General Instructions for Certain IRS Tax Forms 2022

Understanding the General Instructions for Certain IRS Tax Forms

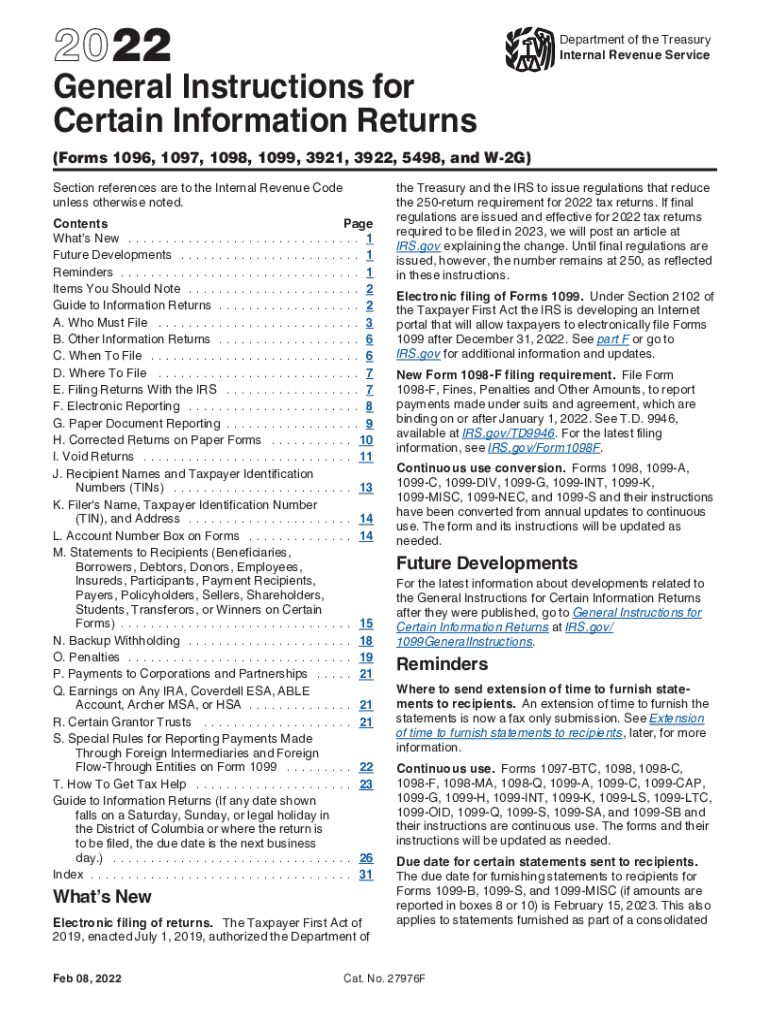

The General Instructions for Certain IRS Tax Forms provide essential guidelines for taxpayers and businesses on how to properly complete and submit various tax forms. These instructions cover a range of forms, including but not limited to the 1099 series, which are used to report different types of income. The instructions detail the requirements for each form, who must file them, and the deadlines for submission. Understanding these guidelines is crucial for ensuring compliance with IRS regulations and avoiding potential penalties.

Steps to Complete the General Instructions for Certain IRS Tax Forms

Completing the General Instructions for Certain IRS Tax Forms involves several key steps. First, identify the specific form required for your reporting needs. Next, gather all necessary information, such as taxpayer identification numbers, amounts to be reported, and any relevant supporting documentation. Carefully read the instructions associated with the form to understand the required fields and any specific filing requirements. Once the form is completed, review it for accuracy before submission to avoid delays or issues with the IRS.

Filing Deadlines and Important Dates

Timely filing of IRS tax forms is essential to avoid penalties. Each form has its own deadline, which can vary based on the type of income being reported and the filing method. For example, forms in the 1099 series typically have a deadline of January thirty-first for providing copies to recipients and February twenty-eighth for submitting to the IRS if filed by paper. If filing electronically, the deadline extends to March thirty-first. Keeping track of these dates is crucial for compliance.

Legal Use of the General Instructions for Certain IRS Tax Forms

The General Instructions for Certain IRS Tax Forms are legally binding, meaning that adherence to these guidelines is necessary for the forms to be considered valid by the IRS. These instructions outline the legal requirements for signatures, the necessity of accurate reporting, and the implications of non-compliance. Utilizing these instructions ensures that taxpayers fulfill their legal obligations and helps protect against audits or penalties.

