Check This Box If You Are Annualizing Your Income Form

Understanding the Check This Box If You Are Annualizing Your Income

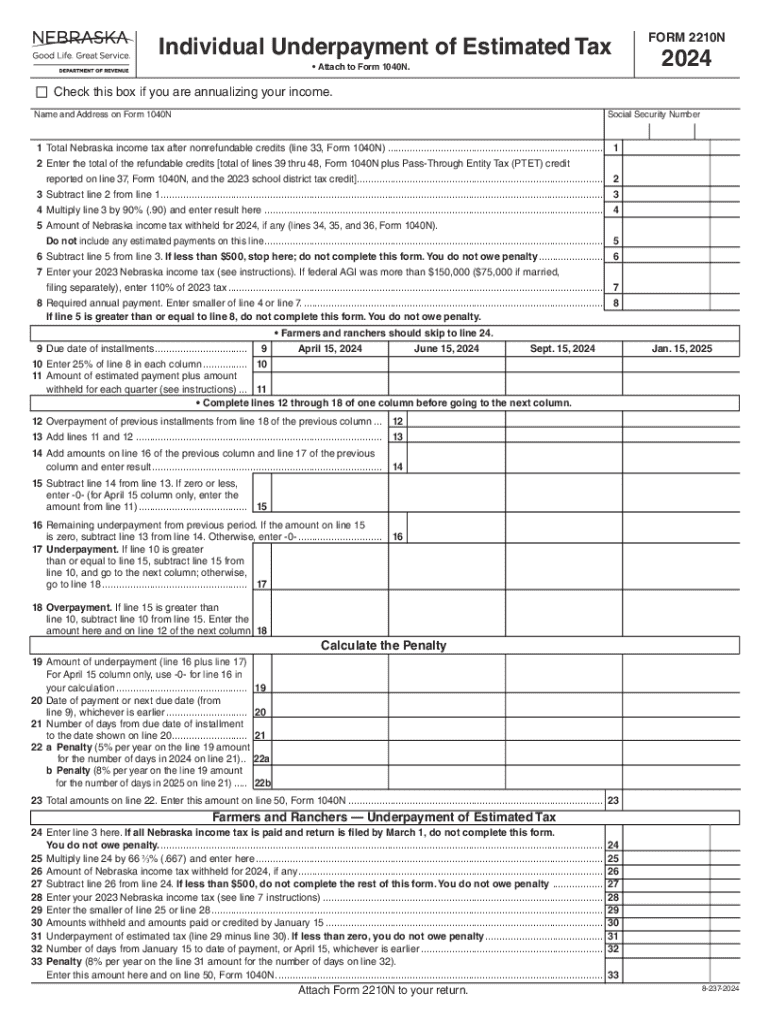

The "Check This Box If You Are Annualizing Your Income" option on the Nebraska Revenue 2210N form is designed for taxpayers who expect their income to fluctuate significantly during the year. By selecting this box, you indicate that you are calculating your estimated tax based on your annual income rather than on a quarterly basis. This method can be beneficial for individuals with variable income, such as freelancers or seasonal workers, as it allows for a more accurate reflection of their tax liability.

Steps to Complete the Check This Box If You Are Annualizing Your Income

To properly complete this section of the Nebraska 2210N form, follow these steps:

- Review your income sources and determine if your earnings will vary throughout the year.

- Calculate your expected annual income based on your current earnings and any anticipated changes.

- If your income is expected to be uneven, check the box indicating you are annualizing your income.

- Complete the remainder of the form, ensuring all calculations reflect your annual income estimate.

Legal Use of the Check This Box If You Are Annualizing Your Income

Using the "Check This Box If You Are Annualizing Your Income" option is legally permissible under Nebraska tax law, provided that your income situation justifies this choice. It is essential to maintain accurate records of your income and any supporting documentation to substantiate your calculations. Misuse of this option could lead to penalties or adjustments by the Nebraska Department of Revenue.

Filing Deadlines / Important Dates

When using the Nebraska Revenue 2210N form, it is crucial to be aware of the filing deadlines. Generally, estimated tax payments are due on a quarterly basis, with specific dates set by the Nebraska Department of Revenue. If you are annualizing your income, ensure that you adhere to these deadlines to avoid any potential penalties for late payments.

Required Documents

To complete the Nebraska 2210N form, you may need the following documents:

- Previous year’s tax return for reference.

- Documentation of income sources, including pay stubs or 1099 forms.

- Any relevant deductions or credits that may affect your estimated tax liability.

Examples of Using the Check This Box If You Are Annualizing Your Income

Consider a freelancer who typically earns more during certain months of the year due to project-based work. By checking the box for annualizing income, they can calculate their estimated tax based on their total expected earnings rather than on a quarterly basis, which may not accurately reflect their income fluctuations. This approach can help them manage their cash flow more effectively throughout the year.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the check this box if you are annualizing your income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska Revenue 2210N form?

The Nebraska Revenue 2210N form is used by taxpayers in Nebraska to calculate underpayment penalties for estimated tax. Understanding this form is crucial for compliance and avoiding penalties. airSlate SignNow can help streamline the process of filling out and submitting the Nebraska Revenue 2210N.

-

How can airSlate SignNow assist with the Nebraska Revenue 2210N?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Nebraska Revenue 2210N form. This simplifies the submission process, ensuring that your documents are securely signed and delivered on time. Our solution is designed to enhance efficiency and reduce the hassle of paperwork.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that can help with forms like the Nebraska Revenue 2210N. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools are particularly useful for managing forms like the Nebraska Revenue 2210N, ensuring that you can easily create, send, and monitor your documents. Our platform is designed to enhance your document workflow.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, including CRM systems and cloud storage services. This allows you to manage your documents, including the Nebraska Revenue 2210N, within your existing workflows. These integrations enhance productivity and streamline your processes.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the Nebraska Revenue 2210N offers numerous benefits, including time savings and improved accuracy. Our platform reduces the risk of errors and ensures that your documents are securely signed and stored. This can lead to a smoother tax filing experience.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive tax documents like the Nebraska Revenue 2210N. We utilize advanced encryption and security protocols to protect your data. You can trust that your information is secure with us.

Get more for Check This Box If You Are Annualizing Your Income

- Trailer pm inspection sheet form

- Selected auction participant appointment form

- Unhcr resettlement registration form

- Thank you for your interest in beanstalk academy form

- Foster application german shepherd rescue of orange county form

- Member patch agreement rev 2018 01 07 member form

- New clients forms mercy pet clinic

- Application for reimbursement status form

Find out other Check This Box If You Are Annualizing Your Income

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template