Azdor Govtax Creditscontributions Qcos and QfcosContributions to QCOs and QFCOsArizona Department of Revenue 2021

Understanding Arizona Form 321 Qualifying

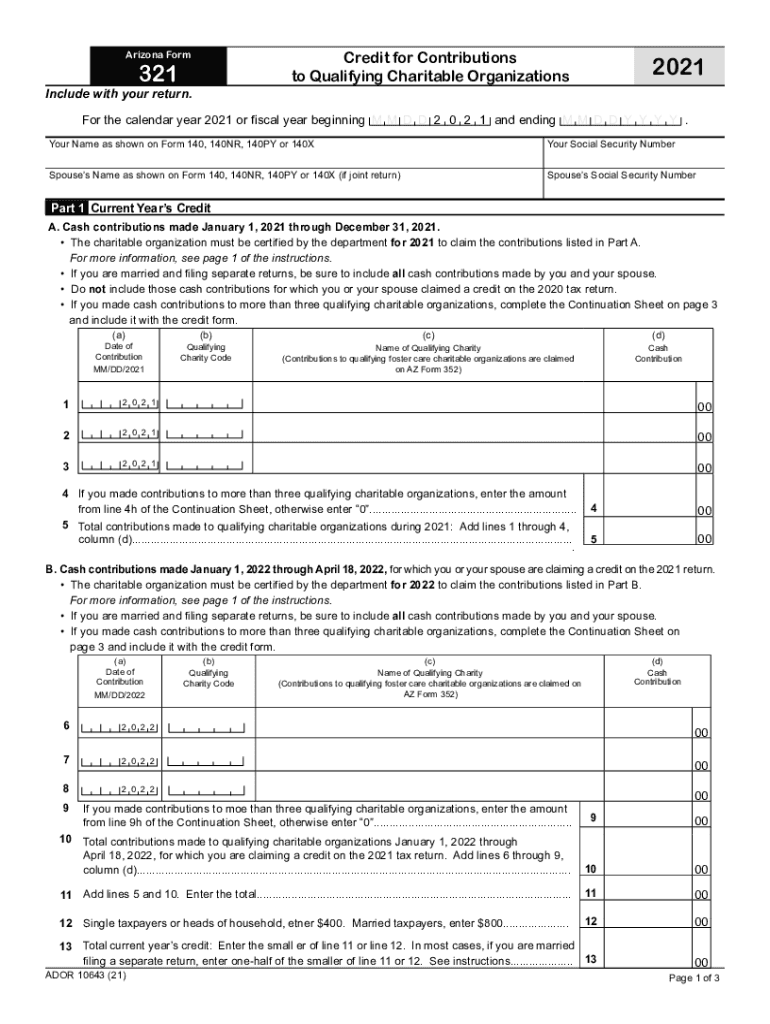

The Arizona Form 321 qualifying is a crucial document for taxpayers who wish to claim tax credits for contributions made to qualifying charitable organizations. This form allows individuals to receive a tax credit for donations made to specific organizations that provide assistance to the community. Understanding the purpose and requirements of this form is essential for maximizing your tax benefits.

Steps to Complete the Arizona Form 321 Qualifying

Completing the Arizona Form 321 qualifying involves several key steps:

- Gather necessary documentation, including proof of contributions made to qualifying organizations.

- Fill out the form accurately, ensuring all personal information and contribution details are correct.

- Calculate the total amount of your contributions to determine the tax credit you are eligible for.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with your tax return to the Arizona Department of Revenue.

Eligibility Criteria for Arizona Form 321 Qualifying

To qualify for the tax credit associated with Arizona Form 321, taxpayers must meet specific eligibility criteria:

- Contributions must be made to organizations that are recognized as qualifying charitable organizations (QCOs) or qualifying foster care organizations (QFCOs).

- The taxpayer must be an Arizona resident and must file an Arizona state income tax return.

- Contributions must be made during the tax year for which the credit is claimed.

Legal Use of Arizona Form 321 Qualifying

The Arizona Form 321 qualifying is legally recognized for claiming tax credits. To ensure compliance with state laws, it is essential to follow all guidelines set forth by the Arizona Department of Revenue. Proper use of the form includes submitting it with accurate information and adhering to deadlines for filing.

Filing Deadlines for Arizona Form 321 Qualifying

Timely submission of the Arizona Form 321 qualifying is vital for receiving your tax credit. The form must be filed along with your Arizona state income tax return, which is typically due on April 15 of each year. If April 15 falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to check for any updates or changes to the filing deadlines each tax year.

Required Documents for Arizona Form 321 Qualifying

When preparing to submit the Arizona Form 321 qualifying, ensure you have the following documents ready:

- Receipts or documentation of contributions made to qualifying organizations.

- Your completed Arizona state income tax return.

- Any additional forms required by the Arizona Department of Revenue related to the tax credit.

Quick guide on how to complete azdorgovtax creditscontributions qcos and qfcoscontributions to qcos and qfcosarizona department of revenue

Effortlessly Create Azdor govtax creditscontributions qcos and qfcosContributions To QCOs And QFCOsArizona Department Of Revenue on Any Gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed files, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to design, alter, and electronically sign your documents quickly and efficiently. Manage Azdor govtax creditscontributions qcos and qfcosContributions To QCOs And QFCOsArizona Department Of Revenue on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

How to Modify and Electronically Sign Azdor govtax creditscontributions qcos and qfcosContributions To QCOs And QFCOsArizona Department Of Revenue with Ease

- Obtain Azdor govtax creditscontributions qcos and qfcosContributions To QCOs And QFCOsArizona Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form—via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Azdor govtax creditscontributions qcos and qfcosContributions To QCOs And QFCOsArizona Department Of Revenue and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct azdorgovtax creditscontributions qcos and qfcoscontributions to qcos and qfcosarizona department of revenue

Create this form in 5 minutes!

How to create an eSignature for the azdorgovtax creditscontributions qcos and qfcoscontributions to qcos and qfcosarizona department of revenue

The best way to make an electronic signature for your PDF file in the online mode

The best way to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The best way to generate an e-signature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The best way to generate an e-signature for a PDF file on Android

People also ask

-

What is Arizona Form 321 qualifying?

Arizona Form 321 qualifying is a document required for businesses to determine eligibility for Arizona tax credits. It helps ensure that businesses comply with state regulations while optimizing their tax obligations. Understanding the requirements of this form is essential for any business operating in Arizona.

-

How can airSlate SignNow help with Arizona Form 321 qualifying?

airSlate SignNow streamlines the process of preparing and signing Arizona Form 321 qualifying. Our platform allows users to securely send and eSign documents, ensuring compliance and efficiency. With airSlate SignNow, businesses can manage all necessary documentation related to Arizona Form 321 qualifying seamlessly.

-

What are the pricing plans for using airSlate SignNow for Arizona Form 321 qualifying?

We offer competitive pricing plans for airSlate SignNow, designed to meet the needs of businesses handling Arizona Form 321 qualifying. Our pricing tiers vary based on the number of users and features required. We also provide a free trial, allowing you to test our service and see how it can facilitate your Arizona Form 321 qualifying processes.

-

What features does airSlate SignNow offer for Arizona Form 321 qualifying documentation?

airSlate SignNow comes with robust features for managing Arizona Form 321 qualifying documentation. Key features include secure eSigning, document templates, and real-time tracking of signatures. These tools help ensure that your documents are prepared and signed quickly and efficiently.

-

Is airSlate SignNow suitable for small businesses handling Arizona Form 321 qualifying?

Absolutely! airSlate SignNow is an ideal solution for small businesses managing Arizona Form 321 qualifying. Our user-friendly interface and cost-effective pricing make it accessible for businesses of all sizes, helping them stay compliant while saving time and resources.

-

Can airSlate SignNow integrate with other software for Arizona Form 321 qualifying?

Yes, airSlate SignNow offers integrations with various software platforms that can facilitate your Arizona Form 321 qualifying documentation. This includes popular CRMs and productivity tools, allowing for a streamlined workflow. Integrating these tools helps to enhance productivity and ensure a seamless experience.

-

What are the benefits of using airSlate SignNow for Arizona Form 321 qualifying?

Using airSlate SignNow for Arizona Form 321 qualifying provides numerous benefits, including improved efficiency and compliance. The platform's secure eSignature capabilities minimize paperwork and reduce turnaround times. Additionally, our service offers detailed tracking, giving you peace of mind during the document signing process.

Get more for Azdor govtax creditscontributions qcos and qfcosContributions To QCOs And QFCOsArizona Department Of Revenue

- Legal last will and testament form for married person with adult children florida

- Legal last will and testament form for a married person with no children florida

- Florida last form

- Will amending form

- Mutual wills package with last wills and testaments for married couple with adult children florida form

- Will married couple 497303519 form

- Mutual wills package with last wills and testaments for married couple with minor children florida form

- Florida simple will form for married person

Find out other Azdor govtax creditscontributions qcos and qfcosContributions To QCOs And QFCOsArizona Department Of Revenue

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed