NJ 1040 Resident Income Tax Return 2024-2026

What is the NJ 1040 Resident Income Tax Return

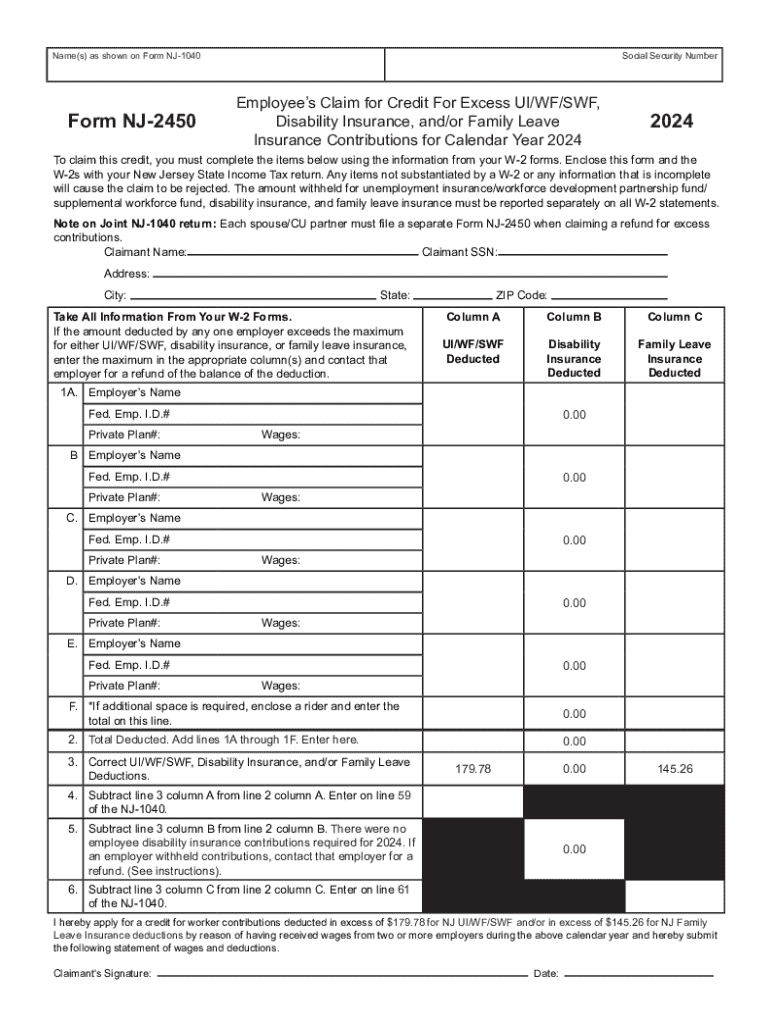

The NJ 1040 Resident Income Tax Return is a form used by residents of New Jersey to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state and need to comply with New Jersey tax regulations. It collects information on various income sources, deductions, and credits that may apply to the taxpayer, ensuring accurate reporting to the state tax authorities.

Steps to complete the NJ 1040 Resident Income Tax Return

Completing the NJ 1040 Resident Income Tax Return involves several key steps:

- Gather all necessary financial documents, including W-2 forms, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and eligibility for certain deductions.

- Fill out the form accurately, ensuring that all income, deductions, and credits are reported correctly.

- Review the completed form for accuracy before submission to avoid potential penalties.

- Submit the form by the designated deadline, either online, by mail, or in person.

Required Documents

To successfully complete the NJ 1040 Resident Income Tax Return, you will need several documents:

- W-2 forms from employers, detailing your earned income.

- 1099 forms for any additional income, such as freelance or contract work.

- Records of any deductions you plan to claim, such as mortgage interest or medical expenses.

- Proof of any tax credits you may qualify for, including education credits or property tax deductions.

Form Submission Methods

The NJ 1040 Resident Income Tax Return can be submitted through various methods, providing flexibility for taxpayers:

- Online: Many taxpayers choose to file electronically through the New Jersey Division of Taxation's website or approved tax software.

- Mail: You can print the completed form and send it to the designated address provided in the form instructions.

- In-Person: Some taxpayers may opt to deliver their forms directly to a local tax office for submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the NJ 1040 Resident Income Tax Return is crucial to avoid penalties:

- The typical deadline for filing is April 15 of each year, aligning with federal tax deadlines.

- If the deadline falls on a weekend or holiday, it is extended to the next business day.

- Taxpayers may request an extension, but any owed taxes must still be paid by the original deadline to avoid interest and penalties.

Penalties for Non-Compliance

Failing to file the NJ 1040 Resident Income Tax Return or submitting it late can result in significant penalties:

- Late filing penalties may apply if the return is not submitted by the deadline, typically calculated as a percentage of the unpaid tax.

- Interest accrues on any unpaid taxes from the original due date until the tax is paid in full.

- In severe cases, additional legal action may be taken by the state for non-compliance.

Create this form in 5 minutes or less

Find and fill out the correct nj 1040 resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the nj 1040 resident income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ui wf swf feature in airSlate SignNow?

The ui wf swf feature in airSlate SignNow allows users to create and manage workflows seamlessly. This feature enhances the user interface, making it easier to navigate and utilize the software for eSigning documents. With a focus on user experience, the ui wf swf ensures that businesses can streamline their document processes efficiently.

-

How does airSlate SignNow's pricing compare for ui wf swf functionalities?

AirSlate SignNow offers competitive pricing for its ui wf swf functionalities, making it accessible for businesses of all sizes. The pricing plans are designed to provide value, ensuring that users can leverage the full potential of the ui wf swf features without breaking the bank. You can choose from various plans based on your specific needs.

-

What benefits does the ui wf swf feature provide for businesses?

The ui wf swf feature provides numerous benefits, including improved efficiency and reduced turnaround times for document signing. By simplifying the workflow, businesses can enhance productivity and focus on core operations. Additionally, the intuitive design of the ui wf swf feature minimizes the learning curve for new users.

-

Can I integrate airSlate SignNow with other tools using ui wf swf?

Yes, airSlate SignNow supports integrations with various tools and platforms through its ui wf swf feature. This allows businesses to connect their existing systems, enhancing overall workflow efficiency. Integrating with other applications ensures that you can manage documents and signatures in a cohesive environment.

-

Is the ui wf swf feature suitable for small businesses?

Absolutely! The ui wf swf feature in airSlate SignNow is designed to cater to the needs of small businesses. Its user-friendly interface and cost-effective solutions make it an ideal choice for small teams looking to streamline their document signing processes without extensive resources.

-

How secure is the ui wf swf feature in airSlate SignNow?

The ui wf swf feature in airSlate SignNow prioritizes security, employing advanced encryption and compliance measures. This ensures that all documents signed through the platform are protected against unauthorized access. Businesses can trust that their sensitive information remains secure while using the ui wf swf functionalities.

-

What types of documents can I manage with the ui wf swf feature?

With the ui wf swf feature, you can manage a wide variety of documents, including contracts, agreements, and forms. This versatility allows businesses to handle all their document signing needs in one place. The ui wf swf feature simplifies the process, making it easy to upload, send, and sign documents.

Get more for NJ 1040 Resident Income Tax Return

- Chapter 23 employment tax internal revenue service form

- Sample authorization for prior employer to release information

- Authorization of release of information agreement to whom

- My boss found out im job huntingask a manager form

- Managers checklist for final discipline form

- How to conduct an effective disciplinary interviewchroncom form

- Formal warning memo

- What are the advantages of the critical incident method of form

Find out other NJ 1040 Resident Income Tax Return

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document