Topic No 857, Individual Taxpayer Identification Number ITIN 2024-2026

What is the Individual Taxpayer Identification Number (ITIN)?

The Individual Taxpayer Identification Number (ITIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to individuals who are required to have a taxpayer identification number but do not qualify for a Social Security Number (SSN). ITINs are primarily used for tax purposes, allowing non-resident aliens, their spouses, and dependents to file tax returns and comply with U.S. tax laws. The ITIN format is similar to an SSN, beginning with the number nine and following a specific pattern.

How to Obtain an ITIN

To obtain an ITIN, individuals must complete Form W-7, Application for IRS Individual Taxpayer Identification Number. This form requires personal information, including the applicant's name, mailing address, and foreign status. Supporting documentation must be submitted to verify identity and foreign status, such as a passport or national identification card. Applications can be submitted by mail to the IRS or in person at designated IRS Taxpayer Assistance Centers. It is essential to ensure that all information is accurate to avoid delays in processing.

Key Elements of the ITIN

Understanding the key elements of the ITIN is crucial for effective tax compliance. The ITIN is solely for tax purposes and does not authorize work in the United States or provide eligibility for Social Security benefits. Additionally, ITINs are not a substitute for an SSN. It is important to note that ITINs must be renewed if not used on a federal tax return for three consecutive years. Furthermore, individuals must ensure that their ITIN is valid for the current tax year to avoid penalties.

Legal Use of the ITIN

The ITIN is legally recognized by the IRS for tax reporting purposes. Individuals who use an ITIN must ensure that they comply with all tax obligations, including filing annual tax returns and reporting income accurately. The ITIN allows individuals to claim tax benefits, such as the Child Tax Credit and the American Opportunity Tax Credit, provided they meet the eligibility criteria. It is crucial to keep records of all tax filings and correspondence with the IRS to support the legal use of the ITIN.

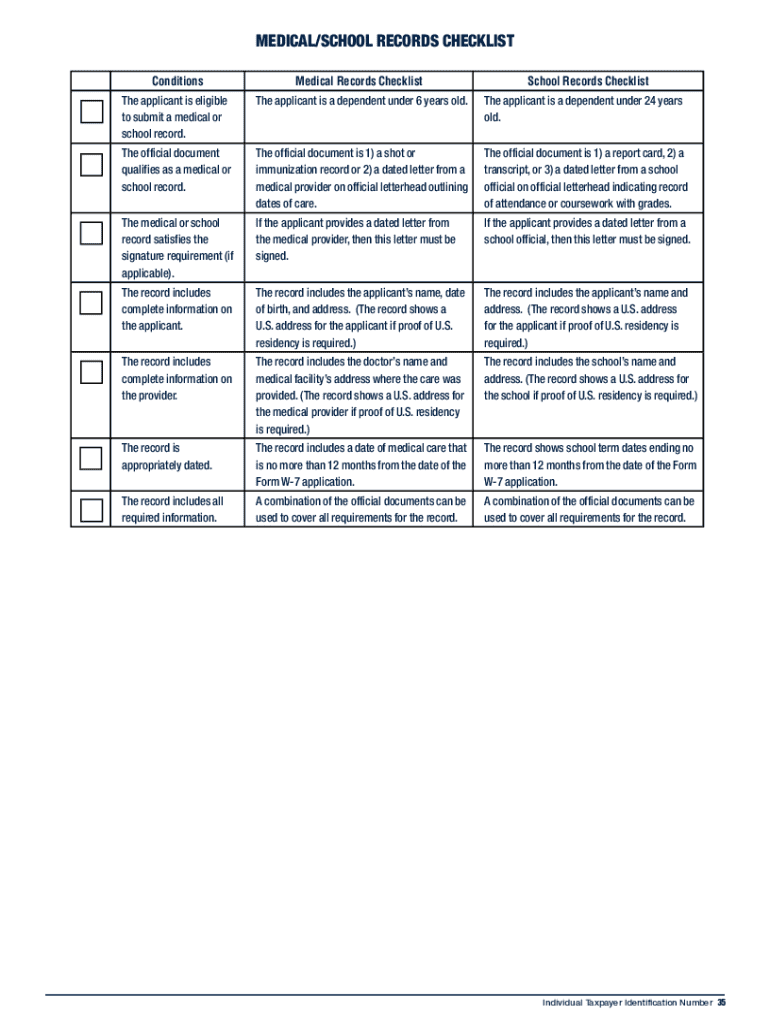

Required Documents for ITIN Application

When applying for an ITIN, it is essential to submit the required documents along with Form W-7. Applicants must provide proof of identity and foreign status, which can include:

- Passport

- National identification card

- U.S. driver's license

- Birth certificate

- Other government-issued documents

All documents must be original or certified copies, and they should be in English or accompanied by a certified translation. Ensuring that all required documents are included can expedite the application process.

IRS Guidelines for ITIN Usage

The IRS provides specific guidelines for the use of ITINs, emphasizing that they are intended for individuals who do not qualify for an SSN. The IRS recommends that ITIN holders file their tax returns annually, even if they do not owe taxes, to maintain their ITIN status. Additionally, the IRS periodically reviews ITINs and may deactivate those that have not been used for tax filings in the past three years. Staying informed about IRS guidelines can help individuals effectively manage their tax responsibilities.

Create this form in 5 minutes or less

Find and fill out the correct topic no 857 individual taxpayer identification number itin

Create this form in 5 minutes!

How to create an eSignature for the topic no 857 individual taxpayer identification number itin

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ITIN number and why is it important?

An ITIN number, or Individual Taxpayer Identification Number, is essential for individuals who need to file taxes but do not have a Social Security number. Understanding ITIN number is crucial for ensuring compliance with tax regulations and for accessing certain financial services.

-

How can airSlate SignNow help with documents related to ITIN numbers?

airSlate SignNow provides a seamless platform for sending and eSigning documents related to ITIN applications and tax filings. Understanding ITIN number documentation is made easier with our user-friendly interface, ensuring that all necessary forms are completed accurately and efficiently.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Understanding ITIN number processes can be more cost-effective with our affordable solutions, allowing you to manage your document workflows without breaking the bank.

-

Is airSlate SignNow secure for handling sensitive information like ITIN numbers?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all sensitive information, including ITIN numbers, is protected. Understanding ITIN number security is vital, and our platform employs advanced encryption and security measures to safeguard your data.

-

Can I integrate airSlate SignNow with other applications for managing ITIN-related documents?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow for managing ITIN-related documents. Understanding ITIN number processes can be streamlined through these integrations, allowing for a more efficient document management experience.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and automated workflows. Understanding ITIN number documentation is simplified with these tools, making it easier to create, send, and track important tax-related documents.

-

How does airSlate SignNow improve the efficiency of handling ITIN applications?

By using airSlate SignNow, businesses can signNowly reduce the time spent on handling ITIN applications. Understanding ITIN number processes is made more efficient with our automated workflows and real-time tracking, ensuring that you stay organized and compliant.

Get more for Topic No 857, Individual Taxpayer Identification Number ITIN

- Penn financial aid supplement form

- Adp background check form v1112

- Grievanceappeal form mcna dental mcna

- Aftercare plan template 427787725 form

- Pa notice of intent to file lien form

- Form ef oklahoma income tax declaration for electronic filing 771915265

- Form 511 tx credit for tax paid to another state 771915266

- Form 561 nr oklahoma capital gain deduction for part year and nonresidents filing form 511nr

Find out other Topic No 857, Individual Taxpayer Identification Number ITIN

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form