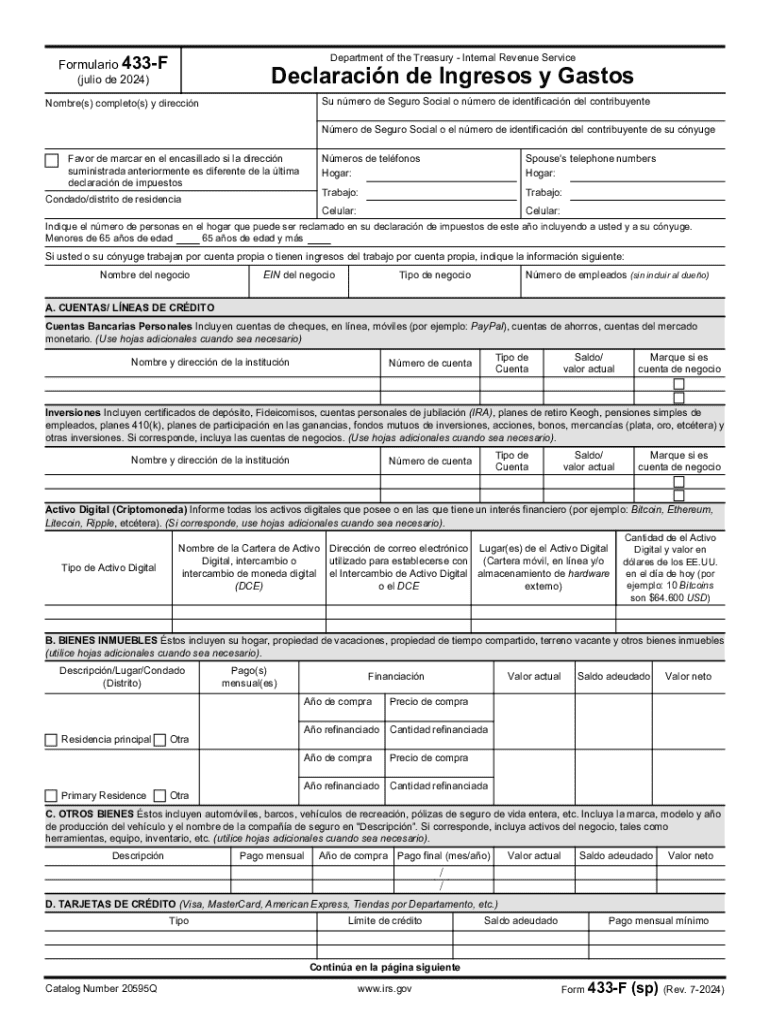

The Form 433 F sp Rev 7 Collection Information Statement Spanish Version is an essential document used by individuals to provide the Internal Revenue Service (IRS) with a detailed overview of their financial situation. This form is primarily utilized during the collection process, allowing taxpayers to disclose their income, expenses, and assets. By completing this form, individuals can demonstrate their ability to pay tax liabilities or request relief options, such as an installment agreement or currently not collectible status. The Spanish version ensures accessibility for Spanish-speaking taxpayers, facilitating clear communication with the IRS.

How to use the Form 433 F sp Rev 7 Collection Information Statement Spanish Version

Using the Form 433 F sp Rev 7 Collection Information Statement Spanish Version involves several straightforward steps. First, gather all necessary financial documents, including income statements, bank statements, and records of expenses. Next, fill out the form accurately, ensuring all sections are completed, including personal information, income details, and asset disclosures. Once the form is completed, review it for accuracy and completeness. Finally, submit the form to the appropriate IRS office, either by mail or electronically, depending on your specific situation. It is crucial to keep a copy for your records.

Steps to complete the Form 433 F sp Rev 7 Collection Information Statement Spanish Version

Completing the Form 433 F sp Rev 7 Collection Information Statement Spanish Version requires attention to detail. Follow these steps for effective completion:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Provide details about your income sources, such as wages, self-employment income, and any other earnings.

- List your monthly expenses, including housing costs, utilities, transportation, and other necessary expenditures.

- Disclose your assets, including cash, bank accounts, real estate, and vehicles.

- Sign and date the form, confirming that the information provided is accurate and complete.

Legal use of the Form 433 F sp Rev 7 Collection Information Statement Spanish Version

The Form 433 F sp Rev 7 Collection Information Statement Spanish Version is legally binding, meaning that the information provided must be truthful and accurate. Misrepresentation or failure to disclose relevant financial information can lead to penalties or further collection actions by the IRS. Taxpayers are encouraged to seek assistance from tax professionals or legal advisors to ensure compliance with IRS regulations when completing this form. Understanding the legal implications of the form can help avoid complications in the tax collection process.

Key elements of the Form 433 F sp Rev 7 Collection Information Statement Spanish Version

Several key elements are critical to the Form 433 F sp Rev 7 Collection Information Statement Spanish Version. These include:

- Personal Information: This section requires the taxpayer's identification details, including name and contact information.

- Income Details: Taxpayers must outline all sources of income, providing a comprehensive view of their financial situation.

- Monthly Expenses: A detailed account of regular expenses helps the IRS assess the taxpayer's ability to pay.

- Asset Disclosure: This section requires listing all significant assets, which may influence the IRS's collection decisions.

How to obtain the Form 433 F sp Rev 7 Collection Information Statement Spanish Version

The Form 433 F sp Rev 7 Collection Information Statement Spanish Version can be obtained directly from the IRS website or through various tax preparation services. Taxpayers may also request a copy by contacting the IRS directly. It is important to ensure that you are using the most current version of the form to avoid any issues during the submission process. Additionally, local tax offices may provide physical copies of the form for those who prefer in-person assistance.

Create this form in 5 minutes or less

Find and fill out the correct form 433 f sp rev 7 collectioninformation statement spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 433 f sp rev 7 collectioninformation statement spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 433 F sp Rev 7 Collection Information Statement Spanish Version?

The Form 433 F sp Rev 7 Collection Information Statement Spanish Version is a document used by the IRS to collect financial information from individuals. This form helps the IRS assess a taxpayer's ability to pay their tax liabilities. By providing accurate information, taxpayers can negotiate payment plans or settle their debts more effectively.

-

How can airSlate SignNow help with the Form 433 F sp Rev 7 Collection Information Statement Spanish Version?

airSlate SignNow simplifies the process of completing and signing the Form 433 F sp Rev 7 Collection Information Statement Spanish Version. Our platform allows users to fill out the form electronically, ensuring accuracy and efficiency. Additionally, you can easily eSign the document and send it securely to the IRS.

-

Is there a cost associated with using airSlate SignNow for the Form 433 F sp Rev 7 Collection Information Statement Spanish Version?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are cost-effective and provide access to features that streamline the completion of the Form 433 F sp Rev 7 Collection Information Statement Spanish Version. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the Form 433 F sp Rev 7 Collection Information Statement Spanish Version?

airSlate SignNow provides a range of features for the Form 433 F sp Rev 7 Collection Information Statement Spanish Version, including customizable templates, electronic signatures, and secure document storage. These features enhance the user experience and ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for the Form 433 F sp Rev 7 Collection Information Statement Spanish Version?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the Form 433 F sp Rev 7 Collection Information Statement Spanish Version. Whether you use CRM systems or cloud storage solutions, our platform can connect seamlessly to enhance your productivity.

-

What are the benefits of using airSlate SignNow for the Form 433 F sp Rev 7 Collection Information Statement Spanish Version?

Using airSlate SignNow for the Form 433 F sp Rev 7 Collection Information Statement Spanish Version offers numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your documents are processed quickly and securely, allowing you to focus on other important tasks.

-

Is airSlate SignNow user-friendly for completing the Form 433 F sp Rev 7 Collection Information Statement Spanish Version?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface makes it easy for anyone to complete the Form 433 F sp Rev 7 Collection Information Statement Spanish Version without prior experience. Our step-by-step guidance ensures a smooth process from start to finish.

Get more for Form 433 F sp Rev 7 CollectionInformation Statement Spanish Version

Find out other Form 433 F sp Rev 7 CollectionInformation Statement Spanish Version

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document