Credit for Prior Year Minimum Tax Corporations Irs 2022

Understanding the Credit For Prior Year Minimum Tax Corporations

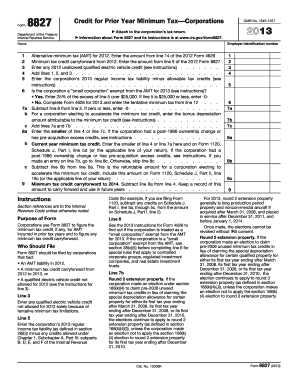

The Credit For Prior Year Minimum Tax Corporations is a tax credit provided by the IRS to corporations that paid alternative minimum tax (AMT) in previous years. This credit allows eligible corporations to offset their regular tax liability with credits earned from prior AMT payments, effectively reducing their overall tax burden. The credit is particularly beneficial for corporations that have fluctuating income, as it helps smooth out tax liabilities over time.

Eligibility Criteria for the Credit

To qualify for the Credit For Prior Year Minimum Tax Corporations, a corporation must have paid AMT in a prior tax year. Additionally, the corporation must be subject to the regular corporate tax rate. It is essential for corporations to maintain accurate records of their AMT payments, as these will be necessary for claiming the credit. The IRS provides specific guidelines on eligibility, which should be reviewed to ensure compliance.

Steps to Claim the Credit

Claiming the Credit For Prior Year Minimum Tax Corporations involves several steps:

- Determine eligibility by reviewing past AMT payments.

- Complete the appropriate IRS forms, typically including Form 8801, which is used to calculate the credit.

- Attach the completed form to the corporation's tax return for the current year.

- Ensure all required documentation is included to support the claim.

Following these steps carefully can help ensure that the credit is claimed correctly and efficiently.

Required Documentation for Claiming the Credit

When claiming the Credit For Prior Year Minimum Tax Corporations, corporations must provide specific documentation to support their claim. This includes:

- Records of prior AMT payments, including any relevant tax returns.

- The completed Form 8801, which calculates the amount of credit.

- Any additional forms or schedules that may be required based on the corporation's tax situation.

Maintaining thorough records is crucial for a successful claim and to avoid potential issues with the IRS.

IRS Guidelines for the Credit

The IRS provides detailed guidelines regarding the Credit For Prior Year Minimum Tax Corporations. These guidelines outline eligibility requirements, the calculation of the credit, and the necessary forms to be submitted. Corporations should refer to the IRS instructions for Form 8801 and other related documents to ensure compliance with current tax laws. Staying informed about any updates or changes in the guidelines is essential for accurate reporting.

Filing Deadlines for the Credit

Corporations must be aware of the filing deadlines associated with the Credit For Prior Year Minimum Tax Corporations. Generally, the credit should be claimed on the corporation's tax return for the year in which it is eligible. Key deadlines include:

- The due date for filing the corporate tax return, typically the fifteenth day of the fourth month after the end of the corporation's tax year.

- Extensions, if applicable, which may provide additional time to file but do not extend the time to pay any taxes owed.

Adhering to these deadlines is vital to avoid penalties and ensure the credit is applied correctly.

Create this form in 5 minutes or less

Find and fill out the correct credit for prior year minimum tax corporations irs

Create this form in 5 minutes!

How to create an eSignature for the credit for prior year minimum tax corporations irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Credit For Prior Year Minimum Tax Corporations Irs?

The Credit For Prior Year Minimum Tax Corporations Irs is a tax credit available to corporations that paid a minimum tax in previous years. This credit allows eligible corporations to offset their current tax liabilities, providing signNow financial relief. Understanding this credit can help businesses optimize their tax strategies.

-

How can airSlate SignNow help with filing for the Credit For Prior Year Minimum Tax Corporations Irs?

airSlate SignNow simplifies the document management process, making it easier for corporations to prepare and file necessary tax documents related to the Credit For Prior Year Minimum Tax Corporations Irs. With our eSigning capabilities, you can quickly gather signatures and ensure compliance. This streamlines your workflow and saves valuable time.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents effectively. These features ensure that your documents related to the Credit For Prior Year Minimum Tax Corporations Irs are organized and easily accessible. Additionally, our platform is user-friendly, making it suitable for businesses of all sizes.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax credits?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses, especially those navigating tax credits like the Credit For Prior Year Minimum Tax Corporations Irs. Our pricing plans are flexible and cater to various business needs, ensuring that you can manage your tax documentation without breaking the bank. This affordability allows small businesses to focus on growth while staying compliant.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, allowing you to manage your tax documents and credits like the Credit For Prior Year Minimum Tax Corporations Irs efficiently. This integration ensures that all your financial data is synchronized, reducing the risk of errors and enhancing productivity. You can easily streamline your workflow with our platform.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents provides numerous benefits, including enhanced security, faster processing times, and improved collaboration. With features tailored for managing credits like the Credit For Prior Year Minimum Tax Corporations Irs, you can ensure that your documents are handled efficiently. This not only saves time but also reduces stress during tax season.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents by implementing advanced encryption and secure cloud storage. This ensures that sensitive information related to the Credit For Prior Year Minimum Tax Corporations Irs is protected from unauthorized access. Our commitment to security allows you to focus on your business without worrying about data bsignNowes.

Get more for Credit For Prior Year Minimum Tax Corporations Irs

- Thank you letter committee member sample form

- Diagram of injury form

- Loan application schoolsfirst federal credit union retirement retirement schoolsfirstfcu form

- Nj form o 71

- Docvelocity user guide form

- Pechanga tax statement form

- Resale certificate 27 form

- Request for rental history of your former resident

Find out other Credit For Prior Year Minimum Tax Corporations Irs

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template