Check Here If Entity Filed Federal Form 1065

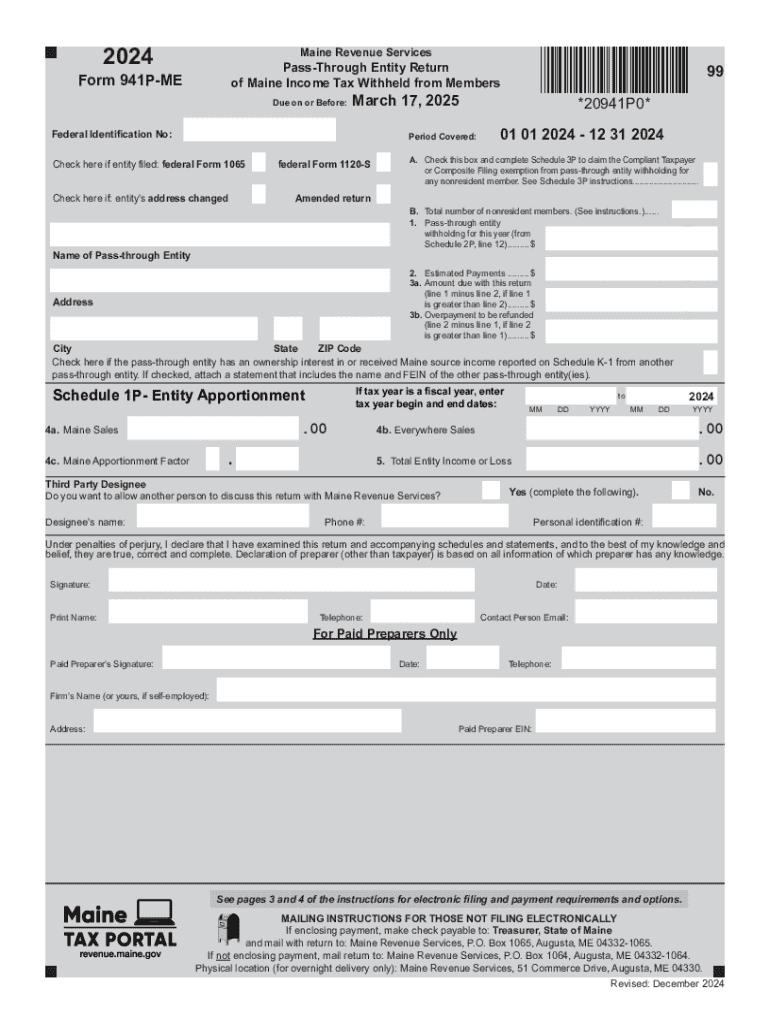

Understanding the Maine Form 941P ME

The Maine Form 941P ME is a crucial document for employers in Maine who need to report income tax withholding for their employees. This form is specifically designed for employers to report the amounts withheld from employee wages for state income tax purposes. Understanding the details of this form is essential for compliance with state tax regulations.

Steps to Complete the Maine Form 941P ME

Completing the Maine Form 941P ME involves several key steps:

- Gather necessary information, including employee wages and the total amount withheld for state income tax.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form by the specified deadline to avoid penalties.

Filing Deadlines for the Maine Form 941P ME

It is important to be aware of the filing deadlines for the Maine Form 941P ME. Employers are typically required to file this form quarterly. The deadlines for submission are:

- For the first quarter: April 30

- For the second quarter: July 31

- For the third quarter: October 31

- For the fourth quarter: January 31 of the following year

Required Documents for Filing the Maine Form 941P ME

When preparing to file the Maine Form 941P ME, employers should have the following documents ready:

- Employee payroll records

- Total wages paid during the reporting period

- Amounts withheld for state income tax

- Any previous filings for reference

Penalties for Non-Compliance with the Maine Form 941P ME

Failing to file the Maine Form 941P ME on time or submitting inaccurate information can result in penalties. These may include:

- Late filing penalties, which can accumulate over time

- Interest on any unpaid taxes

- Potential audits by the state tax authority

Digital Submission Methods for the Maine Form 941P ME

Employers have the option to submit the Maine Form 941P ME digitally, which can streamline the filing process. The digital submission can typically be done through the state’s tax portal, allowing for quick processing and confirmation of receipt.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the check here if entity filed federal form 1065

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maine Form 941P ME?

The Maine Form 941P ME is a tax form used by employers in Maine to report payroll taxes. It is essential for businesses to accurately complete this form to ensure compliance with state tax regulations. Using airSlate SignNow can simplify the process of filling out and submitting the Maine Form 941P ME.

-

How can airSlate SignNow help with the Maine Form 941P ME?

airSlate SignNow provides an easy-to-use platform for businesses to eSign and send the Maine Form 941P ME. With its intuitive interface, you can quickly fill out the form and ensure that all necessary signatures are obtained. This streamlines the process and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small business or a larger enterprise, you can find a plan that fits your budget while providing access to features that assist with forms like the Maine Form 941P ME. Check our website for detailed pricing information.

-

Are there any features specifically for managing the Maine Form 941P ME?

Yes, airSlate SignNow includes features that are particularly beneficial for managing the Maine Form 941P ME. These features include customizable templates, automated reminders for deadlines, and secure storage for completed forms. This ensures that you can manage your payroll tax documentation efficiently.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the Maine Form 941P ME offers numerous benefits, including time savings and enhanced accuracy. The platform allows for easy collaboration among team members and ensures that all documents are securely signed and stored. This can signNowly reduce the stress associated with tax season.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software. This means you can easily sync your data and streamline the process of managing the Maine Form 941P ME alongside your other financial documents, enhancing overall efficiency.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive tax documents like the Maine Form 941P ME. The platform uses advanced encryption and secure access controls to protect your information, ensuring that your data remains confidential and secure.

Get more for Check Here If Entity Filed Federal Form 1065

- Tcpdf main features are searchcode form

- Stockholders affidavit form

- Settlement agreement and general release secgov form

- Resolution of church membership form

- Full text of ampquotcolonial mobile an historical study largely form

- Transfer an interest in real property form

- How to form a corporation in alabamanolo

- Comes now and hereby gives notice of appearance as form

Find out other Check Here If Entity Filed Federal Form 1065

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement