Form or TM, Tri County Metropolitan Transportation DistrictSelf Employment Tax, 150 555 001 2020

What is the Form OR TM?

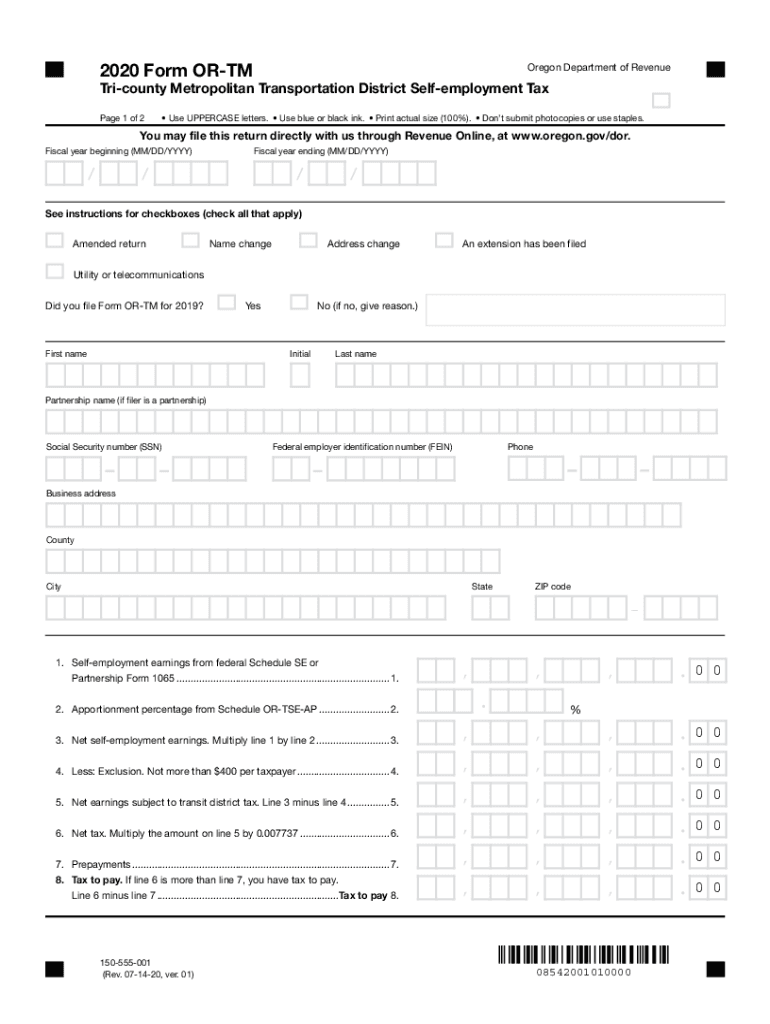

The Form OR TM, officially known as the Tri County Metropolitan Transportation District Self Employment Tax, is a specific tax form used by self-employed individuals in the Portland, Oregon area. This form is essential for reporting and paying the self-employment tax that supports public transportation services. The form is identified by the number 150 555 001 and is required for individuals who earn income through self-employment within the TriMet district. Understanding this form is crucial for compliance with local tax regulations.

How to Use the Form OR TM

Using the Form OR TM involves several steps to ensure accurate reporting of self-employment income. First, gather all relevant financial documents, including income statements and expense records. Next, fill out the form with your personal information and income details. It is important to accurately report your earnings to avoid any discrepancies. After completing the form, review it for errors before submission. The form can be submitted either online or via traditional mail, depending on your preference.

Steps to Complete the Form OR TM

Completing the Form OR TM requires careful attention to detail. Follow these steps:

- Begin by entering your name, address, and Social Security number at the top of the form.

- Report your total self-employment income from all sources.

- Deduct any allowable business expenses to calculate your net earnings.

- Calculate the self-employment tax based on your net earnings using the provided tax rate.

- Sign and date the form to certify that the information is accurate.

Legal Use of the Form OR TM

The Form OR TM is legally binding when completed accurately and submitted in compliance with local tax laws. It is essential to understand that failing to file this form can result in penalties and interest on unpaid taxes. The form must be submitted by the designated deadline to avoid complications. Additionally, keeping a copy of the submitted form and any supporting documents is advisable for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Form OR TM are crucial for compliance. Typically, the form must be submitted by April 15 of each year for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to filing dates, as local regulations may vary and impact your submission timeline.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Form OR TM can lead to significant penalties. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is essential for self-employed individuals to understand their obligations and ensure timely submission of the form to avoid these consequences. Regularly reviewing tax obligations can help mitigate risks associated with non-compliance.

Quick guide on how to complete 2020 form or tm tri county metropolitan transportation districtself employment tax 150 555 001

Complete Form OR TM, Tri County Metropolitan Transportation DistrictSelf Employment Tax, 150 555 001 effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage Form OR TM, Tri County Metropolitan Transportation DistrictSelf Employment Tax, 150 555 001 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Form OR TM, Tri County Metropolitan Transportation DistrictSelf Employment Tax, 150 555 001 with ease

- Find Form OR TM, Tri County Metropolitan Transportation DistrictSelf Employment Tax, 150 555 001 and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you would prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you prefer. Modify and electronically sign Form OR TM, Tri County Metropolitan Transportation DistrictSelf Employment Tax, 150 555 001 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form or tm tri county metropolitan transportation districtself employment tax 150 555 001

Create this form in 5 minutes!

How to create an eSignature for the 2020 form or tm tri county metropolitan transportation districtself employment tax 150 555 001

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the airSlate SignNow form or tm 2018, and how can it benefit my business?

The airSlate SignNow form or tm 2018 is an advanced document management solution that streamlines the process of sending and electronically signing documents. It enhances efficiency by reducing the time spent on paperwork, allowing businesses to focus on growth. With its user-friendly interface, you can easily customize templates and automate workflows.

-

How much does the airSlate SignNow form or tm 2018 cost?

The pricing for the airSlate SignNow form or tm 2018 is competitive, offering various plans to suit different business needs. Our plans are designed to be cost-effective while providing robust features, ensuring you get the best value. You can choose from flexible monthly or annual subscriptions, depending on your usage requirements.

-

What features are included in the airSlate SignNow form or tm 2018?

The airSlate SignNow form or tm 2018 includes a variety of powerful features such as document templates, eSignature capabilities, and automated workflows. Users can also enjoy real-time tracking and alerts, making it easier to manage documents. These features collectively enhance the efficiency and security of your document handling processes.

-

Is it easy to integrate the airSlate SignNow form or tm 2018 with other tools?

Yes, integrating the airSlate SignNow form or tm 2018 with other applications is seamless. The platform supports various integrations with popular software, including CRMs and productivity tools, enhancing your workflow automation. This means you can enhance your existing tools without any hassle while centralizing your eSigning needs.

-

Can I customize the templates in the airSlate SignNow form or tm 2018?

Absolutely! The airSlate SignNow form or tm 2018 allows you to customize document templates to fit your specific business requirements. You can create personalized workflows, add branding elements, and tailor content to resonate with your audience. Customization enhances user experience and ensures consistent branding.

-

What types of documents can I sign with the airSlate SignNow form or tm 2018?

The airSlate SignNow form or tm 2018 enables you to sign a wide range of documents, including contracts, agreements, and forms. Its versatility makes it suitable for various industries, from real estate to healthcare. This extensive document support ensures that you can handle all your signing needs in one platform.

-

How secure is the airSlate SignNow form or tm 2018 for signing documents?

Security is a top priority with the airSlate SignNow form or tm 2018. The platform employs advanced encryption and complies with industry standards to protect your documents and signatures. This commitment to security gives you peace of mind while handling sensitive information online.

Get more for Form OR TM, Tri County Metropolitan Transportation DistrictSelf Employment Tax, 150 555 001

Find out other Form OR TM, Tri County Metropolitan Transportation DistrictSelf Employment Tax, 150 555 001

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure