for One Time Taxpayer and Person Registering under E 2024-2026

Understanding the 1904 BIR Forms

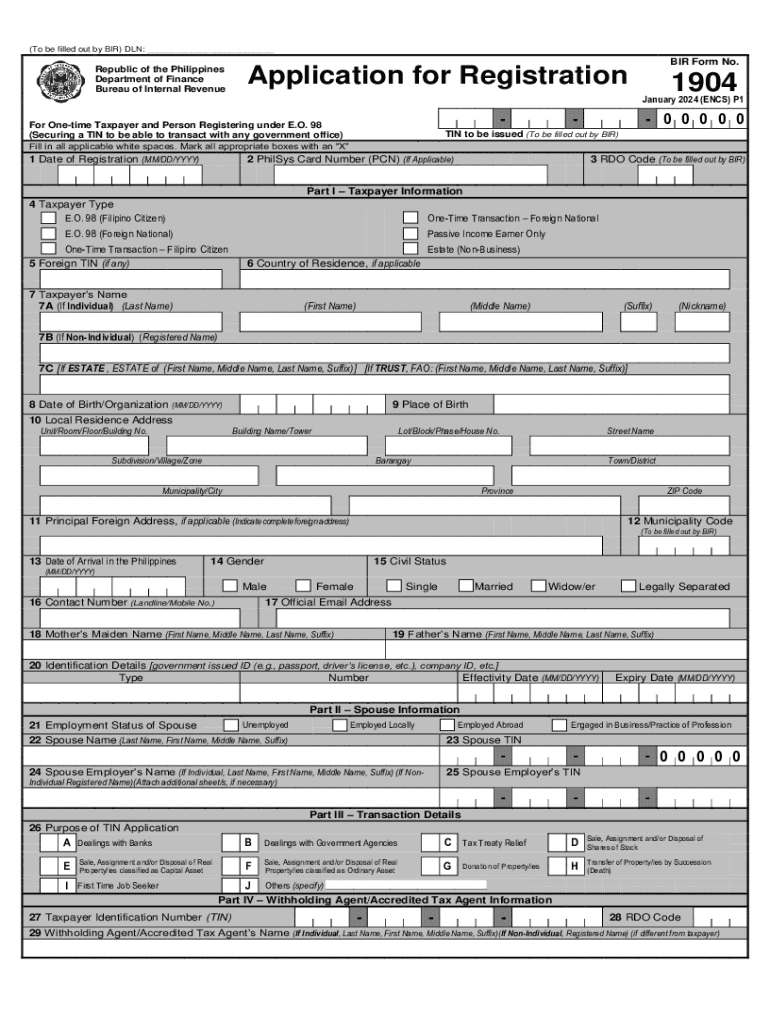

The 1904 BIR forms are essential documents for individuals and businesses in the Philippines who need to register as one-time taxpayers. This form is primarily used for those who are not regular taxpayers but need to comply with tax obligations for specific transactions. Understanding the purpose and requirements of the 1904 form is crucial for ensuring compliance with tax regulations.

Steps to Complete the 1904 BIR Forms

Completing the 1904 BIR form involves several key steps:

- Gather Required Information: Collect personal details, including your Tax Identification Number (TIN), address, and the nature of the transaction.

- Fill Out the Form: Enter the required information accurately in the 1904 form. Ensure that all fields are completed to avoid delays.

- Review for Accuracy: Double-check all entries for accuracy and completeness before submission.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person at the local BIR office.

Legal Use of the 1904 BIR Forms

The 1904 BIR forms serve a legal purpose by formalizing the registration of one-time taxpayers. Completing this form correctly ensures compliance with the Bureau of Internal Revenue (BIR) regulations in the Philippines. It is essential for avoiding penalties associated with non-compliance and for maintaining a good standing with tax authorities.

Required Documents for the 1904 BIR Forms

When preparing to fill out the 1904 BIR forms, certain documents are necessary to support your application. These include:

- Your valid identification, such as a government-issued ID.

- Proof of the transaction that necessitates registration, such as contracts or agreements.

- Any previous tax documents, if applicable, that may provide additional context or information.

Form Submission Methods

There are multiple methods for submitting the 1904 BIR forms, allowing for flexibility based on individual preferences:

- Online Submission: Utilize the BIR's online portal for electronic submission.

- Mail: Send the completed form to the designated BIR office via postal service.

- In-Person: Visit your local BIR office to submit the form directly.

Eligibility Criteria for Using the 1904 BIR Forms

To utilize the 1904 BIR forms, individuals must meet specific eligibility criteria. This includes being a one-time taxpayer engaged in a transaction that requires registration with the BIR. It is important to confirm that your situation aligns with the requirements set forth by the BIR to ensure proper usage of the form.

Handy tips for filling out For One time Taxpayer And Person Registering Under E online

Quick steps to complete and e-sign For One time Taxpayer And Person Registering Under E online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a GDPR and HIPAA compliant solution for optimum simplicity. Use signNow to electronically sign and send For One time Taxpayer And Person Registering Under E for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct for one time taxpayer and person registering under e

Create this form in 5 minutes!

How to create an eSignature for the for one time taxpayer and person registering under e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 1904 BIR forms and why are they important?

1904 BIR forms are essential tax documents used in the Philippines for reporting income and tax liabilities. They help businesses comply with tax regulations and ensure accurate reporting to the Bureau of Internal Revenue. Using airSlate SignNow to manage these forms streamlines the process, making it easier to stay compliant.

-

How can airSlate SignNow help with filling out 1904 BIR forms?

airSlate SignNow provides an intuitive platform that simplifies the process of filling out 1904 BIR forms. With its user-friendly interface, you can easily input necessary information, ensuring accuracy and efficiency. This reduces the risk of errors and helps you meet deadlines effortlessly.

-

Is there a cost associated with using airSlate SignNow for 1904 BIR forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans are designed to be cost-effective, providing great value for the features offered, including eSigning and document management for 1904 BIR forms. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing 1904 BIR forms?

airSlate SignNow includes features such as eSigning, document templates, and secure cloud storage, all of which are beneficial for managing 1904 BIR forms. These features enhance collaboration and ensure that your documents are easily accessible and securely stored. Additionally, you can track the status of your forms in real-time.

-

Can I integrate airSlate SignNow with other software for 1904 BIR forms?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow for 1904 BIR forms. Whether you use accounting software or CRM systems, these integrations enhance productivity and ensure seamless data transfer between platforms.

-

What are the benefits of using airSlate SignNow for 1904 BIR forms?

Using airSlate SignNow for 1904 BIR forms provides numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. The platform allows for quick eSigning and easy document sharing, which saves time and resources. This ultimately helps businesses focus on their core operations.

-

Is airSlate SignNow secure for handling 1904 BIR forms?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your 1904 BIR forms are handled safely. The platform employs advanced encryption and security protocols to protect sensitive information. You can trust that your documents are secure while using airSlate SignNow.

Get more for For One time Taxpayer And Person Registering Under E

- Designation of successor custodian by donor form

- Home improvement contractors license application form

- Free owner finance contract form

- Resolution no 18 027 resolution authorizing and tdhca form

- Credit cardholders report of lost or stolen credit card form

- Sample letters to adapt and use union democracy form

- Release and waiver of liability given by customer in favor form

- Musician work for hire agreement public domain template form

Find out other For One time Taxpayer And Person Registering Under E

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will