Charles Schwab Charitable Gift Transfer Form

What is the Charles Schwab Charitable Gift Transfer Form

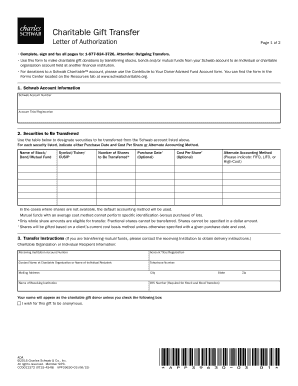

The Charles Schwab Charitable Gift Transfer Form is a document used to facilitate the transfer of assets to a charitable organization through Charles Schwab. This form is essential for individuals looking to make charitable contributions while potentially benefiting from tax deductions. It allows donors to specify the type of asset being transferred, the recipient charity, and any specific instructions regarding the donation.

How to use the Charles Schwab Charitable Gift Transfer Form

Using the Charles Schwab Charitable Gift Transfer Form involves several straightforward steps. First, gather all necessary information about the asset you wish to donate, including its value and the intended charitable organization. Next, fill out the form with accurate details, ensuring that all required fields are completed. After completing the form, review it for accuracy and submit it according to the provided instructions, either online or via mail.

Steps to complete the Charles Schwab Charitable Gift Transfer Form

To complete the Charles Schwab Charitable Gift Transfer Form, follow these steps:

- Begin by entering your personal information, including your name, address, and Schwab account number.

- Specify the type of asset you are transferring, such as cash, stocks, or mutual funds.

- Provide details about the charitable organization, including its name and address.

- Indicate the amount or number of shares you wish to donate.

- Sign and date the form to validate your request.

Key elements of the Charles Schwab Charitable Gift Transfer Form

The key elements of the Charles Schwab Charitable Gift Transfer Form include the donor's information, asset details, recipient charity information, and the donor's signature. Each section is designed to ensure clarity and compliance with IRS regulations. It is important to provide accurate information to avoid delays in processing the transfer.

Form Submission Methods

The Charles Schwab Charitable Gift Transfer Form can be submitted through various methods. Donors may choose to submit the form online through the Schwab platform, ensuring a quick and efficient process. Alternatively, the form can be printed and mailed to the designated address provided on the form. In some cases, in-person submissions may also be accepted at local Schwab branches, depending on the specific policies in place.

IRS Guidelines

When completing the Charles Schwab Charitable Gift Transfer Form, it is crucial to adhere to IRS guidelines regarding charitable contributions. Donors should ensure that the charity is recognized as a qualified organization by the IRS to qualify for tax deductions. Additionally, proper documentation must be maintained for all donations, particularly for larger contributions, to substantiate the deduction claims when filing taxes.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the charles schwab charitable gift transfer form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Charles Schwab charitable gift transfer form?

The Charles Schwab charitable gift transfer form is a document that allows donors to make charitable contributions through Schwab. This form simplifies the process of transferring assets to eligible charities, ensuring that your donations are processed efficiently and securely.

-

How do I complete the Charles Schwab charitable gift transfer form?

To complete the Charles Schwab charitable gift transfer form, you need to provide your personal information, details about the charity, and the assets you wish to donate. Make sure to follow the instructions carefully to ensure a smooth transfer process.

-

Are there any fees associated with the Charles Schwab charitable gift transfer form?

Typically, there are no fees for using the Charles Schwab charitable gift transfer form itself. However, it's important to check with Schwab for any potential fees related to the assets being transferred or specific charity requirements.

-

What types of assets can I transfer using the Charles Schwab charitable gift transfer form?

You can transfer various types of assets using the Charles Schwab charitable gift transfer form, including cash, stocks, and mutual funds. Each asset type may have different implications for tax deductions, so it's advisable to consult with a financial advisor.

-

How does the Charles Schwab charitable gift transfer form benefit my charitable giving?

Using the Charles Schwab charitable gift transfer form streamlines the donation process, making it easier for you to support your favorite charities. Additionally, it can provide potential tax benefits, allowing you to maximize your charitable contributions.

-

Can I track my donations made through the Charles Schwab charitable gift transfer form?

Yes, you can track your donations made through the Charles Schwab charitable gift transfer form by accessing your Schwab account. This feature allows you to keep a record of your charitable contributions for personal tracking and tax purposes.

-

Is the Charles Schwab charitable gift transfer form secure?

Absolutely, the Charles Schwab charitable gift transfer form is designed with security in mind. Schwab employs advanced encryption and security measures to protect your personal and financial information during the donation process.

Get more for Charles Schwab Charitable Gift Transfer Form

- Fill out waiver to save time jump a roos form

- Aadhar card form pdf download assam

- Stetson forms

- Month to month residential rental agreement form

- Doh 5032 form

- Rponse du locataire l avis d augmentation de loyer form

- Bahamas technical amp bvocationalb institute medical record btvi btvi edu form

- California department of corporations complaint in interpleader star escrow inc form

Find out other Charles Schwab Charitable Gift Transfer Form

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe