Nj 1080e Form 2013

What is the Nj 1080e Form

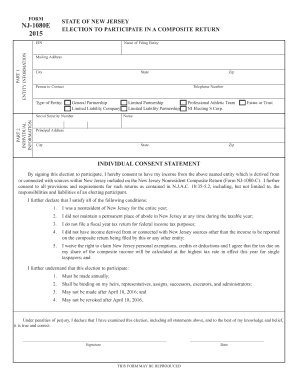

The Nj 1080e Form is a state-specific tax form used by residents of New Jersey to report their income and calculate their tax liabilities. This form is essential for individuals who need to file their state income tax returns, ensuring compliance with New Jersey tax laws. It is particularly relevant for taxpayers who may have additional income sources or specific deductions applicable to their situation.

How to use the Nj 1080e Form

Using the Nj 1080e Form involves several steps to ensure accurate reporting of income and deductions. Taxpayers must first gather all necessary financial documents, such as W-2s, 1099s, and any relevant receipts for deductions. Once the form is obtained, individuals should fill it out carefully, entering their income details, applicable deductions, and credits. After completing the form, it can be submitted either electronically or via mail, depending on the taxpayer's preference and eligibility.

Steps to complete the Nj 1080e Form

Completing the Nj 1080e Form requires a systematic approach to ensure accuracy. Here are the key steps:

- Gather all relevant financial documents, including income statements and deduction records.

- Obtain the Nj 1080e Form from the New Jersey Division of Taxation website or other authorized sources.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, including wages, interest, and dividends.

- Claim any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Review the completed form for accuracy before submission.

- Submit the form electronically or by mail to the appropriate tax authority.

Legal use of the Nj 1080e Form

The legal use of the Nj 1080e Form is crucial for ensuring that taxpayers meet their obligations under New Jersey tax law. This form must be filled out accurately and submitted by the designated deadline to avoid penalties. Electronic submissions are legally recognized, provided they comply with the necessary eSignature regulations. It is important for taxpayers to keep copies of their submitted forms and any supporting documentation for their records.

Filing Deadlines / Important Dates

Filing deadlines for the Nj 1080e Form are typically aligned with the federal tax deadlines. Taxpayers should be aware of the following important dates:

- The annual filing deadline is usually April 15, unless it falls on a weekend or holiday.

- Extensions may be available, but they must be requested before the deadline.

- Taxpayers should also note any specific deadlines for estimated tax payments throughout the year.

Form Submission Methods (Online / Mail / In-Person)

The Nj 1080e Form can be submitted through various methods to accommodate different preferences. Taxpayers have the option to:

- Submit the form electronically through the New Jersey Division of Taxation's online portal.

- Mail a paper copy of the completed form to the appropriate tax office.

- In some cases, individuals may be able to file in person at designated tax offices, although this option may be limited.

Quick guide on how to complete nj 1080e form

Effortlessly Prepare Nj 1080e Form on Any Device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to access the correct form and safely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and electronically sign your documents without complications. Manage Nj 1080e Form on any platform using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and eSign Nj 1080e Form effortlessly

- Locate Nj 1080e Form and click Get Form to begin.

- Utilize the tools available to complete your document.

- Indicate important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to preserve your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Modify and eSign Nj 1080e Form to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nj 1080e form

Create this form in 5 minutes!

People also ask

-

What is the Nj 1080e Form?

The Nj 1080e Form is used for the New Jersey income tax declaration for certain residents. It allows individuals to report their income and claim deductions and credits applicable to their tax situation. Understanding this form is essential for accurate tax filing in New Jersey.

-

How can airSlate SignNow help with the Nj 1080e Form?

airSlate SignNow simplifies the process of eSigning and sending the Nj 1080e Form, making tax submission effortless. Our platform ensures that your documents are secure and easily accessible for review and approval. Experience seamless eSignature workflows for all your tax documentation needs.

-

Is there a cost associated with using airSlate SignNow for the Nj 1080e Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. While there is a cost to access our platform’s features, the investment ensures a cost-effective solution for managing documents like the Nj 1080e Form. Pricing varies depending on the features and the scale of usage.

-

What are the key features of airSlate SignNow for eSigning the Nj 1080e Form?

Key features of airSlate SignNow include secure eSignatures, automated workflows, and customizable templates for the Nj 1080e Form. The platform also offers real-time tracking of document status, ensuring you stay informed on the signing process. This enhances efficiency and reduces manual errors in tax filing.

-

Can I integrate airSlate SignNow with other applications for managing the Nj 1080e Form?

Absolutely! airSlate SignNow provides integration options with popular applications like Google Workspace, Salesforce, and more. This feature allows you to streamline the workflow related to the Nj 1080e Form, making it easier to manage your tax documentation alongside your existing systems.

-

Is it safe to eSign the Nj 1080e Form using airSlate SignNow?

Yes, airSlate SignNow prioritizes security and complies with industry standards to ensure your eSignatures and documents are protected. Our platform uses advanced encryption technology, providing a safe environment for signing the Nj 1080e Form and other sensitive documents.

-

How does airSlate SignNow improve the efficiency of filing the Nj 1080e Form?

airSlate SignNow streamlines the document signing process, allowing users to quickly prepare and send the Nj 1080e Form without physical paperwork. With automated reminders and notifications, you can ensure timely completion and submission. This enhances overall productivity during tax season.

Get more for Nj 1080e Form

- 21 michigan department of licensing and regulatory form

- Michigan profit corporation filing information

- Pdf foreign registration statement arizona corporation commission form

- Get the free fis 0407 618 department of insurance and form

- Board of behavioral sciences state of california weekly form

- Staff health report licensed child care centers dcf f cfs54 form

- Food service license application 2019 2020 food service license application 2019 2020 form

- Ap blamend form

Find out other Nj 1080e Form

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form