Sc Angel Investor Credit 2021

What is the SC Angel Investor Credit

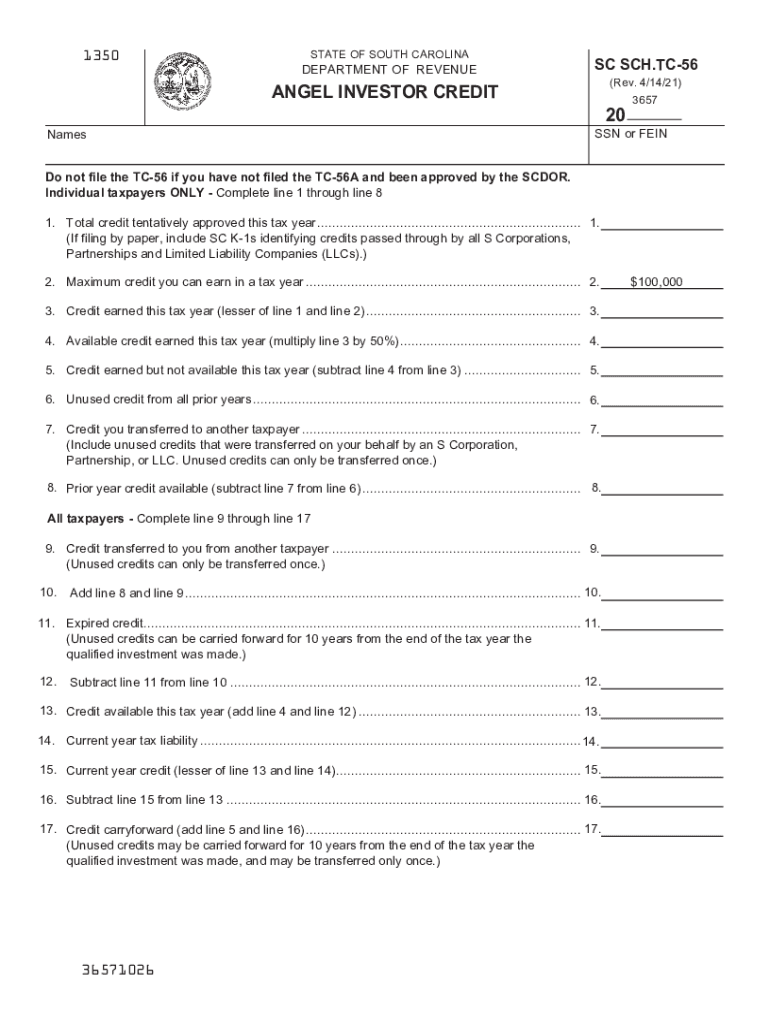

The SC Angel Investor Credit is a tax incentive designed to encourage investment in qualified South Carolina businesses. This credit allows individual investors to receive a tax credit for a percentage of their investment in a certified South Carolina business. The primary goal is to stimulate economic growth by supporting startups and small businesses that are poised for growth and innovation. The credit is applicable to investments made in businesses that meet specific eligibility criteria, including being a certified South Carolina business and engaging in qualified activities.

Eligibility Criteria

To qualify for the SC Angel Investor Credit, both the investor and the business must meet certain criteria. Investors must be individuals or pass-through entities, and they must invest in a certified South Carolina business. The business must be engaged in qualified activities, such as manufacturing, technology, or other sectors that contribute to economic development. Additionally, the business must have fewer than 25 full-time employees and less than $1 million in gross revenues at the time of investment. These criteria ensure that the credit is directed towards businesses that are likely to benefit from the funding.

Steps to Complete the SC Angel Investor Credit

Completing the SC Angel Investor Credit involves several key steps to ensure compliance and maximize benefits. First, an investor must identify a qualified South Carolina business and confirm its certification status. After making the investment, the investor should obtain the necessary documentation from the business, including proof of investment and a certification letter. Next, the investor must complete the appropriate tax forms, including the SC Angel Investor Credit application, and submit them with their tax return. It is crucial to keep records of all documents related to the investment for future reference and potential audits.

Required Documents

When applying for the SC Angel Investor Credit, specific documents are necessary to support the application. These include:

- Proof of investment in the certified South Carolina business.

- A certification letter from the business confirming its status and the amount invested.

- Completed SC Angel Investor Credit application form.

- Tax return documentation to support the claim for the credit.

Having these documents organized and readily available will facilitate a smoother application process and ensure compliance with state regulations.

Form Submission Methods

The SC Angel Investor Credit application can be submitted through various methods, depending on the preference of the investor. The options include:

- Online submission through the South Carolina Department of Revenue's e-filing system.

- Mailing the completed forms directly to the Department of Revenue.

- In-person submission at designated Department of Revenue offices.

Choosing the appropriate submission method can help ensure timely processing and adherence to deadlines.

Key Elements of the SC Angel Investor Credit

Understanding the key elements of the SC Angel Investor Credit is essential for maximizing its benefits. Important aspects include:

- The percentage of the investment that qualifies for the tax credit, which is typically a specified rate set by the state.

- The maximum credit amount available per investor, which may vary based on the investment and business type.

- The duration for which the credit can be claimed, often aligning with the investor's tax filing schedule.

These elements are crucial for investors to consider when planning their investments and tax strategies.

Quick guide on how to complete sc angel investor credit

Effortlessly Complete Sc Angel Investor Credit on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage Sc Angel Investor Credit on any platform with airSlate SignNow mobile applications for Android or iOS, and streamline any document-related task today.

How to Modify and Electronically Sign Sc Angel Investor Credit with Ease

- Obtain Sc Angel Investor Credit and then click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the specialized tools airSlate SignNow offers.

- Create your signature using the Sign tool, which takes just seconds and possesses the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to save your edits.

- Select your preferred method to share your form, either via email, SMS, an invite link, or download it to your computer.

Say goodbye to lost or disorganized documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Sc Angel Investor Credit to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc angel investor credit

Create this form in 5 minutes!

How to create an eSignature for the sc angel investor credit

The best way to generate an e-signature for a PDF document in the online mode

The best way to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The best way to create an e-signature from your mobile device

How to create an e-signature for a PDF document on iOS devices

The best way to create an e-signature for a PDF file on Android devices

People also ask

-

What is SC angel investor credit and how can it benefit my business?

SC angel investor credit refers to tax credits available for investors who provide funding to small businesses in South Carolina. By leveraging this credit, businesses can attract potential investors, which can enhance funding opportunities and support growth initiatives. This can ultimately lead to more successful fundraising and operational expansion.

-

How does airSlate SignNow support the process of securing SC angel investor credit?

airSlate SignNow streamlines the documentation process necessary for applying for SC angel investor credit. With our easy-to-use eSignature tools, businesses can quickly sign and send required forms to investors, ensuring a smooth application process and timely submission. This efficiency helps companies focus on securing funding rather than getting bogged down in paperwork.

-

What features does airSlate SignNow offer to enhance investor communications for SC angel investor credit?

airSlate SignNow offers robust features such as customizable templates, real-time tracking, and collaborative editing, which are essential for effective communication with investors regarding SC angel investor credit. These tools ensure that all stakeholders are informed and can provide input efficiently, facilitating a smoother funding process.

-

Is there a cost associated with using airSlate SignNow to apply for SC angel investor credit?

Yes, while there is a nominal subscription fee for using airSlate SignNow, the investment can be worthwhile given the potential benefits of attracting investors through SC angel investor credit. Our pricing plans are designed to fit a range of business needs, providing a cost-effective solution for managing essential documents and eSignatures.

-

Can I integrate airSlate SignNow with other tools to assist in obtaining SC angel investor credit?

Absolutely! airSlate SignNow seamlessly integrates with various CRMs and productivity tools, which can help streamline your workflow when applying for SC angel investor credit. This integration ensures that all necessary documents are easily accessible, promoting a more organized and efficient funding process.

-

How secure is airSlate SignNow for handling documents related to SC angel investor credit?

Security is a top priority at airSlate SignNow. We employ industry-standard encryption and compliance measures to protect sensitive documents involved in SC angel investor credit applications. Businesses can rest assured that their information is kept confidential and secure throughout the signing process.

-

What types of documents can I manage with airSlate SignNow related to SC angel investor credit?

With airSlate SignNow, you can manage various types of documents essential for SC angel investor credit, including funding agreements, investor contracts, and compliance forms. Our platform allows for easy creation, sharing, and signing of these documents, ensuring all parties involved have access to what they need quickly.

Get more for Sc Angel Investor Credit

- Hvac contractor package florida form

- Landscaping contractor package florida form

- Commercial contractor package florida form

- Excavation contractor package florida form

- Florida contractor form

- Concrete mason contractor package florida form

- Demolition contractor package florida form

- Security contractor package florida form

Find out other Sc Angel Investor Credit

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer