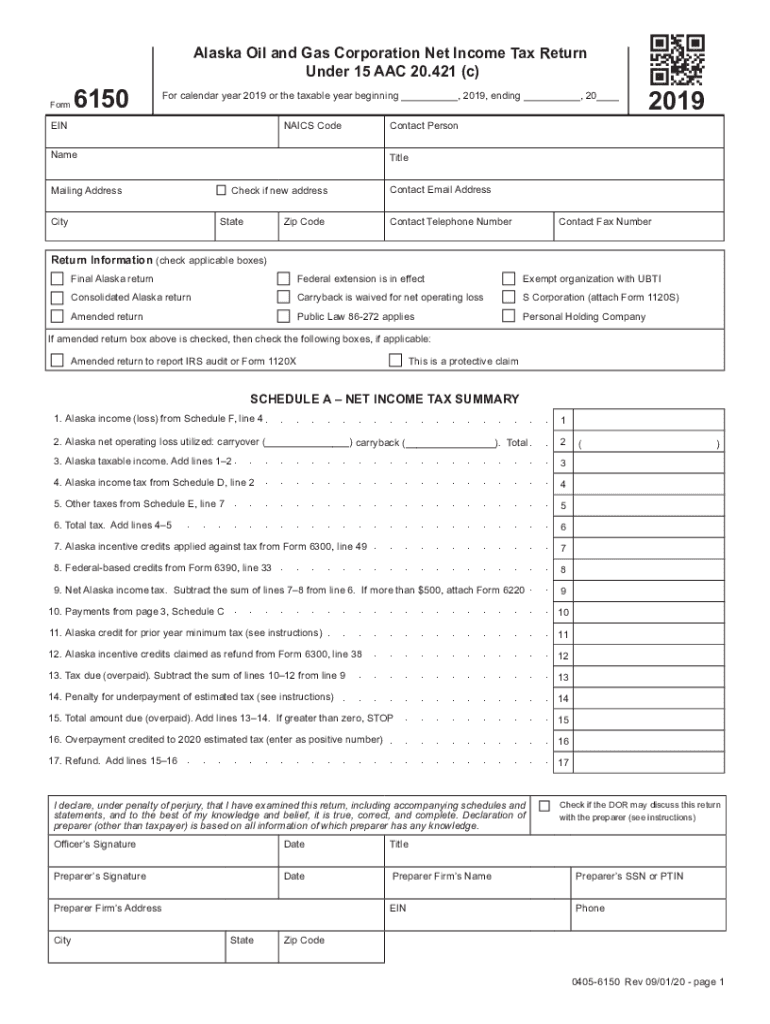

Consolidated Alaska Return 2019

What is the Consolidated Alaska Return

The Consolidated Alaska Return is a specific tax form designed for residents of Alaska to report their income and calculate their tax obligations. This form consolidates various income sources, allowing taxpayers to submit a single return rather than multiple forms. It is essential for ensuring compliance with state tax laws and facilitates the accurate assessment of tax liabilities.

How to use the Consolidated Alaska Return

Using the Consolidated Alaska Return involves several steps. Taxpayers must first gather all necessary documentation, including income statements, deductions, and credits. Once the information is compiled, individuals can fill out the form either digitally or on paper. It is crucial to ensure that all entries are accurate and complete to avoid delays in processing. After completing the form, taxpayers can submit it through the appropriate channels, ensuring they meet any filing deadlines.

Steps to complete the Consolidated Alaska Return

Completing the Consolidated Alaska Return requires attention to detail. Follow these steps for a smooth process:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income-related paperwork.

- Review the instructions for the form carefully to understand each section's requirements.

- Fill out the form accurately, ensuring all income and deductions are reported.

- Double-check all entries for errors or omissions.

- Sign and date the form before submission.

Legal use of the Consolidated Alaska Return

The legal use of the Consolidated Alaska Return is governed by state tax laws. To ensure that the form is legally binding, it must be completed accurately and submitted in accordance with the specified guidelines. Electronic submissions are permissible, provided that they comply with eSignature laws and maintain the integrity of the document. Utilizing a reliable eSignature platform can enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the Consolidated Alaska Return are critical for compliance. Typically, the form must be submitted by April fifteenth of each year. However, taxpayers should verify specific dates as they may vary based on individual circumstances or changes in tax regulations. Staying informed about these deadlines helps avoid penalties and ensures timely processing of returns.

Required Documents

To complete the Consolidated Alaska Return, several documents are necessary. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as receipts for business expenses or charitable contributions

Having these documents organized and readily available will streamline the completion of the return.

Quick guide on how to complete consolidated alaska return

Complete Consolidated Alaska Return effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documentation, allowing you to find the right form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage Consolidated Alaska Return on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related operation today.

How to edit and electronically sign Consolidated Alaska Return with ease

- Find Consolidated Alaska Return and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, through email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Consolidated Alaska Return and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct consolidated alaska return

Create this form in 5 minutes!

How to create an eSignature for the consolidated alaska return

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is a Consolidated Alaska Return?

A Consolidated Alaska Return is a specific tax return designed for businesses operating in Alaska, allowing them to report income and expenses efficiently. This type of return simplifies tax filings for companies with multiple subsidiaries under one consolidated form.

-

How can airSlate SignNow assist with the Consolidated Alaska Return?

airSlate SignNow provides a streamlined platform for businesses to eSign and manage their tax documents, including the Consolidated Alaska Return. With its intuitive interface, users can ensure timely submission of their returns while maintaining compliance with tax regulations.

-

What features does airSlate SignNow include for handling the Consolidated Alaska Return?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and document tracking, which are essential for efficiently managing the Consolidated Alaska Return. These tools help eliminate paperwork hassle and enhance collaboration between team members.

-

Is airSlate SignNow cost-effective for preparing the Consolidated Alaska Return?

Yes, airSlate SignNow is a cost-effective solution for preparing the Consolidated Alaska Return, offering flexible pricing plans that cater to various business sizes. Users can save time and resources, ultimately reducing the total cost of managing their tax filings.

-

Can I integrate airSlate SignNow with accounting software for my Consolidated Alaska Return?

Absolutely! airSlate SignNow integrates seamlessly with major accounting software, allowing for efficient management of your financial documents related to the Consolidated Alaska Return. This integration minimizes data entry errors and ensures all financial information is accurate.

-

What are the benefits of using airSlate SignNow for my Consolidated Alaska Return?

Using airSlate SignNow for your Consolidated Alaska Return offers numerous benefits, including enhanced efficiency, improved document security, and easy access to eSigned contracts. Businesses can maintain compliance while streamlining their tax processes.

-

How secure is airSlate SignNow when handling my Consolidated Alaska Return?

airSlate SignNow prioritizes security with bank-level encryption and robust authentication methods, ensuring that your Consolidated Alaska Return and other sensitive documents remain safe. You can trust that your information is protected throughout the eSigning process.

Get more for Consolidated Alaska Return

- Wisconsin month form

- Residential rental lease agreement wisconsin form

- Tenant welcome letter wisconsin form

- Warning of default on commercial lease wisconsin form

- Warning of default on residential lease wisconsin form

- Landlord tenant closing statement to reconcile security deposit wisconsin form

- Wisconsin name change form

- Name change notification form wisconsin

Find out other Consolidated Alaska Return

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement