Returns 2018

What is the Returns

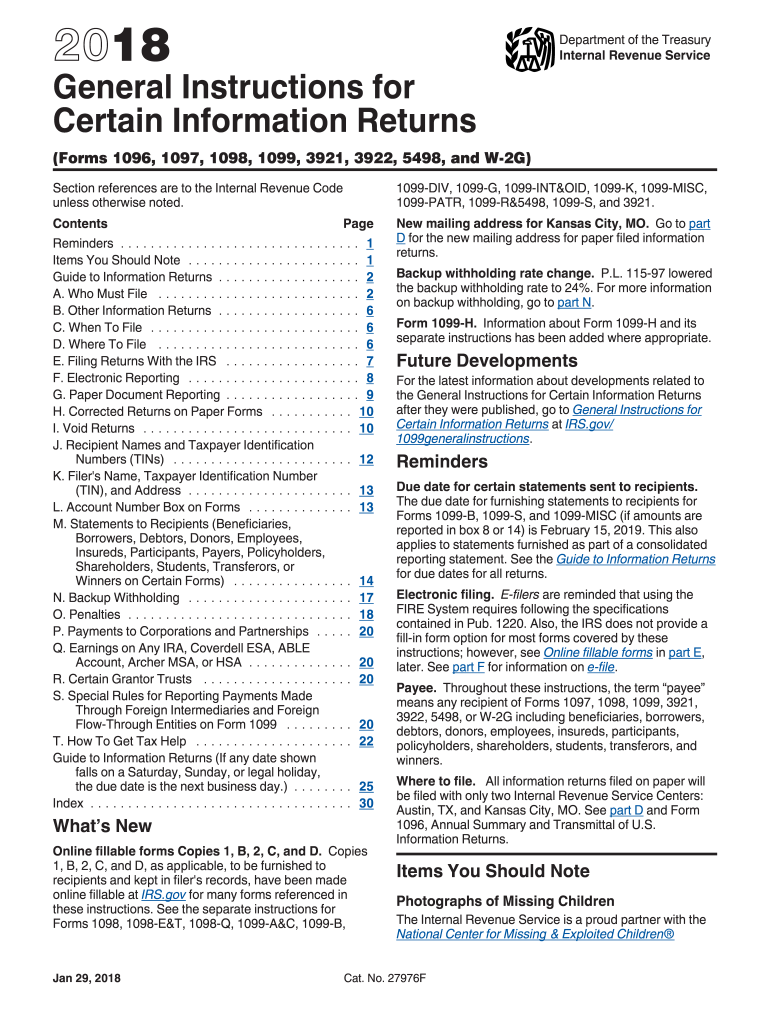

The 2017 instructions information pertains to specific guidelines for completing various tax forms, particularly those related to income reporting and information returns. These instructions help taxpayers understand their obligations when filing forms such as the 1099 series, which is crucial for reporting payments made to individuals or entities. The instructions provide clarity on the types of income that must be reported, ensuring compliance with Internal Revenue Service (IRS) requirements.

How to use the Returns

Using the 2017 instructions information effectively involves understanding the specific forms that apply to your situation. Taxpayers should first identify the correct form based on the type of income they are reporting. Once the appropriate form is selected, individuals can refer to the instructions to navigate the completion process. This includes guidance on filling out each section accurately, ensuring that all required information is provided to avoid delays or penalties.

Steps to complete the Returns

Completing the 2017 instructions information requires a systematic approach. Here are the key steps:

- Identify the correct form based on your income type.

- Gather all necessary documentation, including W-2s and other income statements.

- Refer to the specific instructions for that form, ensuring you understand each section.

- Fill out the form accurately, double-checking for errors.

- Submit the form by the applicable deadline, either online or via mail.

Legal use of the Returns

The legal use of the 2017 instructions information is vital for ensuring compliance with federal tax laws. Properly completed forms serve as official records of income and payments, which can be reviewed by the IRS. Adhering to the guidelines set forth in the instructions helps avoid legal issues, such as audits or penalties for non-compliance. It is essential for taxpayers to understand that inaccurate or incomplete submissions can lead to significant repercussions.

IRS Guidelines

The IRS guidelines associated with the 2017 instructions information provide a framework for taxpayers to follow. These guidelines cover various aspects, including eligibility criteria for different forms and the necessary documentation required for submission. By adhering to these guidelines, taxpayers can ensure that their filings are accurate and timely, reducing the risk of complications with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines are critical when dealing with the 2017 instructions information. Typically, information returns must be filed by January thirty-first of the year following the reporting year. However, specific forms may have different deadlines, so it is important to consult the instructions for exact dates. Missing these deadlines can result in penalties, making it essential for taxpayers to stay informed about their filing obligations.

Quick guide on how to complete general instructions 2018 2019 form

Complete Returns seamlessly on any device

Digital document management has become increasingly favored by both organizations and individuals. It offers a superb environmentally friendly substitute for traditional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow presents all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Returns on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The easiest way to alter and eSign Returns without hassle

- Locate Returns and click on Get Form to initiate the process.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that task.

- Generate your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Returns and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct general instructions 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the general instructions 2018 2019 form

How to create an eSignature for your General Instructions 2018 2019 Form in the online mode

How to generate an eSignature for the General Instructions 2018 2019 Form in Chrome

How to generate an electronic signature for signing the General Instructions 2018 2019 Form in Gmail

How to create an eSignature for the General Instructions 2018 2019 Form right from your smartphone

How to generate an electronic signature for the General Instructions 2018 2019 Form on iOS

How to generate an electronic signature for the General Instructions 2018 2019 Form on Android OS

People also ask

-

What is the airSlate SignNow return policy?

The airSlate SignNow return policy allows users to request a refund within 30 days of purchase if they are not satisfied with the service. This ensures that you can confidently explore our eSigning features without financial risk. Our goal is to provide a cost-effective solution for your document signing needs.

-

How does airSlate SignNow handle document returns?

AirSlate SignNow simplifies the process of handling document returns by providing a secure and efficient eSigning platform. Users can quickly resend documents for signature or make necessary adjustments before returning them to ensure fast turnaround times. This feature enhances workflow efficiency and customer satisfaction.

-

Are there any fees associated with document returns on airSlate SignNow?

There are no additional fees associated with document returns on airSlate SignNow. Our pricing model is straightforward and cost-effective, allowing users to manage their documents without worrying about hidden charges. This transparency is part of our commitment to customer satisfaction.

-

What features does airSlate SignNow offer for managing returns?

AirSlate SignNow offers various features for managing returns, including real-time tracking of document status and automated reminders for recipients. These tools ensure that you stay informed about your document's progress and can effectively follow up on any returns. This enhances your overall document management process.

-

Can I integrate airSlate SignNow with other tools to streamline returns?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM, cloud storage, and project management tools to streamline the returns process. These integrations allow you to manage your documents more efficiently, making it easier to send and receive returns. This flexibility is a key benefit of choosing airSlate SignNow.

-

What benefits does airSlate SignNow provide for handling returns?

The primary benefits of using airSlate SignNow for handling returns include increased efficiency, reduced turnaround time, and enhanced visibility over document progress. Our user-friendly interface makes it easy to send, sign, and manage returns, ensuring a smooth experience for both you and your clients. This efficiency contributes to overall business productivity.

-

Is customer support available for issues related to returns?

Absolutely! airSlate SignNow provides dedicated customer support to assist with any issues related to returns and other features. Our support team is available via chat, email, or phone to ensure you have the help you need. We are committed to your satisfaction and success with our eSigning solution.

Get more for Returns

- Urinalysis report form

- Lpb 44 05 ir l real estate contract residential short form washington form washington limited practice board forms

- Ak tier ii form page 1 doc state of alaska ready alaska

- Los angeles county dba form

- Nationstar loss form

- Application for wire transfer habib american bank form

- Nanny performance evaluation form nanny taxes

- Memorandum for record air force form

Find out other Returns

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online