Arizona Form 321 Credit for Contributions to Qualifying 2023

What is the Arizona Form 321 Credit for Contributions to Qualifying Charities?

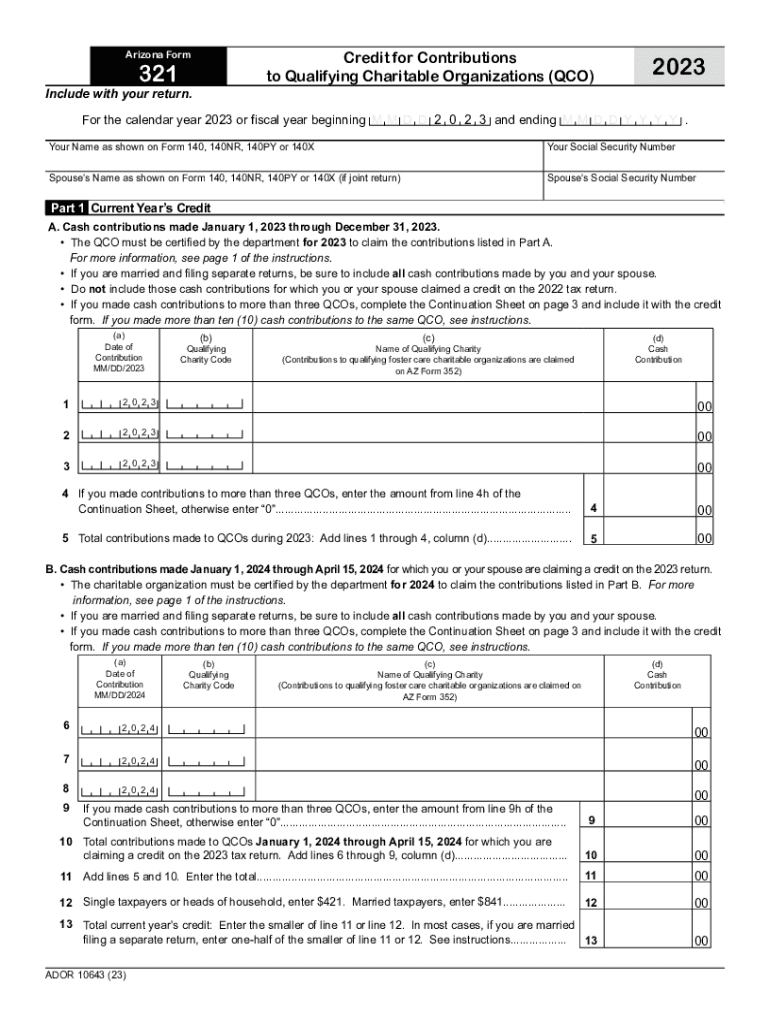

The Arizona Form 321 Credit allows taxpayers to receive a tax credit for contributions made to qualifying charitable organizations. This credit is designed to encourage donations to specific charities that provide essential services to Arizona residents. Taxpayers can claim this credit on their state income tax return, effectively reducing their tax liability while supporting local charities.

Eligibility Criteria for Arizona Form 321 Credit

To qualify for the Arizona Form 321 Credit, taxpayers must meet certain criteria. Contributions must be made to a qualifying charitable organization as defined by Arizona law. Additionally, taxpayers must ensure that their contributions do not exceed the specified limits set by the state. It is important to verify that the charity is recognized as eligible to receive these contributions, as only donations to approved organizations will qualify for the credit.

Steps to Complete the Arizona Form 321 Credit

Completing the Arizona Form 321 Credit involves several straightforward steps:

- Gather documentation of your contributions to qualifying charities.

- Obtain the Arizona Form 321, which can be downloaded from the Arizona Department of Revenue website.

- Fill out the form with accurate information regarding your contributions and personal details.

- Calculate the credit amount based on the contributions made.

- Attach the completed form to your Arizona state tax return when filing.

How to Obtain the Arizona Form 321 Credit

The Arizona Form 321 Credit can be obtained through the Arizona Department of Revenue's website. Taxpayers can download the form directly from the site. Additionally, physical copies may be available at local tax offices or community centers. It is advisable to ensure that you are using the most current version of the form to avoid any issues during the filing process.

Key Elements of the Arizona Form 321 Credit

Several key elements are essential to understanding the Arizona Form 321 Credit:

- Contribution Limits: The state sets specific limits on the amount that can be claimed as a credit.

- Qualifying Charities: Only contributions to approved organizations qualify for the credit.

- Filing Requirements: Taxpayers must include the form with their state tax return to claim the credit.

Examples of Using the Arizona Form 321 Credit

Taxpayers can benefit from the Arizona Form 321 Credit in various scenarios. For instance, an individual who donates to a qualifying charity can reduce their state tax liability by the amount contributed, up to the maximum allowed. Another example includes a married couple who jointly contribute to eligible organizations, allowing them to claim a higher credit together. These examples illustrate how the credit can effectively support both charitable giving and tax savings.

Quick guide on how to complete arizona form 321 credit for contributions to qualifying

Effortlessly Manage Arizona Form 321 Credit For Contributions To Qualifying on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Handle Arizona Form 321 Credit For Contributions To Qualifying on any platform with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to Edit and eSign Arizona Form 321 Credit For Contributions To Qualifying with Ease

- Locate Arizona Form 321 Credit For Contributions To Qualifying and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and has the same legal value as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, either via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Arizona Form 321 Credit For Contributions To Qualifying and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona form 321 credit for contributions to qualifying

Create this form in 5 minutes!

How to create an eSignature for the arizona form 321 credit for contributions to qualifying

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Arizona 321 Credit and how does it work?

Arizona 321 Credit is a financial service that helps individuals improve their credit scores and manage their credit histories effectively. By utilizing its tools and resources, users can gain insights into their credit reports and learn strategies to build better credit. This service is designed for those in Arizona looking to enhance their financial standing.

-

What are the benefits of using Arizona 321 Credit?

Using Arizona 321 Credit provides numerous benefits, including personalized credit consultations, access to credit-building resources, and improvement planning. Users can take actionable steps to enhance their financial health, making it easier to secure loans and better interest rates in the future. The service is user-friendly and tailored specifically for Arizona residents.

-

How much does Arizona 321 Credit cost?

Arizona 321 Credit offers various pricing plans to cater to different needs and budgets. Depending on the features and services you choose, costs can vary signNowly. It's advised to check their website for the most up-to-date pricing information to ensure you select the option that best fits your financial goals.

-

Are there any integrations available with Arizona 321 Credit?

Yes, Arizona 321 Credit seamlessly integrates with various financial tools and platforms to enhance the user experience. These integrations allow for easier tracking of financial data and credit improvements, ensuring users can manage their credit profiles efficiently. Explore the official website for a complete list of compatible integrations.

-

How can Arizona 321 Credit help improve my credit score?

Arizona 321 Credit provides tailored advice and actionable steps to help users improve their credit scores over time. Through personalized analyses of individual credit reports, users receive specific recommendations on how to address negative factors affecting their scores. Utilizing their resources consistently can lead to noticeable improvements.

-

What features are included in Arizona 321 Credit?

Arizona 321 Credit includes features such as credit monitoring, dispute management, and educational resources for improving financial literacy. Users can also access tools to track their progress and receive alerts about changes in their credit status. These features collectively empower customers to take charge of their credit health.

-

Is Arizona 321 Credit suitable for everyone?

Arizona 321 Credit is designed to assist a wide audience, from individuals looking to improve their credit to those aiming to maintain a healthy credit profile. It’s especially beneficial for Arizona residents seeking localized guidance. However, it’s essential for users to consider their unique financial situations when deciding if this service is right for them.

Get more for Arizona Form 321 Credit For Contributions To Qualifying

Find out other Arizona Form 321 Credit For Contributions To Qualifying

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document