Required Documents for Filing

When preparing to file certain IRS tax forms, it is important to gather all required documents. This may include W-2 forms, previous year’s tax returns, and any relevant financial statements. For forms like the 1099, documentation of payments made to contractors or other entities is also necessary. Having these documents ready can streamline the process and ensure that all required information is accurately reported.

Form Submission Methods

There are several methods available for submitting IRS tax forms, including online, by mail, or in-person. Electronic filing is often the preferred method due to its speed and efficiency. The IRS provides a secure online portal for submitting forms electronically. For those who choose to file by mail, it is important to send forms to the correct address based on the type of form and the taxpayer's location. In-person submissions may be made at designated IRS offices, though appointments may be necessary.

Penalties for Non-Compliance

Failure to comply with the General Instructions for Certain IRS Tax Forms can result in significant penalties. These may include fines for late filing, inaccuracies in reported amounts, or failure to file altogether. The IRS may impose additional penalties for intentional disregard of filing requirements. Understanding the consequences of non-compliance emphasizes the importance of accurately completing and submitting forms on time.

Quick guide on how to complete 2020 general instructions for certain irs tax forms

Easily Prepare General Instructions For Certain IRS Tax Forms on Any Device

Digital document management has gained widespread acceptance among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, alter, and electronically sign your documents quickly and without interruptions. Handle General Instructions For Certain IRS Tax Forms on any device using airSlate SignNow's applications for Android or iOS and enhance any document-centric operation today.

The Optimal Way to Alter and Electronically Sign General Instructions For Certain IRS Tax Forms with Ease

- Obtain General Instructions For Certain IRS Tax Forms, then click Get Form to begin.

- Utilize the tools we provide to submit your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your chosen device. Modify and eSign General Instructions For Certain IRS Tax Forms to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 general instructions for certain irs tax forms

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it help with info returns?

airSlate SignNow is a user-friendly eSignature solution that empowers businesses to manage and send documents effortlessly. It streamlines the document signing process, making it ideal for info returns by saving time and reducing manual paperwork. With airSlate SignNow, companies can ensure they receive required signatures promptly and efficiently.

-

What features does airSlate SignNow offer for managing info returns?

airSlate SignNow includes a range of features specifically designed for handling info returns, such as customizable templates, automated workflows, and real-time tracking of document statuses. These tools allow users to create an efficient process for collecting info returns with ease. Additionally, the platform integrates seamlessly with other applications to further enhance productivity.

-

Is airSlate SignNow cost-effective for businesses needing help with info returns?

Yes, airSlate SignNow is a cost-effective solution for businesses seeking an efficient way to manage info returns. Our pricing plans are designed to accommodate various business sizes and specifically aim to provide excellent value for eSignature services. By opting for airSlate SignNow, businesses can save on printing and mailing costs associated with traditional document handling.

-

How can airSlate SignNow integrate with my existing systems for info returns?

airSlate SignNow offers numerous integrations with popular applications and software, enhancing its utility for info returns processing. Through these integrations, businesses can connect their CRM, cloud storage, and other essential tools seamlessly. This ensures a smooth workflow while managing documents and info returns in one centralized platform.

-

What are the security measures in place for info returns with airSlate SignNow?

Security is paramount at airSlate SignNow, especially when it comes to handling sensitive info returns. Our platform complies with industry-standard security protocols, such as encryption and secure storage options. This ensures that your documents and data remain safe and confidential throughout the signing process.

-

Can I customize documents for info returns using airSlate SignNow?

Absolutely! airSlate SignNow allows users to create and customize documents for info returns effortlessly. You can personalize templates to suit your business needs, ensuring that each document meets specific requirements and reflects your branding.

-

What benefits does airSlate SignNow provide for tracking info returns?

airSlate SignNow provides excellent tracking capabilities, allowing businesses to monitor the status of their info returns in real-time. Users receive notifications when documents are opened, signed, or completed, ensuring that nothing falls through the cracks. This level of tracking promotes accountability and efficiency in document management.

Get more for General Instructions For Certain IRS Tax Forms

- Illinois satisfaction judgment form

- Il llc company form

- Landlord tenant notice 497306124 form

- Illinois tenant notice form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497306126 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair illinois form

- Letter tenant notice 497306128 form

- Landlord demand repair form

Find out other General Instructions For Certain IRS Tax Forms

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA