Ohio Sd 100 Form 2023

What is the Ohio SD 100 Form

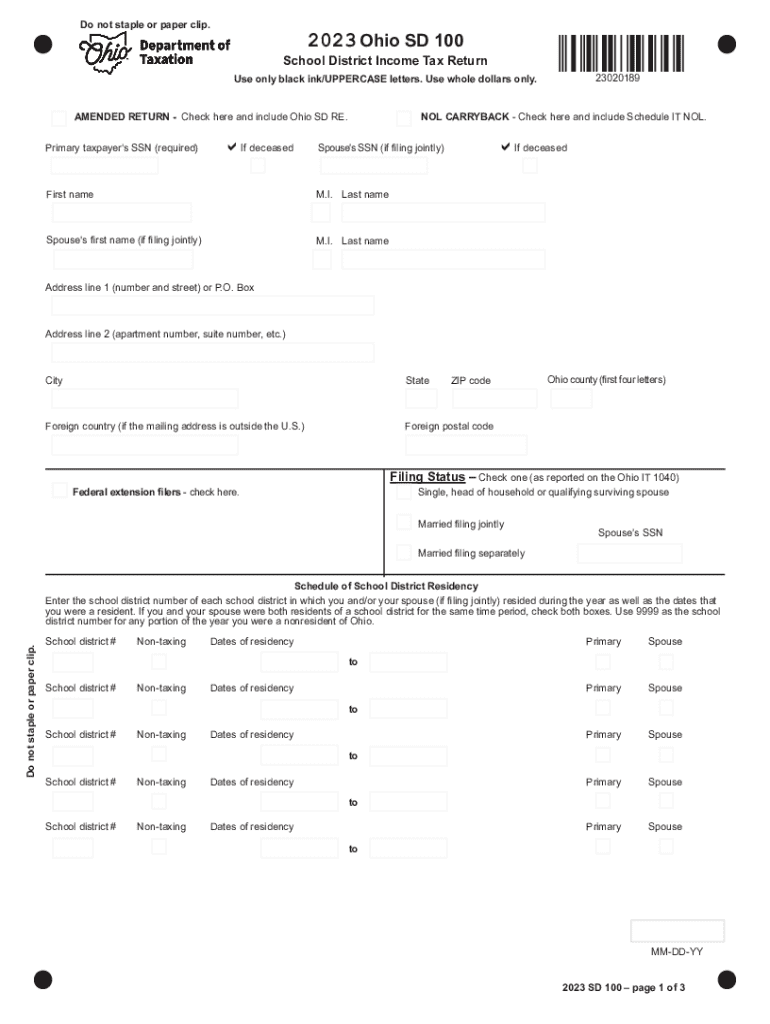

The Ohio SD 100 Form is a tax document used by residents of Ohio to report income and calculate school district income tax. This form is specifically designed for individuals who have taxable income and need to fulfill their tax obligations to their respective school districts. The SD 100 is essential for determining the correct amount of tax owed based on the taxpayer's income and the applicable school district tax rates.

How to use the Ohio SD 100 Form

To use the Ohio SD 100 Form, taxpayers must gather their financial information, including total income, deductions, and any credits applicable to their situation. The form requires detailed reporting of income sources, such as wages, self-employment income, and other taxable earnings. After completing the form, individuals must submit it to their local school district for processing. It is important to ensure accuracy to avoid penalties or delays in processing.

Steps to complete the Ohio SD 100 Form

Completing the Ohio SD 100 Form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including name, address, and school district.

- Report total income from all sources, ensuring all figures are accurate.

- Calculate any deductions or credits applicable to your situation.

- Determine the total tax due based on the school district's tax rate.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Ohio SD 100 Form. Typically, the form is due on the same date as the federal tax return, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to deadlines to avoid late fees or penalties.

Required Documents

When filling out the Ohio SD 100 Form, certain documents are essential for accurate reporting. These include:

- W-2 forms from employers, detailing wages and withholding.

- 1099 forms for any freelance or contract work.

- Records of any other income, such as interest or dividends.

- Documentation for deductions, including receipts and statements.

Penalties for Non-Compliance

Failing to comply with the requirements of the Ohio SD 100 Form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action by the school district. It is important for taxpayers to file accurately and on time to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct ohio sd 100 form

Create this form in 5 minutes!

How to create an eSignature for the ohio sd 100 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2010 form sd 100x tax?

The 2010 form sd 100x tax is a tax form used for reporting adjustments to previously filed South Dakota tax returns. It allows taxpayers to correct errors or make changes to their tax information. Understanding this form is crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow help with the 2010 form sd 100x tax?

airSlate SignNow provides a streamlined process for electronically signing and sending the 2010 form sd 100x tax. Our platform ensures that your documents are securely signed and easily accessible, making tax filing more efficient. This can save you time and reduce the risk of errors.

-

What are the pricing options for using airSlate SignNow for the 2010 form sd 100x tax?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and teams. Our plans are designed to be cost-effective, ensuring you can manage your 2010 form sd 100x tax filings without breaking the bank. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing the 2010 form sd 100x tax?

With airSlate SignNow, you can easily create, edit, and send the 2010 form sd 100x tax. Our features include customizable templates, secure eSigning, and document tracking, which enhance your workflow. These tools help ensure that your tax documents are processed efficiently and accurately.

-

Are there any benefits to using airSlate SignNow for the 2010 form sd 100x tax?

Using airSlate SignNow for the 2010 form sd 100x tax offers numerous benefits, including increased efficiency and reduced paperwork. Our platform simplifies the signing process, allowing you to focus on your business rather than administrative tasks. Additionally, it enhances document security and compliance.

-

Can I integrate airSlate SignNow with other software for the 2010 form sd 100x tax?

Yes, airSlate SignNow integrates seamlessly with various software applications, making it easier to manage your 2010 form sd 100x tax alongside your existing tools. This integration helps streamline your workflow and ensures that all your documents are in one place. Check our integrations page for more details.

-

Is airSlate SignNow secure for handling the 2010 form sd 100x tax?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive information, including the 2010 form sd 100x tax. You can trust that your documents are safe and secure while using our platform.

Get more for Ohio Sd 100 Form

Find out other Ohio Sd 100 Form

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed