Form it 216 Claim for Child and Dependent Care Credit Tax 2020

What is the Form IT 216 Claim For Child And Dependent Care Credit Tax

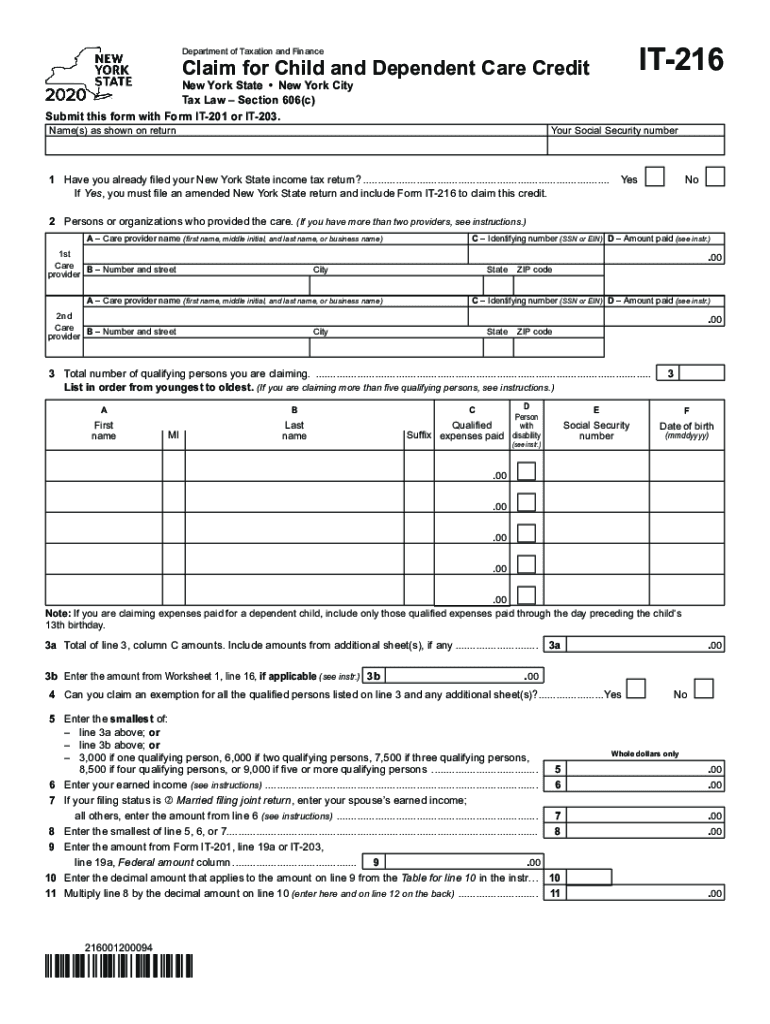

The Form IT 216 is a tax document used by New York State taxpayers to claim the Child and Dependent Care Credit. This credit is designed to assist individuals and families who incur expenses for the care of children or dependents while they work or look for work. The form allows eligible taxpayers to receive a percentage of their qualifying care expenses as a credit against their state income tax. The credit can significantly reduce the tax burden for families, making it an important financial resource for those with dependent care costs.

How to use the Form IT 216 Claim For Child And Dependent Care Credit Tax

Using the Form IT 216 involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding your qualifying care expenses, including the names and taxpayer identification numbers of the care providers. Next, fill out the form by providing details such as your income, the amount spent on care, and any other required information. After completing the form, review it for accuracy before submitting it along with your New York State tax return. It is essential to keep copies of all documents for your records.

Steps to complete the Form IT 216 Claim For Child And Dependent Care Credit Tax

Completing the Form IT 216 involves a systematic approach:

- Gather documentation of your dependent care expenses, including receipts and provider information.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total qualifying expenses for the care of dependents.

- Calculate the credit amount based on your expenses and applicable percentage.

- Double-check all entries for accuracy and completeness.

- Submit the form with your New York State tax return by the designated deadline.

Eligibility Criteria

To qualify for the Child and Dependent Care Credit using Form IT 216, certain criteria must be met. The taxpayer must have earned income, and the care must be provided for a qualifying child under the age of thirteen or for a dependent who is physically or mentally incapable of self-care. Additionally, the care must be necessary for the taxpayer to work or actively look for work. Taxpayers must also meet income limits that determine the percentage of expenses eligible for the credit.

Required Documents

When completing the Form IT 216, it is important to have specific documents ready. These include:

- Receipts or statements from care providers detailing the amount paid for care services.

- The provider's name, address, and taxpayer identification number.

- Your Social Security number and that of your spouse, if applicable.

- Any other documentation that supports your claim for the credit.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 216 can be submitted through various methods. Taxpayers can file their forms online as part of their New York State tax return using approved e-filing software. Alternatively, the completed form can be mailed to the appropriate New York State tax office. In-person submissions are also an option at designated tax offices, allowing for direct assistance if needed. It is important to choose the method that best suits your needs and ensures timely processing.

Quick guide on how to complete form it 216 claim for child and dependent care credit tax

Successfully complete Form IT 216 Claim For Child And Dependent Care Credit Tax effortlessly on any device

Digital document management has gained signNow traction with organizations and individuals alike. It serves as an ideal environmentally conscious alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form IT 216 Claim For Child And Dependent Care Credit Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to edit and electronically sign Form IT 216 Claim For Child And Dependent Care Credit Tax with ease

- Obtain Form IT 216 Claim For Child And Dependent Care Credit Tax and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to secure your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs within a few clicks from any device of your preference. Edit and electronically sign Form IT 216 Claim For Child And Dependent Care Credit Tax to guarantee outstanding communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 216 claim for child and dependent care credit tax

Create this form in 5 minutes!

How to create an eSignature for the form it 216 claim for child and dependent care credit tax

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is the printable New York Form IT-215?

The printable New York Form IT-215 is a tax form that allows residents to claim the Empire State Child Credit, a beneficial tax credit aimed at supporting families with eligible children. It's essential for NY residents to complete this form correctly to maximize their tax benefits.

-

How can I obtain the printable New York Form IT-215?

You can easily download the printable New York Form IT-215 from the New York State Department of Taxation and Finance website. Additionally, airSlate SignNow provides a seamless way to fill out and eSign the form, ensuring you complete your tax paperwork quickly and efficiently.

-

Is the printable New York Form IT-215 easy to fill out?

Yes, the printable New York Form IT-215 is designed to be user-friendly, with clear instructions that guide you through the process. Using airSlate SignNow simplifies filling out the form, enabling you to input your information and eSign it effortlessly.

-

What are the benefits of using airSlate SignNow for Form IT-215?

Using airSlate SignNow allows you to efficiently fill out and eSign the printable New York Form IT-215 from anywhere. The platform is secure, offers document tracking, and integrates with various applications, making your tax filing process smoother and more manageable.

-

Are there any costs associated with using airSlate SignNow for printable New York Form IT-215?

airSlate SignNow offers flexible pricing plans to cater to different users, including businesses and individuals. Many users find that the time saved and efficiency gained in handling the printable New York Form IT-215 outweigh the nominal fees associated with the service.

-

Can I store my completed printable New York Form IT-215 in airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including the printable New York Form IT-215. This feature allows you to access your completed forms anytime and ensures that your important information is safely stored.

-

Does airSlate SignNow integrate with other applications for form management?

Yes, airSlate SignNow offers various integrations with popular applications, enhancing your form management process. You can easily connect with tools like Google Drive, Dropbox, and CRM systems to streamline your workflow when working with documents like the printable New York Form IT-215.

Get more for Form IT 216 Claim For Child And Dependent Care Credit Tax

- Form 29 450287601

- Jcavs user guide november form

- The fee payment module by army public school rk puram secunderabad is a form

- Ub92 form example

- National grid service request form

- Alaska birth certificate cost form

- Final project 71016 214am fill in this information to

- Construction of and groundwater monitoring systems handbook deq louisiana form

Find out other Form IT 216 Claim For Child And Dependent Care Credit Tax

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe