3 70 Douglascountynv Form

What is the 370 tax form?

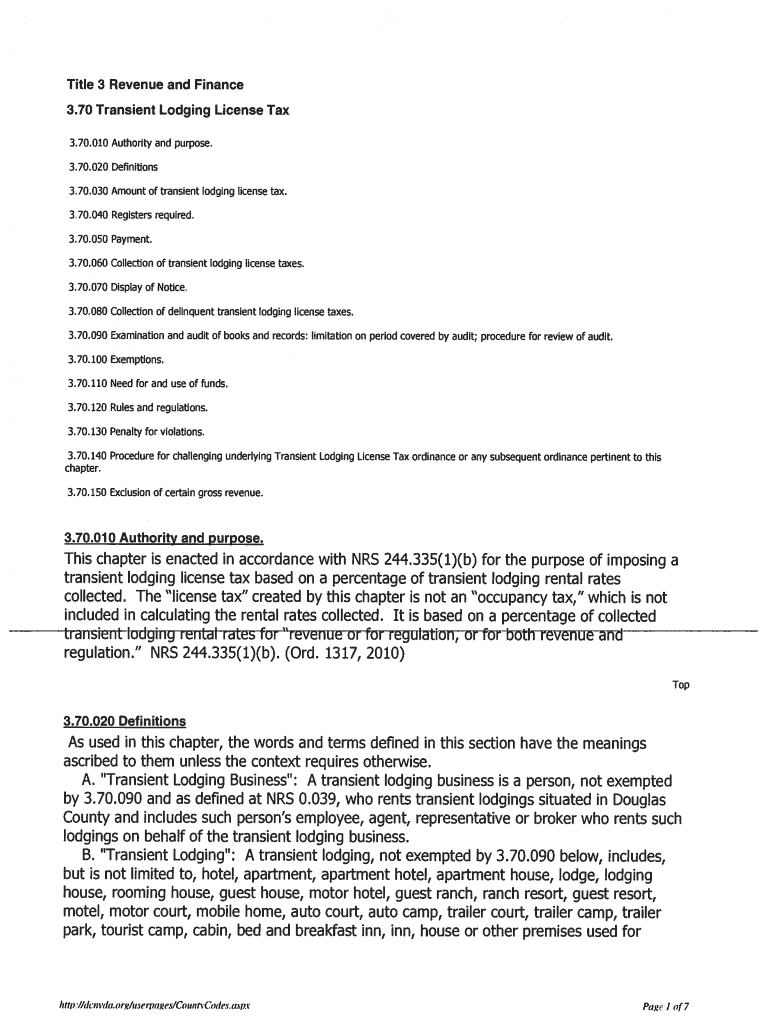

The 370 tax form, often referred to as the transient lodging form, is a document used primarily in the United States for reporting and collecting lodging license taxes. This form is essential for businesses that provide temporary accommodations, such as hotels and motels, to ensure compliance with local tax regulations. The form captures important information about the lodging services provided, including the duration of stay and the total amount charged to guests. Proper completion of the 370 tax form is crucial for accurate tax reporting and to avoid potential penalties.

Steps to complete the 370 tax form

Completing the 370 tax form requires careful attention to detail. Here are the key steps involved:

- Gather necessary information: Collect details about your business, including the name, address, and tax identification number, as well as information about the guests and their stays.

- Fill out the form: Input the required details accurately, including the dates of stay, room rates, and any applicable taxes.

- Review for accuracy: Double-check all entries to ensure there are no errors, as inaccuracies can lead to compliance issues.

- Submit the form: Depending on your local regulations, submit the completed form online, by mail, or in person to the appropriate tax authority.

Legal use of the 370 tax form

The 370 tax form serves a legal purpose in the context of transient lodging. It is recognized by tax authorities as an official document for reporting lodging tax obligations. To ensure its legal validity, the form must be filled out completely and accurately. Additionally, compliance with local laws regarding lodging taxes is essential. The use of electronic signatures on the form is permissible, provided that the eSignature meets the requirements set forth by the ESIGN Act and UETA, ensuring that the form is considered legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the 370 tax form can vary based on local regulations. Generally, it is important to submit the form by the end of the month following the reporting period. For example, if the lodging services were provided in January, the form should typically be filed by the end of February. It is crucial to stay informed about specific deadlines in your jurisdiction to avoid late fees or penalties associated with non-compliance.

Who Issues the Form

The 370 tax form is typically issued by local tax authorities or government agencies responsible for overseeing lodging taxes. In many cases, this may include city or county tax offices. It is important for businesses to obtain the correct version of the form from the appropriate issuing authority to ensure compliance with local regulations. Some jurisdictions may provide the form online, while others may require businesses to request it directly from the office.

Required Documents

When completing the 370 tax form, certain documents may be required to support the information provided. These documents can include:

- Proof of business registration: Documentation showing that your lodging business is registered and licensed to operate.

- Guest invoices: Copies of invoices or receipts issued to guests during the reporting period.

- Payment records: Documentation of payments received for lodging services, which may include bank statements or transaction records.

Quick guide on how to complete 370 douglascountynv

Complete 3 70 Douglascountynv effortlessly on any device

Online document management has become popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools you need to create, alter, and eSign your documents swiftly without delays. Manage 3 70 Douglascountynv on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign 3 70 Douglascountynv with ease

- Obtain 3 70 Douglascountynv and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Alter and eSign 3 70 Douglascountynv and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 370 douglascountynv

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the 370 tax form and who needs it?

The 370 tax form is a document required for specific tax filings, primarily used by individuals and businesses to report income or deductions related to certain financial activities. If you're involved in tax reporting and need to ensure compliance, understanding the 370 tax form is essential for accurate submissions.

-

How can airSlate SignNow assist with the 370 tax form?

airSlate SignNow provides an efficient platform for eSigning and sending essential documents like the 370 tax form. Our user-friendly interface allows you to upload, manage, and share your tax documents securely, ensuring you meet all necessary deadlines seamlessly.

-

Is there a free trial available for using airSlate SignNow for the 370 tax form?

Yes, airSlate SignNow offers a free trial that allows you to explore our features, including handling the 370 tax form. This trial gives you an opportunity to experience our service without any commitments, helping you determine if it's the right fit for your needs.

-

What features are included in airSlate SignNow for handling the 370 tax form?

airSlate SignNow includes features such as eSignature capabilities, document tracking, and templates specifically for the 370 tax form. These tools streamline your document workflow, allowing you to efficiently manage and sign documents necessary for tax compliance.

-

How secure is using airSlate SignNow for the 370 tax form?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption methods to protect your documents, including the 370 tax form, ensuring that sensitive information is secure during transmission and storage.

-

Can I integrate airSlate SignNow with other software for the 370 tax form?

Yes, airSlate SignNow offers integrations with popular software applications, allowing you to easily incorporate your document signing processes for the 370 tax form into your existing workflows. This flexibility enhances productivity and simplifies your tax filing process.

-

What are the benefits of using airSlate SignNow for the 370 tax form?

Using airSlate SignNow for the 370 tax form provides several benefits, including speed, efficiency, and cost-effectiveness. Our platform signNowly reduces the time it takes to prepare and send documents, allowing you to focus on other critical aspects of your tax obligations.

Get more for 3 70 Douglascountynv

- Form 941 employers quarterly federal tax return clover

- Neck disability index 100393420 form

- Mental health assessment form

- Esthetician facial consultation forms

- 23135851162 4664427 form

- Report an illness or health incidentkdhe ks form

- Digital marketing service level agreement template form

- Direct debit agreement template form

Find out other 3 70 Douglascountynv

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement