About General Instructions for Certain Information Returns 2024-2026

Understanding General Instructions for Certain Information Returns

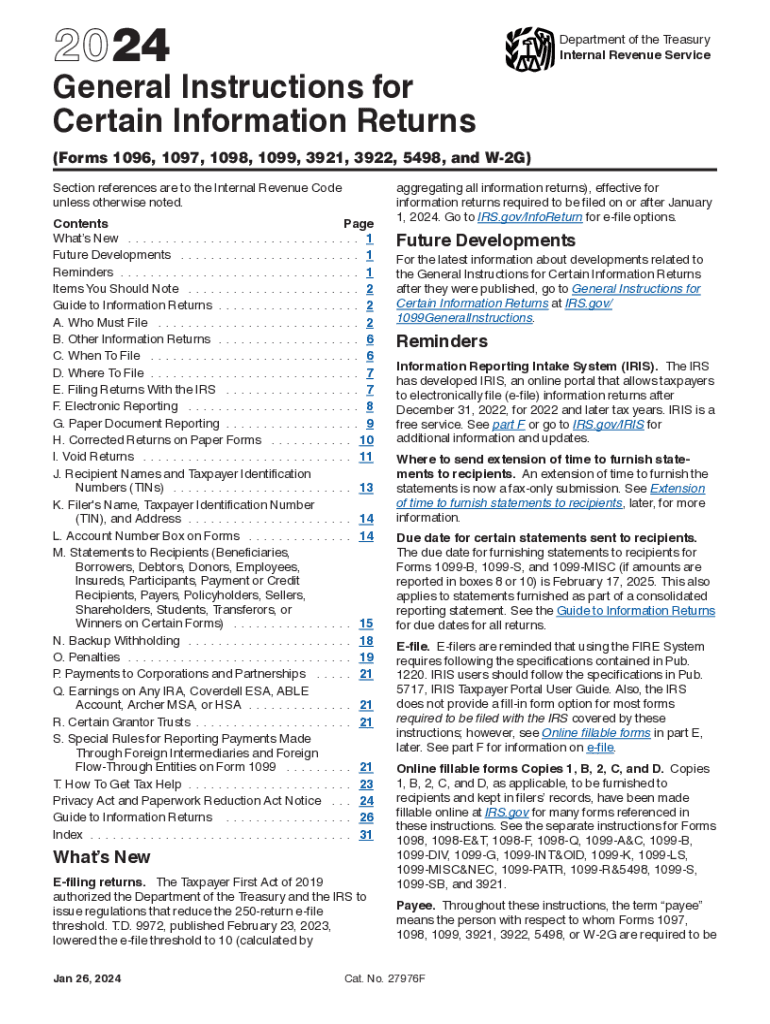

The general instructions for certain information returns provide essential guidance for taxpayers and businesses in the United States. These instructions outline the requirements for reporting various types of income, payments, and transactions to the Internal Revenue Service (IRS). They serve as a comprehensive resource for understanding the obligations associated with specific forms, such as the W-2 and 1099 series, ensuring compliance with federal tax laws.

Steps to Complete the General Instructions for Certain Information Returns

Completing the general instructions for certain information returns involves several key steps. First, identify the specific form applicable to your situation, such as the 1099-MISC for reporting miscellaneous income. Next, gather all necessary documentation, including payment records and recipient information. Carefully follow the instructions provided for each form, ensuring accurate reporting of amounts and compliance with deadlines. Finally, review the completed forms for accuracy before submission to avoid potential penalties.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with certain information returns. Typically, forms must be submitted to the IRS by January 31 for most types of income reporting, including W-2 and 1099 forms. Additionally, recipients must receive their copies by the same date. Failure to meet these deadlines can result in penalties, making timely submission essential for compliance.

Required Documents for Certain Information Returns

To accurately complete certain information returns, you will need specific documents. These may include:

- Payment records, such as invoices or receipts

- Tax identification numbers for both the payer and recipient

- Previous year’s returns for reference

- Any supporting documentation required by the IRS for specific forms

Having these documents ready will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Penalties for Non-Compliance

Non-compliance with the requirements for certain information returns can lead to significant penalties. The IRS imposes fines for late submissions, incorrect information, or failure to file altogether. Penalties can vary based on the severity of the infraction, ranging from a few hundred dollars to thousands, depending on the number of forms involved. Understanding these penalties emphasizes the importance of accurate and timely filing.

IRS Guidelines for Certain Information Returns

The IRS provides detailed guidelines for completing certain information returns, which are essential for ensuring compliance. These guidelines include instructions on how to fill out each form, what information is required, and how to submit the forms. It is advisable for taxpayers and businesses to familiarize themselves with these guidelines to avoid errors and potential penalties.

Create this form in 5 minutes or less

Find and fill out the correct about general instructions for certain information returns

Create this form in 5 minutes!

How to create an eSignature for the about general instructions for certain information returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are certain returns online and how can airSlate SignNow help?

Certain returns online refer to the ability to electronically file specific tax returns or documents. airSlate SignNow simplifies this process by allowing users to eSign and send documents securely, ensuring compliance and efficiency in managing certain returns online.

-

How much does airSlate SignNow cost for managing certain returns online?

airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solution ensures that you can manage certain returns online without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for certain returns online?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools are designed to streamline the process of handling certain returns online, making it easier for businesses to stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for certain returns online?

Yes, airSlate SignNow offers seamless integrations with various applications, including CRM and accounting software. This allows you to manage certain returns online more efficiently by connecting your existing tools with our platform.

-

Is airSlate SignNow secure for handling certain returns online?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. You can confidently manage certain returns online, knowing that your sensitive information is protected.

-

How does airSlate SignNow improve the efficiency of certain returns online?

By automating the eSigning process and providing easy access to documents, airSlate SignNow signNowly reduces the time spent on certain returns online. This efficiency allows businesses to focus on their core operations while ensuring timely submissions.

-

What benefits can I expect from using airSlate SignNow for certain returns online?

Using airSlate SignNow for certain returns online offers numerous benefits, including faster turnaround times, reduced paperwork, and enhanced collaboration. These advantages help businesses streamline their processes and improve overall productivity.

Get more for About General Instructions For Certain Information Returns

Find out other About General Instructions For Certain Information Returns

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement