97 Department of the Treasury Internal Revenue Service 2020

Understanding the General Instructions for Certain Information Returns

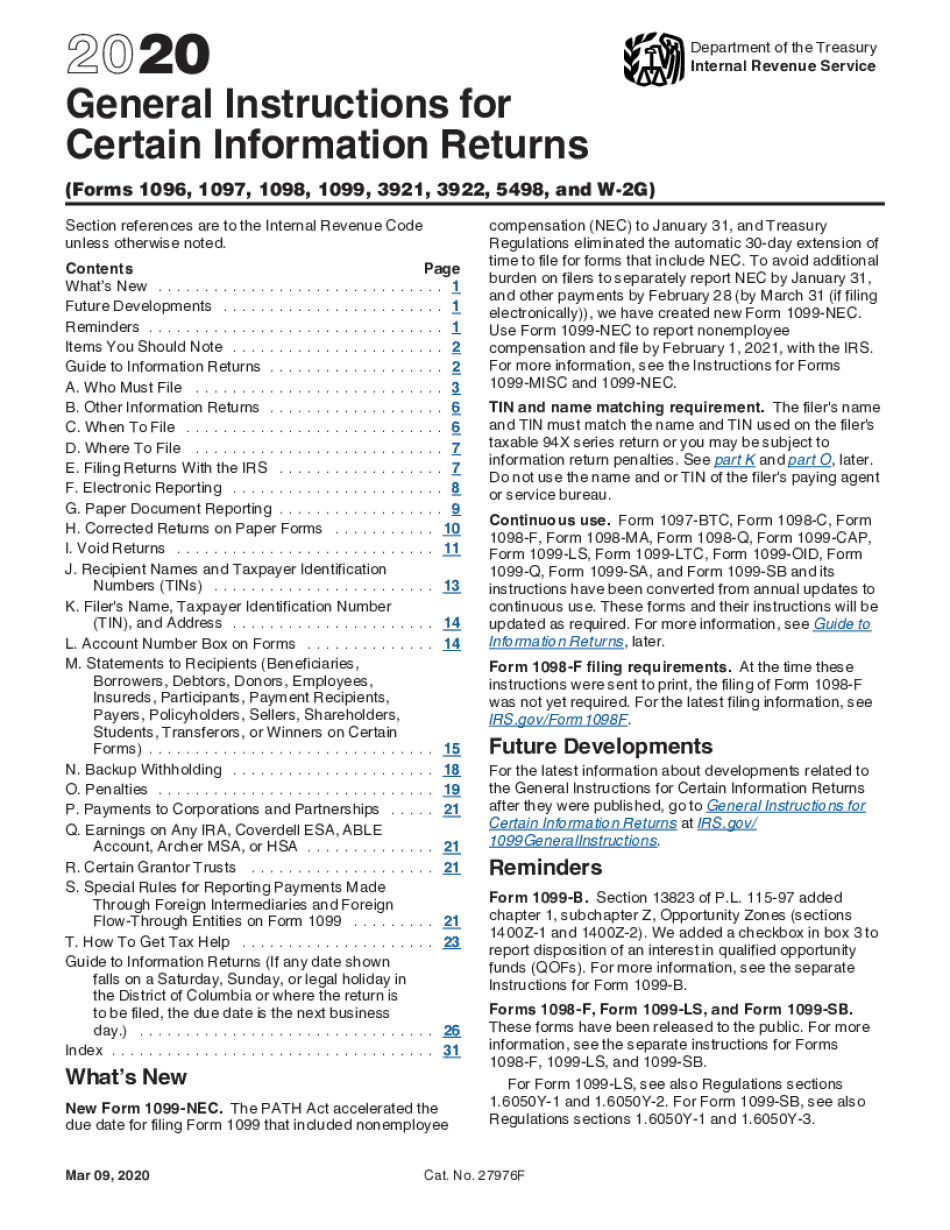

The general instructions for certain information returns provide essential guidance for taxpayers and businesses in the United States. These instructions clarify the requirements for filing various information returns, ensuring compliance with IRS regulations. It is crucial to understand the purpose of these forms, which often include reporting income, payments, or other financial transactions. Familiarity with these instructions helps prevent errors and potential penalties.

Steps to Complete the General Instructions for Certain Information Returns

Completing the general instructions for certain information returns involves several key steps:

- Identify the specific information return required for your situation, such as Form 1099 or W-2.

- Gather all necessary documentation, including financial records and taxpayer identification numbers.

- Carefully read the general instructions to understand the filing requirements, deadlines, and any specific details relevant to your form.

- Fill out the form accurately, ensuring that all information is complete and correct.

- Review the completed form against the general instructions to confirm compliance.

- Submit the form by the specified deadline, either electronically or by mail, as required.

Filing Deadlines and Important Dates

Adhering to filing deadlines is critical when dealing with general instructions for certain information returns. Each form has specific due dates, which can vary based on the type of return and whether it is filed electronically or on paper. For example, many information returns must be submitted by January thirty-first of the following year. It is advisable to check the IRS website or the specific instructions for each form to stay informed about any changes to deadlines.

Legal Use of the General Instructions for Certain Information Returns

The legal use of the general instructions for certain information returns ensures that taxpayers and businesses comply with federal tax laws. These instructions are designed to help filers understand their obligations and the potential consequences of non-compliance. Utilizing these guidelines correctly can protect against audits and penalties, reinforcing the importance of accurate and timely submissions.

Required Documents for Filing

When preparing to file information returns, it is essential to gather the required documents. Commonly needed documents include:

- Taxpayer identification numbers for all parties involved.

- Records of payments made, including invoices and receipts.

- Prior year returns, if applicable, to ensure consistency and accuracy.

- Any additional forms or schedules that may be required based on the specific return being filed.

Penalties for Non-Compliance

Failure to comply with the general instructions for certain information returns can result in significant penalties. The IRS imposes fines for late filings, incorrect information, or failure to file altogether. These penalties can vary based on the severity of the non-compliance and the type of return. Understanding these potential consequences emphasizes the importance of adhering to the guidelines provided in the general instructions.

IRS Guidelines for Information Returns

The IRS provides comprehensive guidelines for completing information returns, which are essential for accurate reporting. These guidelines cover various aspects, including who must file, what information needs to be reported, and how to correct errors. Staying updated with IRS guidelines ensures that taxpayers and businesses remain compliant and avoid unnecessary complications during the filing process.

Quick guide on how to complete 97 department of the treasury internal revenue service

Complete 97 Department Of The Treasury Internal Revenue Service effortlessly on any device

Online document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely preserve it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage 97 Department Of The Treasury Internal Revenue Service across any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign 97 Department Of The Treasury Internal Revenue Service seamlessly

- Find 97 Department Of The Treasury Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign 97 Department Of The Treasury Internal Revenue Service and ensure clear communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 97 department of the treasury internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 97 department of the treasury internal revenue service

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What are general instructions for certain information returns?

General instructions for certain information returns refer to guidelines that detail how different information returns should be prepared and submitted to the IRS. They include specific requirements for reporting various types of income, payments, and transactions, ensuring compliance with tax laws.

-

How does airSlate SignNow help with general instructions for certain information returns?

AirSlate SignNow provides a streamlined platform for creating, sending, and electronically signing documents related to information returns. With templates and digital tools, users can ensure they meet the general instructions for certain information returns, simplifying compliance and reducing the risk of errors.

-

What features does airSlate SignNow offer for managing information returns?

AirSlate SignNow offers features such as customizable templates, automated workflows, and secure e-signature capabilities to manage information returns effectively. These features facilitate adherence to general instructions for certain information returns while enhancing the overall efficiency of document handling.

-

Is airSlate SignNow cost-effective for handling information returns?

Yes, airSlate SignNow offers competitive pricing structures that provide excellent value for businesses managing information returns. With its cost-effective solution, users can benefit from robust features while ensuring compliance with general instructions for certain information returns without breaking the bank.

-

Can I integrate airSlate SignNow with my existing software for information returns?

Absolutely! AirSlate SignNow seamlessly integrates with various software systems, allowing users to streamline their information return processes. This integration helps ensure adherence to general instructions for certain information returns, as data flows smoothly between platforms.

-

What are the benefits of using airSlate SignNow for electronic signatures?

Using airSlate SignNow for electronic signatures provides numerous benefits, including time savings, enhanced security, and improved document tracking. This ensures that organizations remain compliant with general instructions for certain information returns while simplifying the signing process.

-

How can I ensure compliance with general instructions for certain information returns using airSlate SignNow?

To ensure compliance with general instructions for certain information returns, utilize airSlate SignNow's templates and step-by-step guidance. This tool provides clarity on the necessary requirements, helping users create accurate submissions and maintain compliance effortlessly.

Get more for 97 Department Of The Treasury Internal Revenue Service

- Wyoming corporation 497432106 form

- Wyoming pre incorporation agreement shareholders agreement and confidentiality agreement wyoming form

- Wy corporation form

- Corporate records maintenance package for existing corporations wyoming form

- Wyoming formation

- How to form a series llc in wyoming

- Wy company form

- Wyoming statement form

Find out other 97 Department Of The Treasury Internal Revenue Service

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo