Form 943 XAdjusted Employer's ANNUAL Federal Tax 2024-2026

Understanding Form 943

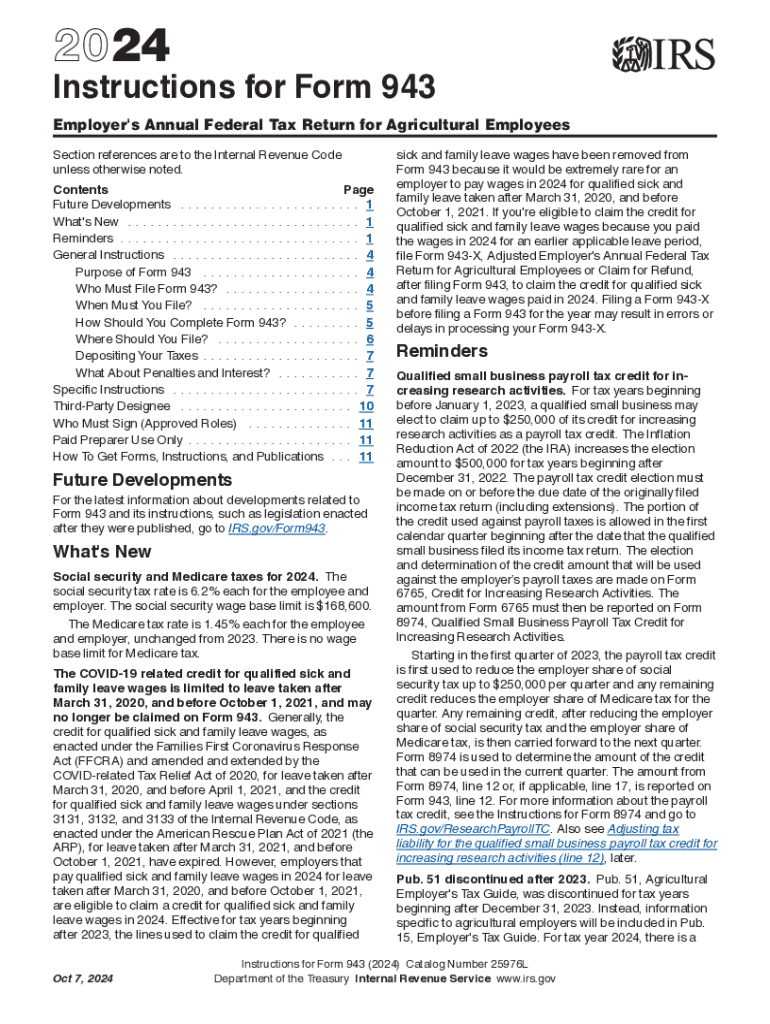

Form 943 is the Adjusted Employer's Annual Federal Tax Return for Agricultural Employees. This form is specifically designed for employers in the agricultural sector who are responsible for reporting and paying federal employment taxes for their agricultural workers. It is essential for employers to accurately report wages, tips, and other compensation paid to their employees, as well as the corresponding taxes withheld.

The form is required for employers who pay wages to farmworkers, including those who work in farming, ranching, and other agricultural operations. Understanding the requirements and instructions for completing Form 943 is crucial for compliance with federal tax regulations.

Steps to Complete Form 943

Completing Form 943 involves several key steps to ensure accuracy and compliance. Here’s a general outline of the process:

- Gather Necessary Information: Collect all relevant data, including employee wages, tips, and the total amount of federal employment taxes withheld.

- Fill Out the Form: Enter the required information in the appropriate sections of Form 943, ensuring that all figures are accurate and reflect the correct amounts.

- Review for Errors: Double-check the completed form for any mistakes or omissions that could lead to penalties.

- Submit the Form: File Form 943 by the specified deadline, either electronically or via mail, depending on your preference and the IRS guidelines.

Filing Deadlines for Form 943

It is crucial to be aware of the filing deadlines associated with Form 943 to avoid penalties. Generally, Form 943 must be filed annually by January 31 of the following year for which the taxes are being reported. If January 31 falls on a weekend or holiday, the deadline is extended to the next business day. Employers should also be mindful of any quarterly tax payments due throughout the year, which may affect their overall filing schedule.

Where to Mail Form 943

Mailing Form 943 to the correct address is essential for ensuring timely processing. The mailing address may vary depending on whether the employer is including a payment with the form. Generally, if no payment is included, Form 943 should be sent to:

Department of the Treasury

Internal Revenue Service

P.O. Box 219227

Kansas City, MO 64

If a payment is included, the form should be sent to:

Internal Revenue Service

P.O. Box 804522

Cincinnati, OH 45

Key Elements of Form 943

Form 943 consists of several key components that employers must complete accurately. These elements include:

- Employer Identification Information: This includes the employer's name, address, and Employer Identification Number (EIN).

- Wages and Tips: Employers must report total wages, tips, and other compensation paid to agricultural employees.

- Tax Calculation: The form requires employers to calculate the total federal employment taxes owed based on the reported wages.

- Signature: The form must be signed by an authorized representative of the employer to validate the information provided.

IRS Guidelines for Form 943

It is important for employers to adhere to IRS guidelines when completing and submitting Form 943. These guidelines provide detailed instructions on how to accurately fill out the form, including the necessary calculations and reporting requirements. Employers should refer to the official IRS instructions for Form 943 to ensure compliance and to understand any updates or changes to the filing process.

Create this form in 5 minutes or less

Find and fill out the correct form 943 xadjusted employers annual federal tax

Create this form in 5 minutes!

How to create an eSignature for the form 943 xadjusted employers annual federal tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 943 and why is it important?

Form 943 is a tax form used by agricultural employers to report wages paid to farmworkers and the associated taxes. Understanding Form 943 is crucial for compliance with IRS regulations, ensuring that employers accurately report their payroll taxes and avoid penalties.

-

How can airSlate SignNow help with Form 943?

airSlate SignNow simplifies the process of completing and submitting Form 943 by providing an intuitive platform for eSigning and document management. With our solution, users can easily fill out, sign, and send Form 943 electronically, streamlining the workflow and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 943?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solution ensures that you can manage Form 943 and other documents without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing Form 943?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows specifically designed for Form 943. These features enhance efficiency and accuracy, making it easier for businesses to handle their tax documentation.

-

Can I integrate airSlate SignNow with other software for Form 943?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to connect your existing tools for managing Form 943. This integration capability enhances productivity by enabling data transfer and reducing manual entry.

-

What are the benefits of using airSlate SignNow for Form 943?

Using airSlate SignNow for Form 943 provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform ensures that your tax documents are handled securely and can be accessed anytime, anywhere, making compliance easier.

-

Is airSlate SignNow user-friendly for completing Form 943?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete Form 943. The intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform effortlessly.

Get more for Form 943 XAdjusted Employer's ANNUAL Federal Tax

Find out other Form 943 XAdjusted Employer's ANNUAL Federal Tax

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free