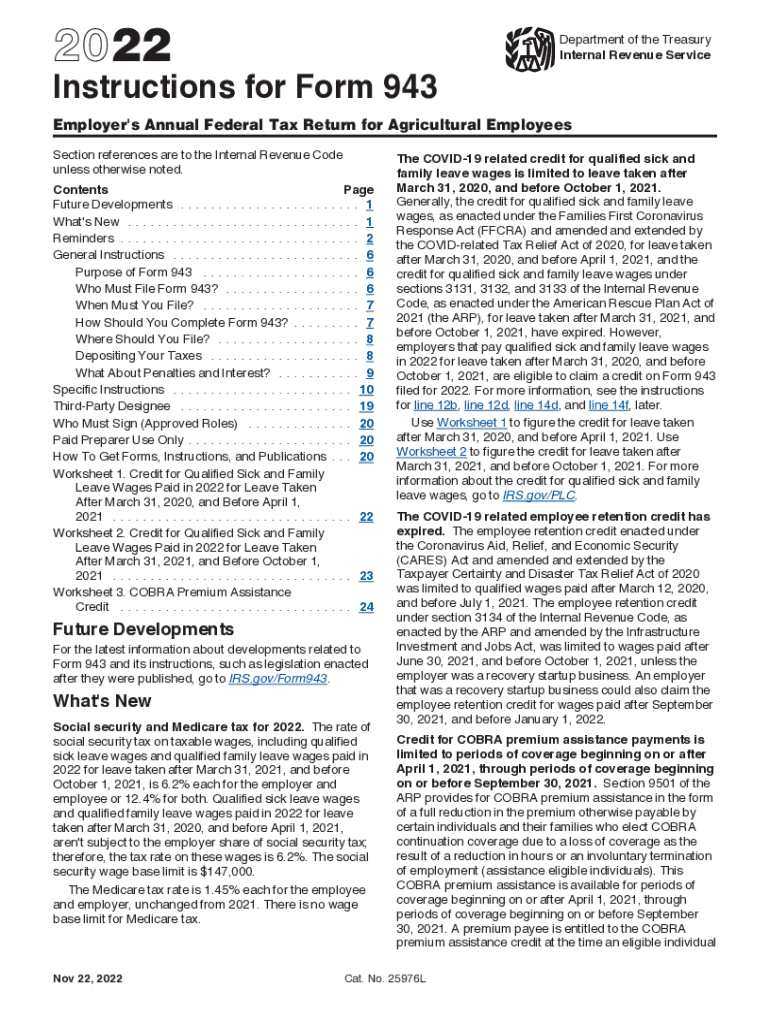

Instructions for Form 943 Instructions for Form 943, Employer's Annual Federal Tax Return for Agricultural Employees 2022

What is Form 943?

Form 943, officially known as the Employer's Annual Federal Tax Return for Agricultural Employees, is a tax document used by employers in the agricultural sector to report wages paid to farmworkers and the associated federal taxes withheld. This form is specifically designed for agricultural employers who pay wages to employees working in farming and agricultural activities. It is essential for these employers to accurately report their tax obligations to the IRS to ensure compliance with federal tax laws.

Steps to Complete Form 943

Completing Form 943 involves several important steps to ensure accuracy and compliance. Here are the key steps:

- Gather necessary information, including your Employer Identification Number (EIN), total wages paid to employees, and the amount of federal taxes withheld.

- Fill out the form, ensuring that all sections are completed accurately. This includes reporting the total number of employees and the total wages paid during the year.

- Calculate the total taxes owed and any adjustments that may apply.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the designated deadline, either electronically or via mail.

Filing Deadlines for Form 943

It is crucial to be aware of the filing deadlines for Form 943 to avoid penalties. Typically, the form is due on January 31 of the year following the tax year being reported. If January 31 falls on a weekend or holiday, the due date may be extended to the next business day. Employers should also be mindful of any specific state deadlines that may apply.

Legal Use of Form 943

Form 943 is legally binding and must be filed accurately to comply with IRS regulations. Employers are required to maintain records supporting the information reported on the form, including payroll records and tax payment documentation. Failure to file Form 943 correctly can result in penalties and interest charges imposed by the IRS.

Required Documents for Form 943

When preparing to file Form 943, employers should have the following documents ready:

- Employer Identification Number (EIN)

- Payroll records detailing wages paid to each employee

- Documentation of federal taxes withheld

- Any prior year tax returns that may be relevant for adjustments

IRS Guidelines for Form 943

The IRS provides specific guidelines for completing Form 943, which include detailed instructions on each section of the form. Employers are encouraged to refer to the official IRS instructions for Form 943 for comprehensive guidance on reporting requirements, calculations, and filing procedures. Staying informed about any updates or changes to the form is essential for compliance.

Quick guide on how to complete 2022 instructions for form 943 instructions for form 943 employers annual federal tax return for agricultural employees

Effortlessly Prepare Instructions For Form 943 Instructions For Form 943, Employer's Annual Federal Tax Return For Agricultural Employees on Any Device

Online document management has gained popularity among companies and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any holdups. Handle Instructions For Form 943 Instructions For Form 943, Employer's Annual Federal Tax Return For Agricultural Employees on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to Modify and Electronically Sign Instructions For Form 943 Instructions For Form 943, Employer's Annual Federal Tax Return For Agricultural Employees with Ease

- Find Instructions For Form 943 Instructions For Form 943, Employer's Annual Federal Tax Return For Agricultural Employees and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your preference. Revise and electronically sign Instructions For Form 943 Instructions For Form 943, Employer's Annual Federal Tax Return For Agricultural Employees and guarantee effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 instructions for form 943 instructions for form 943 employers annual federal tax return for agricultural employees

Create this form in 5 minutes!

People also ask

-

What are the 943 instructions 2023 for using airSlate SignNow?

The 943 instructions 2023 provide essential guidelines on how to navigate the airSlate SignNow platform. Users can easily create, send, and manage electronic signatures using these instructions. Following them ensures compliance and efficiency in document handling.

-

How does airSlate SignNow's pricing align with the 943 instructions 2023?

The pricing for airSlate SignNow is designed to be cost-effective while supporting the 943 instructions 2023. With various plans available, businesses can choose one that fits their needs while ensuring compliance with the latest requirements for document signing.

-

What features are included in airSlate SignNow related to the 943 instructions 2023?

AirSlate SignNow includes advanced features that help users comply with the 943 instructions 2023. These features, such as customizable templates and team management tools, streamline the process of eSigning and document management.

-

Are there any benefits of using airSlate SignNow concerning the 943 instructions 2023?

Yes, using airSlate SignNow in accordance with the 943 instructions 2023 offers multiple benefits. It enhances workflow efficiency, reduces paperwork, and ensures that all legal requirements for eSigning are met, simplifying the overall process.

-

What integrations does airSlate SignNow offer to support the 943 instructions 2023?

AirSlate SignNow seamlessly integrates with various applications and services that are essential to following the 943 instructions 2023. These integrations allow users to easily connect their document workflows with tools like CRM platforms, accounting software, and cloud storage services.

-

Is airSlate SignNow user-friendly for those following the 943 instructions 2023?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, making it simple for anyone to follow the 943 instructions 2023. The intuitive interface ensures that users of all skill levels can quickly navigate the platform and execute eSignatures with ease.

-

How can I get support for the 943 instructions 2023 while using airSlate SignNow?

AirSlate SignNow offers comprehensive support to help users with the 943 instructions 2023. Users can access tutorials, FAQs, and customer support services to resolve any queries or issues they may encounter while using the platform.

Get more for Instructions For Form 943 Instructions For Form 943, Employer's Annual Federal Tax Return For Agricultural Employees

- Estate planning questionnaire and worksheets new york form

- Document locator and personal information package including burial information form new york

- Demand to produce copy of will from heir to executor or person in possession of will new york form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497322053 form

- Bill of sale of automobile and odometer statement ohio form

- Bill of sale for automobile or vehicle including odometer statement and promissory note ohio form

- Promissory note in connection with sale of vehicle or automobile ohio form

- Bill of sale for watercraft or boat ohio form

Find out other Instructions For Form 943 Instructions For Form 943, Employer's Annual Federal Tax Return For Agricultural Employees

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later