Form 943 a Rev December Agricultural Employer's Record of Federal Tax Liability 2024-2026

What is the Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability

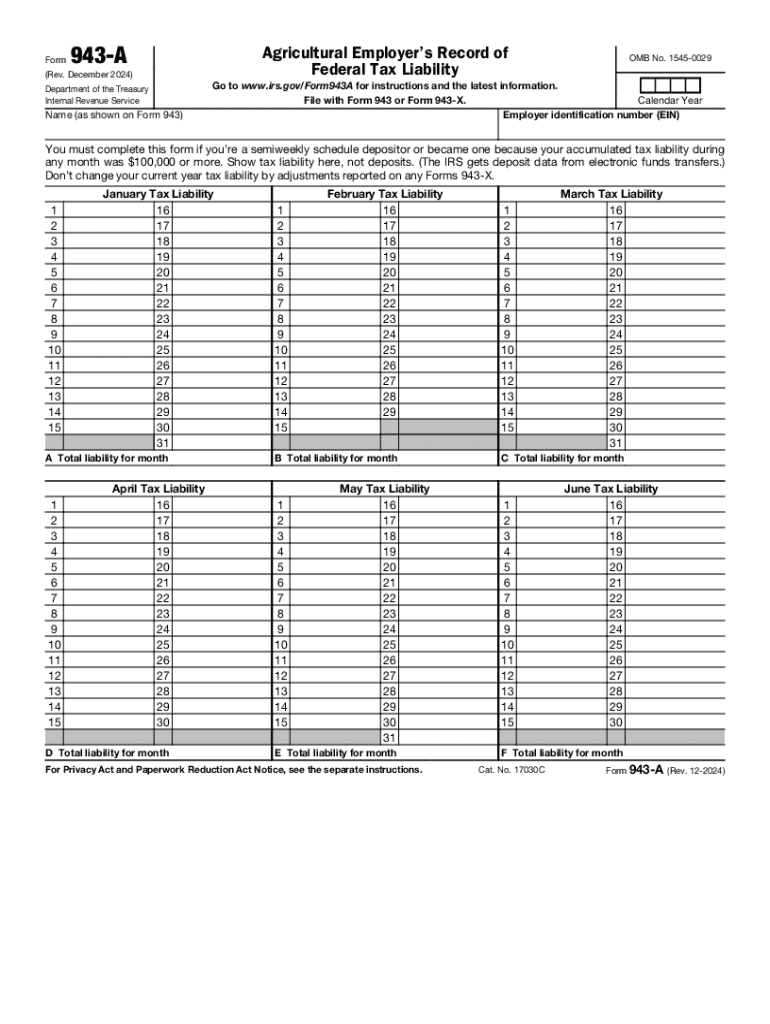

The Form 943 A Rev December is a crucial document for agricultural employers in the United States. It serves as the record of federal tax liability specifically for those who employ farmworkers. This form is essential for reporting the taxes withheld from employees’ wages and any employer contributions. The information provided on this form helps the IRS track compliance with federal tax obligations related to agricultural employment.

How to use the Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability

Using the Form 943 A involves accurately filling out the required sections that detail the employer's federal tax liabilities. Employers must report the total wages paid to farmworkers, the amount of federal income tax withheld, and the employer's share of Social Security and Medicare taxes. It is important to ensure that all information is correct to avoid penalties or issues with the IRS. After completion, the form must be retained for records and may be required during audits.

Steps to complete the Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability

Completing the Form 943 A involves several steps:

- Gather necessary documentation, including payroll records and previous tax filings.

- Fill out the employer identification details at the top of the form.

- Report total wages paid to employees in the designated section.

- Calculate the federal income tax withheld and the employer's tax liabilities.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Form 943 A. Typically, the form is due on January 31 of the year following the tax year being reported. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential for employers to keep track of these dates to avoid late filing penalties.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 943 A can result in significant penalties. These may include fines for late filing, inaccuracies in reporting, or failure to pay the required taxes. Employers should be aware of these risks and ensure timely and accurate submissions to maintain compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 943 A. These guidelines outline the necessary information required, the proper methods of filing, and the importance of accuracy in reporting. Employers should consult the IRS website or official publications for the most current instructions and updates regarding the form.

Create this form in 5 minutes or less

Find and fill out the correct form 943 a rev december agricultural employers record of federal tax liability

Create this form in 5 minutes!

How to create an eSignature for the form 943 a rev december agricultural employers record of federal tax liability

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS 943 employers printable form?

The IRS 943 employers printable form is used by agricultural employers to report wages paid to farmworkers and the associated taxes. This form is essential for compliance with federal tax regulations and ensures that employers fulfill their reporting obligations accurately.

-

How can airSlate SignNow help with IRS 943 employers printable forms?

airSlate SignNow simplifies the process of completing and signing IRS 943 employers printable forms. With our platform, you can easily fill out the form, eSign it, and send it securely, ensuring that your submissions are timely and compliant with IRS requirements.

-

Is there a cost associated with using airSlate SignNow for IRS 943 employers printable forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions provide access to features that streamline the completion and submission of IRS 943 employers printable forms, making it a valuable investment for your business.

-

What features does airSlate SignNow offer for IRS 943 employers printable forms?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for IRS 943 employers printable forms. These tools enhance efficiency and ensure that your forms are completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with other software for IRS 943 employers printable forms?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your IRS 943 employers printable forms alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for IRS 943 employers printable forms?

Using airSlate SignNow for IRS 943 employers printable forms offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your forms are completed correctly and submitted promptly, minimizing the risk of errors.

-

How secure is airSlate SignNow when handling IRS 943 employers printable forms?

airSlate SignNow prioritizes security and compliance, employing advanced encryption and secure storage for all documents, including IRS 943 employers printable forms. You can trust that your sensitive information is protected throughout the signing and submission process.

Get more for Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability

Find out other Form 943 A Rev December Agricultural Employer's Record Of Federal Tax Liability

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word