Azdor Govformstax Credits FormsCredit for Contributions to Qualifying Charitable AZDOR 2022

Understanding the Arizona 321 Qualifying Form

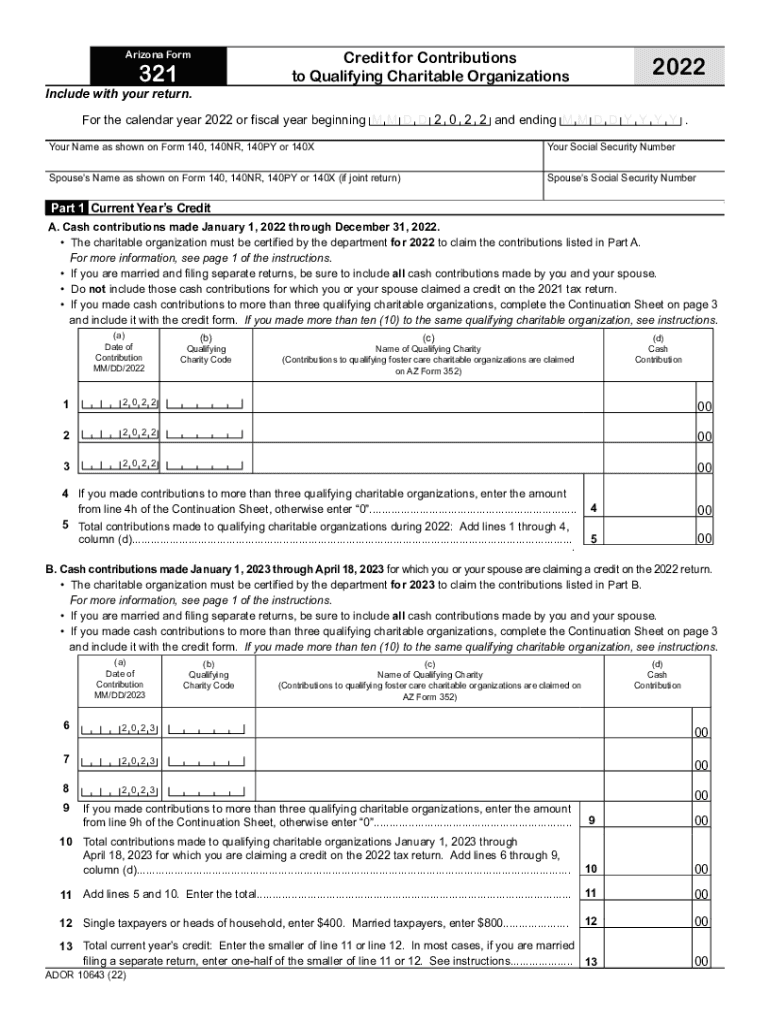

The Arizona 321 qualifying form is a crucial document for taxpayers seeking to claim a credit for contributions made to qualifying charitable organizations. This form is specifically designed to facilitate the process of documenting charitable contributions, allowing taxpayers to benefit from potential tax credits. Understanding its purpose and requirements is essential for ensuring compliance and maximizing tax benefits.

Steps to Complete the Arizona 321 Qualifying Form

Completing the Arizona 321 qualifying form involves several key steps:

- Gather necessary documentation, including records of contributions made to qualifying charities.

- Fill out the form accurately, ensuring that all required fields are completed.

- Calculate the total amount of contributions to determine the eligible credit.

- Review the form for accuracy before submission to avoid potential delays or rejections.

Key Elements of the Arizona 321 Qualifying Form

Several important elements must be included in the Arizona 321 qualifying form:

- Taxpayer Information: This includes the taxpayer's name, address, and Social Security number.

- Contribution Details: A detailed account of contributions made, including the name of the charitable organization and the amount donated.

- Signature: The form must be signed by the taxpayer to validate the information provided.

Eligibility Criteria for the Arizona 321 Qualifying Form

To qualify for the Arizona 321 credit, taxpayers must meet specific eligibility criteria:

- Contributions must be made to qualifying charitable organizations recognized by the Arizona Department of Revenue.

- The taxpayer must itemize deductions on their state tax return to claim the credit.

- Contributions must be made within the tax year for which the credit is being claimed.

Legal Use of the Arizona 321 Qualifying Form

The Arizona 321 qualifying form is legally binding when completed and submitted according to state regulations. It is essential to ensure that the form is filled out accurately and honestly, as any discrepancies may lead to penalties or audits. Compliance with eSignature laws further enhances the legal standing of electronically submitted forms, ensuring they are recognized by the Arizona Department of Revenue.

Form Submission Methods for the Arizona 321 Qualifying Form

Taxpayers have several options for submitting the Arizona 321 qualifying form:

- Online Submission: Forms can be submitted electronically through the Arizona Department of Revenue's online portal.

- Mail: Taxpayers may also print the form and send it via postal mail to the appropriate address provided by the Department of Revenue.

- In-Person: Submitting the form in person at designated state offices is another option for taxpayers.

Quick guide on how to complete azdorgovformstax credits formscredit for contributions to qualifying charitable azdor

Effortlessly Prepare Azdor govformstax credits formsCredit For Contributions To Qualifying Charitable AZDOR on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct version and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without hold-ups. Manage Azdor govformstax credits formsCredit For Contributions To Qualifying Charitable AZDOR on any platform through airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Alter and Electronically Sign Azdor govformstax credits formsCredit For Contributions To Qualifying Charitable AZDOR with Ease

- Obtain Azdor govformstax credits formsCredit For Contributions To Qualifying Charitable AZDOR and click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether by email, SMS, invitation link, or downloading it to your PC.

Eliminate the hassle of lost or mislaid files, the frustration of tedious form retrieval, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Azdor govformstax credits formsCredit For Contributions To Qualifying Charitable AZDOR to guarantee exceptional communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct azdorgovformstax credits formscredit for contributions to qualifying charitable azdor

Create this form in 5 minutes!

People also ask

-

What is the Arizona 321 qualifying form?

The Arizona 321 qualifying form is a document used to determine eligibility for certain state programs. It is essential for businesses operating in Arizona to complete this form accurately to access various benefits. Understanding its requirements can streamline your application process.

-

How can airSlate SignNow help with the Arizona 321 qualifying form?

airSlate SignNow offers an intuitive platform to securely eSign and manage your Arizona 321 qualifying form. With our easy-to-use interface, you can quickly fill out and submit the form, ensuring compliance and efficiency. You’ll save time and reduce errors in your document processes.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans tailored to suit different business needs. Our packages are designed to offer affordable access to essential features, including the ability to handle the Arizona 321 qualifying form efficiently. Signing up is easy, and you can choose a plan that fits your budget.

-

What features does airSlate SignNow offer for managing documents?

airSlate SignNow includes features such as customizable templates, team collaboration, and secure storage. These capabilities are particularly useful when managing important documents like the Arizona 321 qualifying form. Our platform enhances document workflows, making it easier to stay organized and compliant.

-

Is airSlate SignNow compliant with legal standards for e-signatures?

Yes, airSlate SignNow complies with U.S. electronic signature laws, ensuring that your eSigned Arizona 321 qualifying form is legally binding. We follow stringent security practices to protect your data and maintain compliance across various jurisdictions. Trust in our solution to provide a secure signing experience.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, enhancing your workflow capabilities. Whether you need to connect with CRM systems or document storage solutions, our platform can facilitate the efficient management of your Arizona 321 qualifying form alongside other business tools.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for document signing, including the Arizona 321 qualifying form, offers multiple benefits such as increased speed and improved document accuracy. Our platform ensures that all parties can access and sign documents remotely, reducing the turnaround time signNowly. You’ll also enhance security with our robust encryption measures.

Get more for Azdor govformstax credits formsCredit For Contributions To Qualifying Charitable AZDOR

- Special or limited power of attorney for real estate sales transaction by seller montana form

- Special or limited power of attorney for real estate purchase transaction by purchaser montana form

- Limited power of attorney where you specify powers with sample powers included montana form

- Limited power of attorney for stock transactions and corporate powers montana form

- Special durable power of attorney for bank account matters montana form

- Montana small business startup package montana form

- Montana property management package montana form

- New resident guide montana form

Find out other Azdor govformstax credits formsCredit For Contributions To Qualifying Charitable AZDOR

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free