Irs Form 943 2015

What is the IRS Form 943

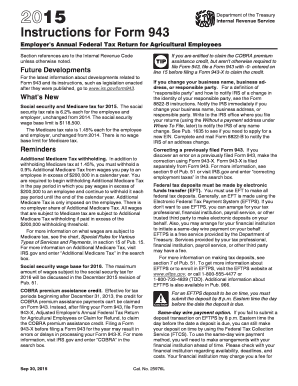

The IRS Form 943 is a tax form specifically designed for agricultural employers in the United States. It is used to report annual payroll taxes withheld from employees who work in agricultural sectors. This form allows employers to report wages, tips, and other compensation paid to farmworkers, as well as the federal income tax withheld from those payments. Understanding this form is crucial for compliance with federal tax regulations and ensuring proper reporting of employee earnings.

How to use the IRS Form 943

To effectively use the IRS Form 943, employers must first gather all relevant payroll information for their agricultural employees. This includes total wages paid, any tips received, and the amount of federal income tax withheld throughout the year. Once the data is compiled, employers can accurately fill out the form, ensuring that all sections are completed correctly. After completing the form, it must be filed with the IRS by the specified deadline to avoid penalties.

Steps to complete the IRS Form 943

Completing the IRS Form 943 involves several key steps:

- Gather necessary payroll records for all agricultural employees.

- Fill out the employer identification information, including your name, address, and Employer Identification Number (EIN).

- Report total wages, tips, and other compensation in the designated sections.

- Calculate the federal income tax withheld and report it accurately.

- Review the completed form for accuracy before submission.

- Submit the form to the IRS by the due date, either electronically or via mail.

Legal use of the IRS Form 943

The IRS Form 943 is legally recognized as a valid document for reporting payroll taxes for agricultural workers. To ensure its legal standing, employers must comply with all IRS guidelines and accurately report all required information. Using a reliable digital platform for e-signatures can enhance the legal validity of the form, as it ensures compliance with regulations such as the ESIGN Act and UETA. Proper completion and timely submission are essential to avoid any legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 943 are crucial for compliance. Generally, the form must be filed annually by January 31 of the following year for the previous tax year. Employers should also be aware of any specific deadlines related to payments of payroll taxes throughout the year. Staying informed about these dates helps prevent penalties and ensures that all tax obligations are met on time.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 943 can be submitted through various methods. Employers can file the form electronically using IRS e-file services, which is often the fastest and most efficient method. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submission is generally not available for this form, but employers can consult with tax professionals for assistance if needed. Choosing the right submission method can streamline the filing process and enhance compliance.

Quick guide on how to complete 2015 irs form 943

Complete Irs Form 943 effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Irs Form 943 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and eSign Irs Form 943 seamlessly

- Locate Irs Form 943 and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invite link, or download it to your PC.

Put aside concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Irs Form 943 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 irs form 943

Create this form in 5 minutes!

How to create an eSignature for the 2015 irs form 943

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is IRS Form 943 and who needs to file it?

IRS Form 943 is used by agricultural employers to report income taxes, social security tax, and Medicare tax withheld from their employees' wages. If you pay wages to farmworkers, you are required to file this form annually. Understanding how to properly complete IRS Form 943 is essential for compliance with federal tax laws.

-

How can airSlate SignNow help with IRS Form 943?

AirSlate SignNow provides an easy-to-use platform for electronically signing and managing IRS Form 943 and other documents. Our solution streamlines the process, making it quicker to send, sign, and store your forms securely. By using airSlate SignNow, you can ensure that your IRS Form 943 is filed accurately and on time.

-

Is there a cost associated with using airSlate SignNow for IRS Form 943?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. Our plans are designed to be cost-effective while providing robust features for electronic signing and document management, including IRS Form 943. You can choose a plan that best suits your volume of document handling.

-

What features does airSlate SignNow offer for managing IRS Form 943?

AirSlate SignNow offers features such as customizable templates, automated workflows, and secure storage for IRS Form 943. Additionally, our platform allows for real-time tracking of document status, ensuring you never miss a filing deadline. These features make managing your IRS Form 943 efficient and hassle-free.

-

Can I integrate airSlate SignNow with other software for filing IRS Form 943?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow for filing IRS Form 943. Whether you use accounting software or other document management systems, our integrations ensure that all your documents are synchronized. This makes it easier to manage your IRS Form 943 alongside your other business documents.

-

What are the benefits of using airSlate SignNow for IRS Form 943?

Using airSlate SignNow to handle IRS Form 943 offers numerous benefits, including time savings, reduced paperwork, and improved accuracy. Our electronic signing solution minimizes the risk of errors and provides a clear audit trail for compliance purposes. Additionally, it enhances the overall efficiency of your document management process.

-

How secure is airSlate SignNow for handling IRS Form 943?

AirSlate SignNow takes security seriously, implementing advanced encryption and compliance measures to protect your IRS Form 943 and other sensitive documents. We adhere to industry standards to ensure that your data remains confidential and secure. You can trust airSlate SignNow to handle your IRS Form 943 with the utmost security.

Get more for Irs Form 943

Find out other Irs Form 943

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy