TC563657 PDF 2024-2026

What is the TC563657 pdf

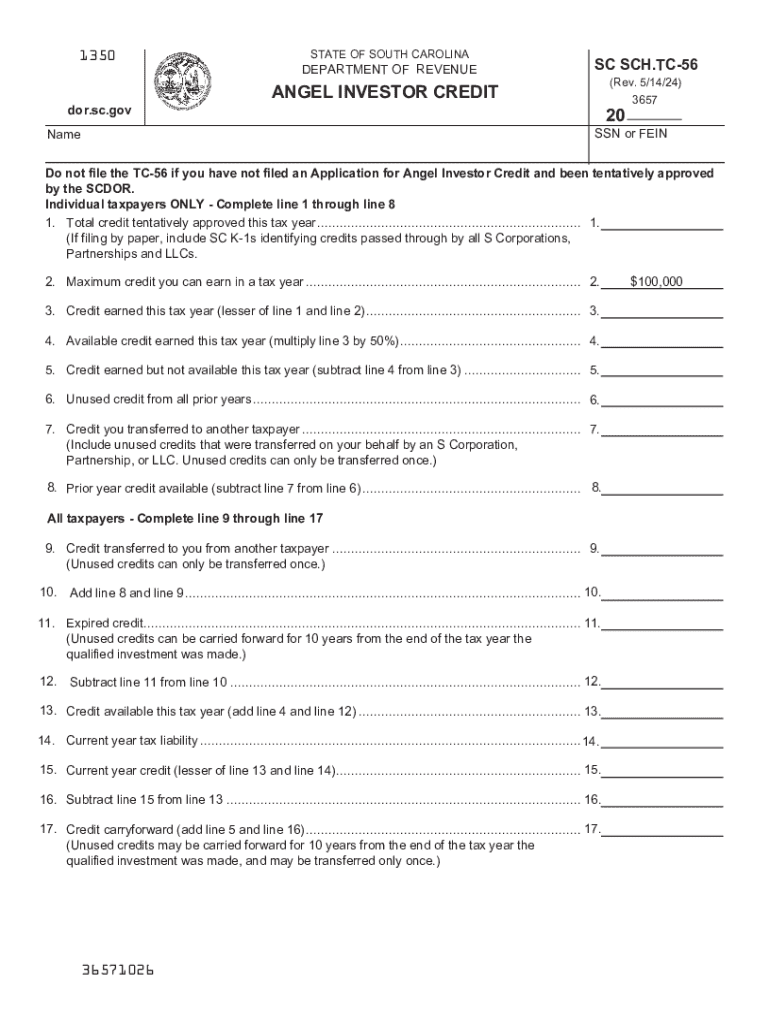

The TC563657 pdf is a specific form utilized within the U.S. tax system, primarily associated with certain tax reporting requirements. This document is essential for individuals or entities that need to report specific financial information to the Internal Revenue Service (IRS). Understanding the purpose of this form is crucial for ensuring compliance with federal tax laws.

How to use the TC563657 pdf

Using the TC563657 pdf involves filling out the form accurately to report the required information. Users should begin by downloading the form from a reliable source. After filling in the necessary fields, it is important to review the information for accuracy. Once completed, the form can be submitted electronically or via mail, depending on the specific instructions provided for that tax year.

Steps to complete the TC563657 pdf

Completing the TC563657 pdf requires a systematic approach. Here are the steps to follow:

- Download the TC563657 pdf from an authorized source.

- Gather all necessary financial documents and information needed to fill out the form.

- Carefully fill in each section of the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form according to the provided instructions, either electronically or by mail.

Legal use of the TC563657 pdf

The TC563657 pdf serves a legal function in the tax reporting process. It is important for users to understand that submitting this form is a legal requirement for those who meet specific criteria set by the IRS. Failure to submit the form correctly or on time can result in penalties or legal repercussions. Therefore, it is advisable to consult a tax professional if there are any uncertainties regarding its use.

Filing Deadlines / Important Dates

Filing deadlines for the TC563657 pdf can vary based on the tax year and the specific circumstances of the filer. Generally, forms must be submitted by the standard tax filing deadline, which is typically April 15 for individual taxpayers. However, extensions may be available under certain conditions. It is essential to stay informed about any changes to deadlines to avoid late penalties.

Who Issues the Form

The TC563657 pdf is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax administration in the United States. The IRS provides the form as part of its efforts to ensure that taxpayers report their financial information accurately and comply with federal tax laws. It is important to use the official version of the form to ensure compliance.

Create this form in 5 minutes or less

Find and fill out the correct tc563657 pdf

Create this form in 5 minutes!

How to create an eSignature for the tc563657 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TC563657 pdf and how can it be used?

The TC563657 pdf is a specific document format that can be easily signed and managed using airSlate SignNow. This tool allows users to upload, send, and eSign the TC563657 pdf efficiently, streamlining the document workflow for businesses.

-

How does airSlate SignNow ensure the security of the TC563657 pdf?

airSlate SignNow prioritizes security by employing advanced encryption methods to protect the TC563657 pdf during transmission and storage. Additionally, the platform complies with industry standards, ensuring that your documents remain confidential and secure.

-

What are the pricing options for using airSlate SignNow with TC563657 pdf?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for handling the TC563657 pdf. You can choose from monthly or annual subscriptions, with features that scale according to your usage and requirements.

-

Can I integrate airSlate SignNow with other applications for managing TC563657 pdf?

Yes, airSlate SignNow provides seamless integrations with popular applications such as Google Drive, Dropbox, and CRM systems. This allows you to manage the TC563657 pdf alongside your other business tools, enhancing productivity and collaboration.

-

What features does airSlate SignNow offer for editing TC563657 pdf documents?

airSlate SignNow includes a variety of features for editing TC563657 pdf documents, such as adding text, images, and signatures. Users can also annotate and highlight sections of the document, making it easier to collaborate and finalize agreements.

-

How can airSlate SignNow improve my workflow with TC563657 pdf?

By using airSlate SignNow, you can signNowly enhance your workflow with the TC563657 pdf through automated processes. The platform allows for quick document routing, eSigning, and tracking, reducing turnaround times and improving overall efficiency.

-

Is it easy to eSign a TC563657 pdf using airSlate SignNow?

Absolutely! airSlate SignNow simplifies the eSigning process for the TC563657 pdf, allowing users to sign documents electronically with just a few clicks. The user-friendly interface ensures that anyone can navigate the signing process effortlessly.

Get more for TC563657 pdf

- Wwwpdffillercom506723629 nmero del colegio2020 form ca fl 200 s fill online printable fillable blank

- Form jd cr 154 ampquotapplication for supervised diversionary programampquot

- Attorney photo id card application jd es 229 forms

- Affidavit relief from abuse judctgov form

- Wwwkssosorg forms businessserviceskansas secretary of state home

- When a request form

- Starter checkliststarter checklist for paye govukstarter checklist for paye govukstarter checklist for paye govuk form

- Krikorian application form

Find out other TC563657 pdf

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later