Enhanced Personal Services a RELATIONSHIP T Rowe Price Form

IRS Guidelines

The IRS provides specific guidelines regarding IRA contribution withdrawals. Understanding these rules is essential to ensure compliance and avoid potential penalties. Generally, you can withdraw contributions from your IRA at any time without penalty, but the tax implications depend on the type of IRA. For traditional IRAs, withdrawals may be subject to income tax, while Roth IRA contributions can be withdrawn tax-free. It is crucial to consult the IRS guidelines or a tax professional to understand the specific requirements and implications for your situation.

Required Documents

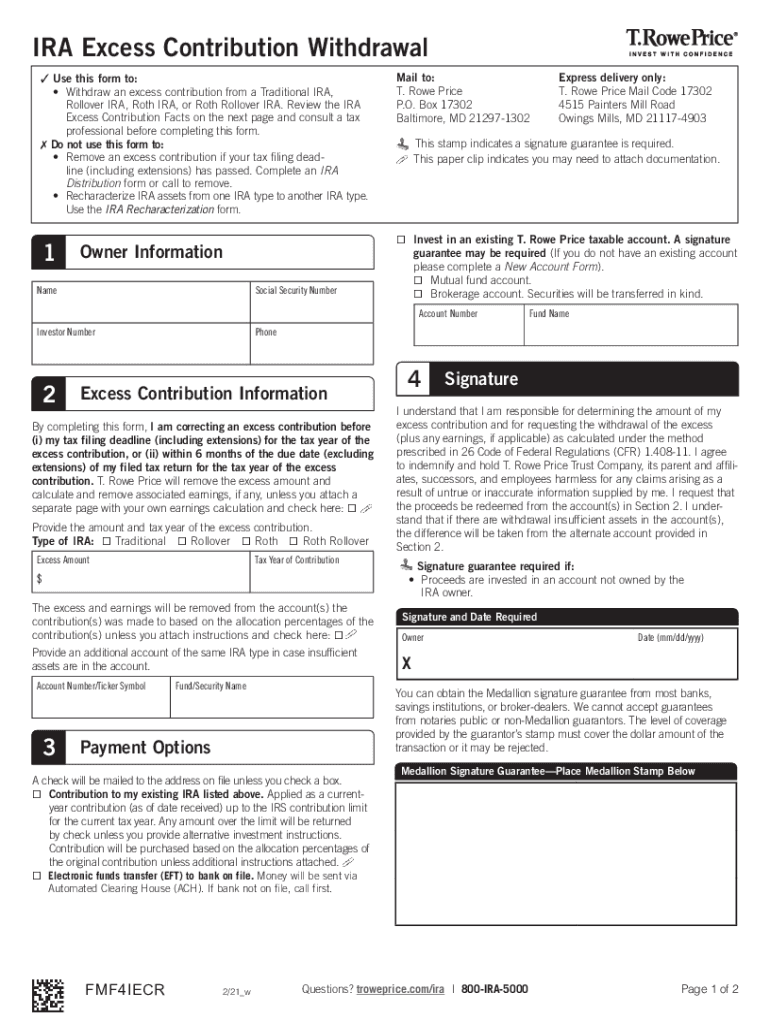

When processing an IRA contribution withdrawal, certain documents are typically required. These may include:

- Your IRA account number.

- Identification verification, such as a driver's license or Social Security number.

- Withdrawal request form, which specifies the amount and type of withdrawal.

- Any additional documentation required by your financial institution.

Having these documents ready can streamline the withdrawal process and ensure that all necessary information is provided to your financial institution.

Form Submission Methods (Online / Mail / In-Person)

Submitting your IRA contribution withdrawal request can be done through various methods, depending on your financial institution's policies. Common submission methods include:

- Online: Many institutions offer an online portal where you can complete and submit your withdrawal request electronically.

- Mail: You may download the withdrawal form, complete it, and send it via postal mail to your financial institution.

- In-Person: Some individuals prefer to visit their financial institution's branch to submit their withdrawal request directly.

Choosing the method that best suits your needs can help ensure a smooth withdrawal process.

Eligibility Criteria

To withdraw contributions from your IRA, you must meet certain eligibility criteria. These can vary based on the type of IRA you hold. Generally, you are eligible to withdraw contributions if:

- You are the account holder of the IRA.

- You have met any age requirements, particularly for traditional IRAs, where withdrawals before age fifty-nine and a half may incur penalties.

- You are not currently subject to any restrictions imposed by your financial institution.

Understanding these criteria can help prevent unnecessary delays or complications during the withdrawal process.

Penalties for Non-Compliance

Failing to comply with IRS regulations regarding IRA contribution withdrawals can lead to significant penalties. For traditional IRAs, early withdrawals may incur a ten percent penalty in addition to regular income tax. Furthermore, failing to report a withdrawal accurately can result in additional fines or interest charges. It is essential to be aware of these potential penalties to avoid unexpected financial burdens.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios can affect how IRA contribution withdrawals are handled. For instance:

- Self-Employed: Self-employed individuals may have different considerations for withdrawing contributions, especially if they are using a SEP IRA or SIMPLE IRA.

- Retired: Retirees often withdraw from their IRAs to supplement retirement income, which may have different tax implications based on their age and withdrawal strategy.

- Students: Students may withdraw contributions for educational expenses, which can have specific tax benefits or considerations.

Understanding how your personal situation impacts your withdrawal can help you make informed decisions.

Quick guide on how to complete enhanced personal services a relationship t rowe price

Complete Enhanced Personal Services A RELATIONSHIP T Rowe Price effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Enhanced Personal Services A RELATIONSHIP T Rowe Price on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Enhanced Personal Services A RELATIONSHIP T Rowe Price with ease

- Find Enhanced Personal Services A RELATIONSHIP T Rowe Price and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, via email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Enhanced Personal Services A RELATIONSHIP T Rowe Price and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the enhanced personal services a relationship t rowe price

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is an IRA contribution withdrawal?

An IRA contribution withdrawal refers to the process of taking money out of your Individual Retirement Account (IRA) that you've contributed. This type of withdrawal can have tax implications and should be carefully considered. Understanding the rules around IRA contribution withdrawals is essential to avoid penalties.

-

What are the tax implications of an IRA contribution withdrawal?

When you make an IRA contribution withdrawal, it may be subject to income tax depending on your age and the type of IRA you have. Traditional IRA withdrawals are typically taxed as ordinary income, while Roth IRA withdrawals may be tax-free if certain conditions are met. Always consult with a tax professional before proceeding.

-

Can I withdraw my IRA contributions at any time?

Yes, you can generally withdraw your IRA contributions anytime without penalties, but it's important to note that withdrawing earnings before age 59½ from a traditional IRA may incur additional taxes and penalties. On the other hand, contributions to a Roth IRA can be withdrawn tax- and penalty-free anytime. Review the specific rules for your account type.

-

What features does airSlate SignNow provide for managing IRA contributions and withdrawals?

airSlate SignNow offers a user-friendly platform that allows you to eSign documents related to IRA contributions and withdrawals securely. With features like document templates and automated workflows, you streamline the process of managing your IRA. This ensures you stay compliant while making any IRA contribution withdrawals.

-

Are there any fees associated with using airSlate SignNow for IRA-related documents?

airSlate SignNow is known for its cost-effective solutions. While there may be subscription fees, there are no hidden costs for featuring IRA document management. You can perform various actions, like preparing and signing documents related to IRA contribution withdrawals, without worrying about excessive fees.

-

How does airSlate SignNow ensure the security of my IRA documents?

With state-of-the-art encryption and robust security protocols, airSlate SignNow ensures that your IRA documents remain safe while you manage your contribution withdrawals. The platform complies with industry standards to protect sensitive information, giving you peace of mind throughout the process.

-

What integrations does airSlate SignNow offer for managing IRA documents?

airSlate SignNow seamlessly integrates with various finance and accounting tools, facilitating efficient IRA contribution withdraw processes. This means you can manage your IRA-related paperwork without manually handling each document. Check the integration options to find the best fit for your workflow.

Get more for Enhanced Personal Services A RELATIONSHIP T Rowe Price

Find out other Enhanced Personal Services A RELATIONSHIP T Rowe Price

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation