Printable Arizona Form 321 Credit for Contributions to Qualifying Charitable Organizations 2020

What is the Printable Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations

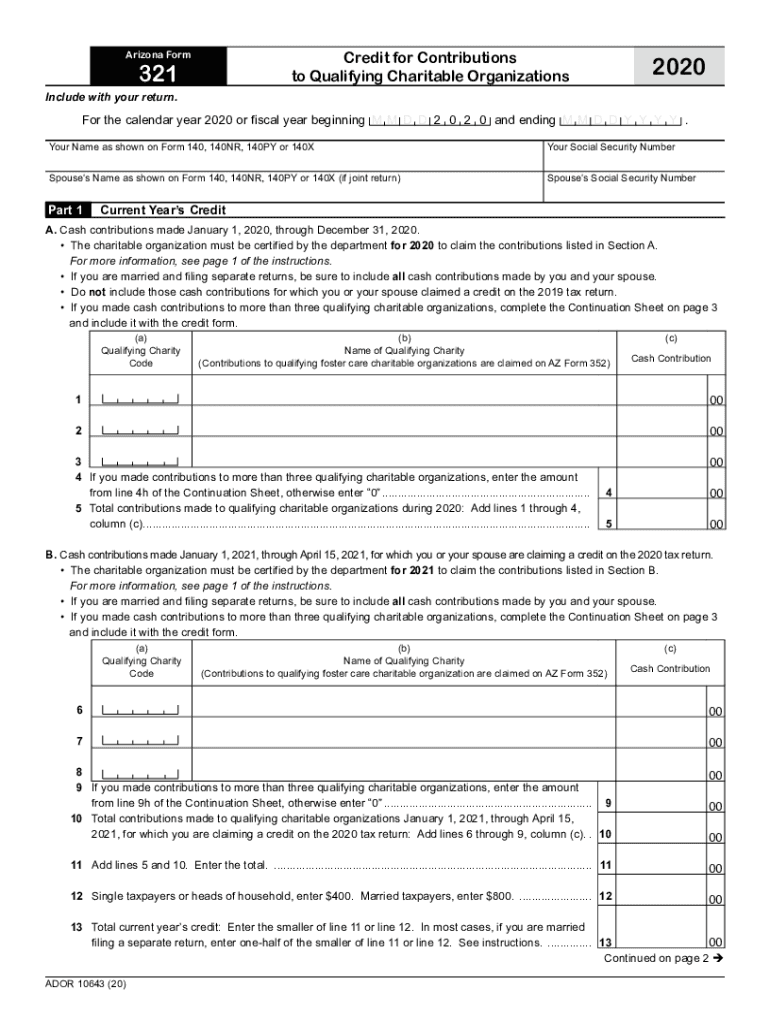

The Arizona Form 321 is a tax form used to claim a credit for contributions made to qualifying charitable organizations. This form allows taxpayers to receive a dollar-for-dollar reduction in their state income tax liability based on their charitable donations. The contributions must be made to organizations that meet specific criteria set by the state of Arizona, ensuring that the funds support eligible charitable activities. Understanding the details of this form is essential for taxpayers looking to maximize their tax benefits while supporting charitable causes.

How to use the Printable Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations

Using the Arizona Form 321 involves several steps to ensure that taxpayers can effectively claim their credits. First, individuals must determine their eligibility based on the contributions made to qualifying organizations. Next, they should obtain the form, which can be downloaded or printed from official state resources. After filling out the required information, including details about the contributions, taxpayers must submit the form along with their state tax return. It is crucial to keep records of the donations, as they may be needed for verification purposes.

Steps to complete the Printable Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations

Completing the Arizona Form 321 requires careful attention to detail. Here are the steps involved:

- Gather documentation of your contributions to qualifying charitable organizations.

- Download and print the Arizona Form 321 from the official state website.

- Fill out the form with accurate information, including your name, address, and the amount donated.

- Calculate the credit based on your contributions and ensure it aligns with the state guidelines.

- Attach the completed form to your Arizona state tax return.

- Keep a copy of the form and related documents for your records.

Eligibility Criteria

To qualify for the Arizona Form 321 credit, taxpayers must meet specific eligibility criteria. Contributions must be made to organizations that qualify under Arizona law, which typically includes non-profit entities that provide charitable services. Additionally, there may be limits on the amount that can be claimed based on filing status and total contributions. Taxpayers should verify the status of the organizations they donate to, ensuring they are recognized as qualifying charitable organizations by the Arizona Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form 321 align with the general state tax return deadlines. Typically, taxpayers must submit their state income tax returns by April 15 of each year. If taxpayers need additional time, they may request an extension, but it is important to check specific guidelines regarding the submission of Form 321 during this period. Keeping track of these important dates ensures that taxpayers do not miss out on claiming their credits.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form 321 can be submitted through various methods, providing flexibility for taxpayers. Individuals can file their state tax returns electronically, which may include submitting Form 321 online through approved tax software. Alternatively, taxpayers may choose to mail their completed form along with their tax return to the appropriate address specified by the Arizona Department of Revenue. In-person submission is also an option at designated tax offices, although this method may require an appointment or adherence to specific office hours.

Quick guide on how to complete printable 2020 arizona form 321 credit for contributions to qualifying charitable organizations

Complete Printable Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage Printable Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations on any platform using the airSlate SignNow Android or iOS applications and streamline any document-based process today.

How to adjust and electronically sign Printable Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations effortlessly

- Obtain Printable Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Select pertinent sections of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Decide how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing fresh copies of documents. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Printable Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 arizona form 321 credit for contributions to qualifying charitable organizations

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 arizona form 321 credit for contributions to qualifying charitable organizations

How to make an eSignature for a PDF in the online mode

How to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the Arizona Form 321 Qualifying and why is it important?

The Arizona Form 321 Qualifying is essential for businesses looking to comply with state regulations while ensuring their documents are legally binding. This form provides a streamlined process for electronic signatures, making it easier to manage your documentation and meet compliance standards.

-

How does airSlate SignNow handle the Arizona Form 321 Qualifying?

airSlate SignNow simplifies the process of using the Arizona Form 321 Qualifying by providing an intuitive platform that allows you to create, send, and eSign the form easily. This ensures that you can complete your document workflows efficiently, maintaining compliance along the way.

-

What features does airSlate SignNow offer for Arizona Form 321 Qualifying?

airSlate SignNow offers several features for efficiently handling the Arizona Form 321 Qualifying, such as customizable templates, real-time tracking, and secure cloud storage. These tools enable users to improve their workflow and ensure that all documents are signed and stored safely.

-

Is there a pricing plan for using airSlate SignNow for Arizona Form 321 Qualifying?

Yes, airSlate SignNow provides flexible pricing plans that are affordable for businesses of all sizes. These plans are designed to offer access to essential features needed for processing the Arizona Form 321 Qualifying, ensuring you get value for your money.

-

What are the benefits of using airSlate SignNow for Arizona Form 321 Qualifying?

Using airSlate SignNow for Arizona Form 321 Qualifying streamlines your documentation process, reduces turnaround time, and enhances security. Additionally, it optimizes the user experience, allowing for easy navigation and faster completion of necessary forms.

-

Can airSlate SignNow integrate with other software for managing Arizona Form 321 Qualifying?

Absolutely! airSlate SignNow integrates with various software applications that help manage the Arizona Form 321 Qualifying. This means you can connect it with your existing systems for seamless data transfer and enhanced efficiency.

-

How secure is airSlate SignNow when handling Arizona Form 321 Qualifying?

airSlate SignNow is committed to security and uses advanced encryption and compliance measures to protect your data when handling the Arizona Form 321 Qualifying. This gives you peace of mind knowing that your documents are secure and compliant with industry standards.

Get more for Printable Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations

- School bus driver diabetes waiver form

- Mileage registration form modot mo

- Low power scooter monthly report and request for coloradogov form

- Drivers record form

- Bmw usa luxury sedans suvs convertibles coupes ampamp wagons form

- Penndot application for revisionreturn of cdl dot33 state pa form

- Pa state inspection practice test form

- Imrf form 611

Find out other Printable Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer