Schedule S Kansas Supplemental Schedule Revised 7 24 Form

What is the Kansas Supplemental Schedule?

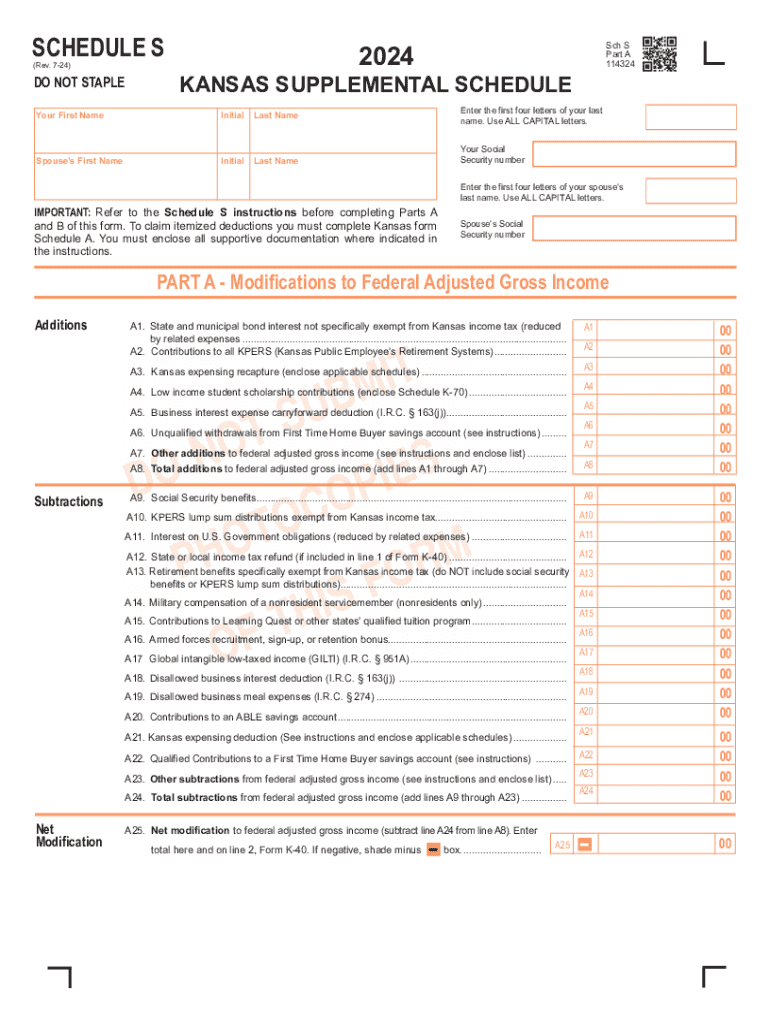

The Kansas Supplemental Schedule, commonly referred to as Schedule S, is a tax form used by individuals and entities in Kansas to report additional income and deductions that may not be captured on the standard income tax return. This form is particularly relevant for taxpayers who need to disclose specific types of income, such as business income, rental income, or other supplemental sources. Understanding the purpose and requirements of Schedule S is essential for accurate tax filing in Kansas.

How to Use the Kansas Supplemental Schedule

Using the Kansas Supplemental Schedule involves several steps. Taxpayers must first determine if they need to file this form based on their income sources. Once confirmed, they should gather all relevant financial documents, including income statements and receipts for deductions. The form itself requires detailed information about various income types and applicable deductions. After completing the Schedule S, it should be submitted along with the primary tax return to ensure all income is accurately reported to the state.

Steps to Complete the Kansas Supplemental Schedule

Completing the Kansas Supplemental Schedule involves a systematic approach:

- Gather Documentation: Collect all necessary financial documents, including W-2s, 1099s, and receipts for deductible expenses.

- Review Instructions: Familiarize yourself with the instructions provided for Schedule S to ensure compliance with state requirements.

- Fill Out the Form: Carefully input the required information about your income and deductions on the form.

- Double-Check Entries: Review your completed form for accuracy, ensuring all calculations are correct.

- Submit the Form: File the Schedule S along with your Kansas income tax return by the designated deadline.

Key Elements of the Kansas Supplemental Schedule

The Kansas Supplemental Schedule includes several key elements that taxpayers must be aware of. These elements typically encompass:

- Income Reporting: Detailed sections for reporting various types of income, including self-employment and rental income.

- Deductions: Areas to claim allowable deductions that can reduce taxable income.

- Taxpayer Information: Basic identification details about the taxpayer, including name, address, and Social Security number.

- Signature: A section for the taxpayer's signature, certifying that the information provided is accurate and complete.

State-Specific Rules for the Kansas Supplemental Schedule

Kansas has specific rules governing the use of the Supplemental Schedule. Taxpayers should be aware of the following:

- Eligibility: Not all taxpayers are required to file Schedule S; it is typically necessary for those with additional income sources.

- Filing Deadlines: Adhere to state deadlines for submitting the Schedule S to avoid penalties.

- Amendments: If errors are discovered after filing, taxpayers may need to amend their returns, including the Schedule S.

Examples of Using the Kansas Supplemental Schedule

Examples of when to use the Kansas Supplemental Schedule include:

- A self-employed individual reporting business income and expenses.

- A property owner declaring rental income and associated deductions.

- A taxpayer receiving income from investments that require additional reporting.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule s kansas supplemental schedule revised 7 24

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Kansas supplemental insurance?

Kansas supplemental insurance is designed to provide additional coverage beyond standard health insurance plans. It helps cover out-of-pocket expenses such as copayments, deductibles, and other costs that may not be fully covered by primary insurance. This type of insurance can be particularly beneficial for those seeking comprehensive financial protection.

-

How does airSlate SignNow support Kansas supplemental insurance providers?

airSlate SignNow offers a streamlined solution for Kansas supplemental insurance providers to manage their documentation efficiently. With features like eSigning and document templates, providers can quickly send and receive important documents, ensuring compliance and enhancing customer service. This efficiency can lead to improved operational workflows and customer satisfaction.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses, including those in the Kansas supplemental insurance sector. Pricing is competitive and designed to provide value, ensuring that businesses can access essential features without breaking the bank. You can choose from various plans based on your document volume and required features.

-

What features does airSlate SignNow provide for Kansas supplemental insurance?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These features are particularly useful for Kansas supplemental insurance providers who need to manage multiple documents efficiently. Additionally, the platform ensures compliance with industry regulations, making it a reliable choice for businesses.

-

Can airSlate SignNow integrate with other software used in Kansas supplemental insurance?

Yes, airSlate SignNow offers seamless integrations with various software applications commonly used in the Kansas supplemental insurance industry. This includes CRM systems, document management tools, and other business applications. These integrations help streamline workflows and enhance productivity by allowing users to manage documents from a single platform.

-

What are the benefits of using airSlate SignNow for Kansas supplemental insurance?

Using airSlate SignNow for Kansas supplemental insurance provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced customer experience. The platform's user-friendly interface allows for quick document processing, which can lead to faster service delivery. Additionally, the secure eSigning feature ensures that all transactions are legally binding and compliant.

-

Is airSlate SignNow secure for handling Kansas supplemental insurance documents?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling Kansas supplemental insurance documents. The platform employs advanced encryption and security protocols to protect sensitive information. This commitment to security ensures that your documents are safe from unauthorized access and bsignNowes.

Get more for Schedule S Kansas Supplemental Schedule Revised 7 24

- Affi davit for hardship license form

- Aoc 4951 doc code dsr w e a l t h of case kycourtsgov form

- Code riet form

- In durham probe grand jury indicts attorney with ties to form

- Forms divorce_or_separation_selfhelp california courts

- Fa 4128vb order to show cause with minor children form

- Dv 140 response to request to modify extend dissolve protective order form

- Homesuperior court of californiacounty of napa form

Find out other Schedule S Kansas Supplemental Schedule Revised 7 24

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney