SD 100 Amended Bundle 2024-2026

What is the SD 100 Amended Bundle

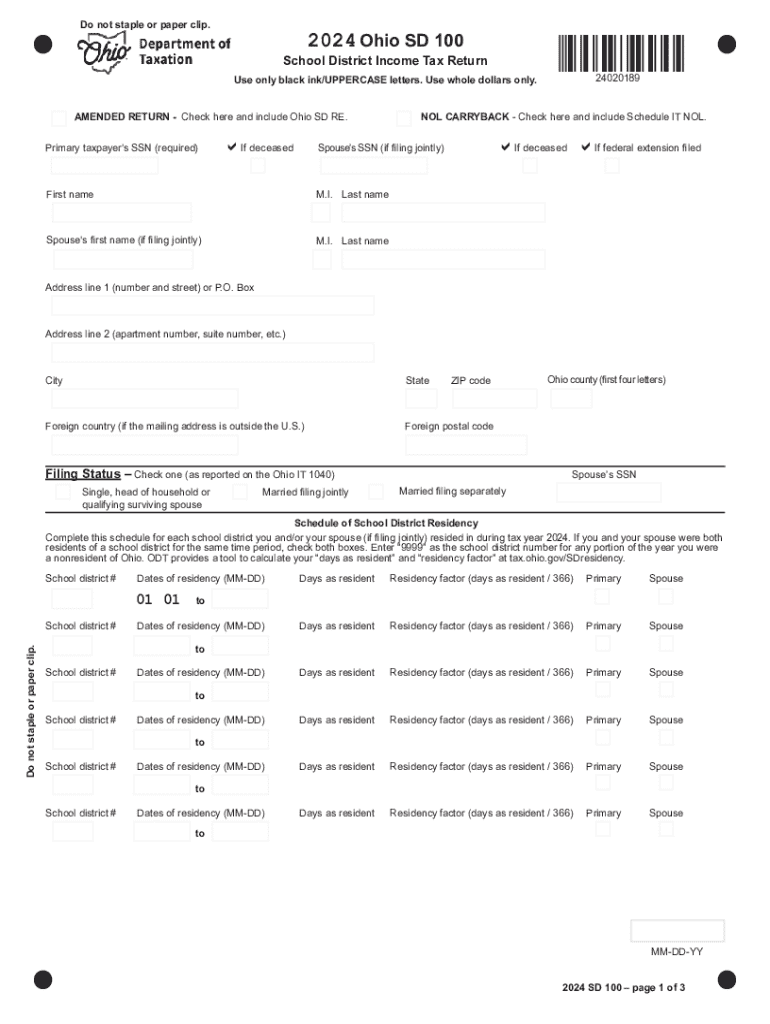

The SD 100 Amended Bundle refers to a specific set of tax forms used in Ohio for amending previously filed school district income tax returns. This bundle is essential for taxpayers who need to correct errors or update information on their original SD 100 forms. The amended bundle typically includes the SD 100X form, which is specifically designed for making adjustments to the school district tax filings.

How to use the SD 100 Amended Bundle

Using the SD 100 Amended Bundle involves several steps to ensure accuracy and compliance with state tax regulations. First, gather all relevant documentation, including your original SD 100 form and any supporting financial records. Next, complete the SD 100X form, clearly indicating the changes being made. It is important to follow the instructions provided with the form to avoid any mistakes. Once completed, submit the amended form to the appropriate tax authority, either online or by mail, depending on your preference.

Steps to complete the SD 100 Amended Bundle

Completing the SD 100 Amended Bundle involves a systematic approach:

- Review your original SD 100 form for any inaccuracies.

- Obtain the SD 100X form, which can be found on the Ohio Department of Taxation website.

- Fill out the SD 100X form, ensuring all changes are clearly documented.

- Attach any necessary supporting documents that justify the amendments.

- Double-check all entries for accuracy before submission.

- Submit the completed form either electronically or by mail, based on your filing preference.

Filing Deadlines / Important Dates

Filing deadlines for the SD 100 Amended Bundle are crucial to avoid penalties. Generally, amended returns must be filed within three years of the original due date of the return. For specific tax years, check the Ohio Department of Taxation for exact deadlines. It is advisable to file as soon as discrepancies are identified to ensure compliance and minimize potential penalties.

Required Documents

When completing the SD 100 Amended Bundle, certain documents are necessary for a successful submission. These include:

- The original SD 100 form that is being amended.

- The completed SD 100X form.

- Any supporting documentation that validates the changes, such as W-2s or 1099s.

- Proof of payment for any additional taxes owed, if applicable.

Penalties for Non-Compliance

Failing to file the SD 100 Amended Bundle correctly or on time can result in penalties imposed by the Ohio Department of Taxation. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is essential to ensure that all forms are accurately completed and submitted within the required timeframes to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct sd 100 amended bundle

Create this form in 5 minutes!

How to create an eSignature for the sd 100 amended bundle

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form sd 100x tax?

The form sd 100x tax is a tax form used for reporting specific tax information in certain jurisdictions. It is essential for businesses to understand how to complete this form accurately to ensure compliance with tax regulations. Using airSlate SignNow can simplify the process of filling out and submitting the form sd 100x tax.

-

How can airSlate SignNow help with the form sd 100x tax?

airSlate SignNow provides an intuitive platform for businesses to easily fill out and eSign the form sd 100x tax. With its user-friendly interface, you can streamline the document management process, ensuring that your tax forms are completed accurately and submitted on time. This reduces the risk of errors and enhances overall efficiency.

-

What are the pricing options for using airSlate SignNow for the form sd 100x tax?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for those specifically needing to manage the form sd 100x tax. Each plan provides access to essential features that help streamline document workflows. You can choose a plan that fits your budget while ensuring you have the tools necessary for tax compliance.

-

Are there any features specifically designed for the form sd 100x tax?

Yes, airSlate SignNow includes features that cater specifically to the needs of users filling out the form sd 100x tax. These features include customizable templates, automated reminders, and secure eSigning capabilities. This ensures that your tax documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for managing the form sd 100x tax?

Absolutely! airSlate SignNow offers integrations with various software applications that can help you manage the form sd 100x tax more effectively. Whether you use accounting software or document management systems, these integrations can streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for the form sd 100x tax?

Using airSlate SignNow for the form sd 100x tax provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and easy document sharing, which can save your business time and resources. Additionally, it helps ensure compliance with tax regulations.

-

Is airSlate SignNow secure for handling the form sd 100x tax?

Yes, airSlate SignNow prioritizes security, making it a safe choice for handling sensitive documents like the form sd 100x tax. The platform employs advanced encryption and security protocols to protect your data. You can confidently manage your tax documents knowing they are secure.

Get more for SD 100 Amended Bundle

Find out other SD 100 Amended Bundle

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple