New Jersey Election to Participate in a Composite Return, Form NJ 1080E 2021

Understanding the New Jersey Election To Participate In A Composite Return, Form NJ 1080E

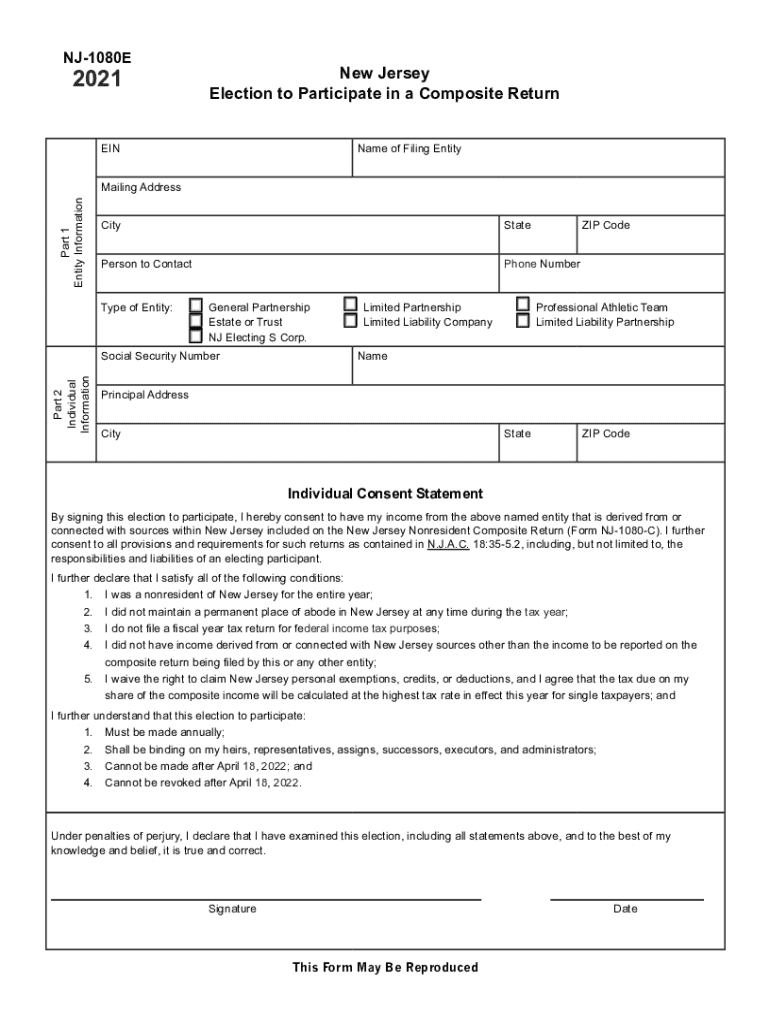

The New Jersey Election To Participate In A Composite Return, commonly referred to as Form NJ 1080E, is a critical document for certain taxpayers. This form allows non-resident partners, shareholders, or members of a pass-through entity to elect to have their income reported on a composite return. This simplifies the tax filing process by allowing the entity to file a single return on behalf of multiple participants, thereby reducing the need for individual filings. Understanding the purpose and implications of this form is essential for compliance and efficient tax management.

Steps to Complete the New Jersey Election To Participate In A Composite Return, Form NJ 1080E

Completing Form NJ 1080E involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the entity and its participants, including names, addresses, and taxpayer identification numbers. Next, fill out the form with precise details about the income earned and the respective shares of each participant. It is crucial to ensure that all calculations are correct and that the form is signed by an authorized representative of the entity. Once completed, the form must be submitted by the specified deadline to avoid penalties.

Eligibility Criteria for the New Jersey Election To Participate In A Composite Return, Form NJ 1080E

To be eligible to use Form NJ 1080E, certain criteria must be met. Typically, this form is available to non-resident partners or shareholders of partnerships, S corporations, or limited liability companies that conduct business in New Jersey. Participants must not have a tax liability in New Jersey that exceeds the amount withheld by the entity. Additionally, all participants must agree to the election and be included in the composite return. Understanding these criteria helps ensure that the election is valid and beneficial for all involved parties.

Filing Deadlines for the New Jersey Election To Participate In A Composite Return, Form NJ 1080E

Filing deadlines for Form NJ 1080E are crucial for compliance. Typically, the form must be filed by the due date of the entity's tax return, which is usually the 15th day of the fourth month following the end of the tax year. For calendar year filers, this means the deadline is April 15. It is important to stay informed about any changes to these deadlines, as late submissions can lead to penalties and interest on unpaid taxes.

Form Submission Methods for the New Jersey Election To Participate In A Composite Return, Form NJ 1080E

Form NJ 1080E can be submitted through various methods to accommodate different preferences. Taxpayers can file the form electronically through approved e-filing systems, which can streamline the process and ensure faster processing times. Alternatively, the form can be mailed to the appropriate New Jersey Division of Taxation address, or it may be submitted in person at designated offices. Each submission method has its own requirements and processing times, so it is important to choose the one that best fits the taxpayer's needs.

Key Elements of the New Jersey Election To Participate In A Composite Return, Form NJ 1080E

Several key elements are essential to the proper completion and submission of Form NJ 1080E. These include accurate identification of all participating entities and individuals, correct reporting of income and deductions, and ensuring that all necessary signatures are obtained. Additionally, it is important to include any required attachments, such as schedules or supporting documentation, to substantiate the information provided on the form. Understanding these elements helps ensure that the form is filed correctly and efficiently.

Quick guide on how to complete 2021 new jersey election to participate in a composite return form nj 1080e

Complete New Jersey Election To Participate In A Composite Return, Form NJ 1080E effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can retrieve the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your papers promptly without holdups. Handle New Jersey Election To Participate In A Composite Return, Form NJ 1080E on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to adjust and eSign New Jersey Election To Participate In A Composite Return, Form NJ 1080E without breaking a sweat

- Obtain New Jersey Election To Participate In A Composite Return, Form NJ 1080E and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or black out confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from a device of your choosing. Modify and eSign New Jersey Election To Participate In A Composite Return, Form NJ 1080E and ensure excellent communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 new jersey election to participate in a composite return form nj 1080e

Create this form in 5 minutes!

How to create an eSignature for the 2021 new jersey election to participate in a composite return form nj 1080e

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is a New Jersey composite return?

A New Jersey composite return is a tax return filed by a corporation on behalf of its non-resident shareholders. It allows the company to consolidate the tax liabilities of multiple shareholders into a single return, making it easier for businesses operating in New Jersey. Understanding this can help streamline your tax process signNowly.

-

Who needs to file a New Jersey composite return?

Any corporation that has non-resident shareholders and conducts business in New Jersey may need to file a New Jersey composite return. This process helps ensure compliance with state tax obligations while standardizing the tax requirements for non-residents. It's essential for businesses to assess their ownership structure to determine the necessity of filing.

-

What are the benefits of filing a New Jersey composite return?

Filing a New Jersey composite return simplifies the tax process for businesses with non-resident shareholders. It allows companies to handle tax payments collectively, reducing the administrative burden. Additionally, it can help prevent individual tax liabilities from complicating your business operations.

-

How does airSlate SignNow facilitate the filing of New Jersey composite returns?

AirSlate SignNow makes the process of filing New Jersey composite returns easier by providing an intuitive platform for document preparation and e-signatures. This ensures that all necessary documentation is completed accurately and efficiently, saving time and reducing errors. Plus, the ease of sending documents for signature simplifies compliance for your business.

-

What features should I look for in a New Jersey composite return service?

When choosing a service for New Jersey composite returns, look for features like e-signature capabilities, automatic notifications, and secure document storage. AirSlate SignNow offers these features, ensuring a smooth, efficient filing process. Additionally, consider services that provide integration with tax software to save time.

-

Is there a cost associated with filing a New Jersey composite return using airSlate SignNow?

While the exact cost of filing a New Jersey composite return can vary depending on specific needs, airSlate SignNow offers a cost-effective solution for e-signing and document management. Pricing structures may include various service tiers to accommodate businesses of all sizes. It’s recommended to check their website for current pricing options and potential discounts.

-

Can AirSlate SignNow integrate with other accounting software for New Jersey composite returns?

Yes, AirSlate SignNow can integrate with various accounting and tax software, making it easier to file your New Jersey composite returns. This integration streamlines the data transfer process, reducing the risk of errors and saving time for your finance team. Always verify compatibility with your existing tools to ensure a smooth experience.

Get more for New Jersey Election To Participate In A Composite Return, Form NJ 1080E

- Mo business llc form

- Business credit application missouri form

- Individual credit application missouri form

- Interrogatories to plaintiff for motor vehicle occurrence missouri form

- Interrogatories to defendant for motor vehicle accident missouri form

- Llc notices resolutions and other operations forms package missouri

- Notice of commencement compensation payments for workers compensation missouri form

- Residential real estate sales disclosure statement missouri form

Find out other New Jersey Election To Participate In A Composite Return, Form NJ 1080E

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document