New Jersey Election to Participate in a Composite Return, Form NJ 1080E 2020

What is the New Jersey Election To Participate In A Composite Return, Form NJ 1080E

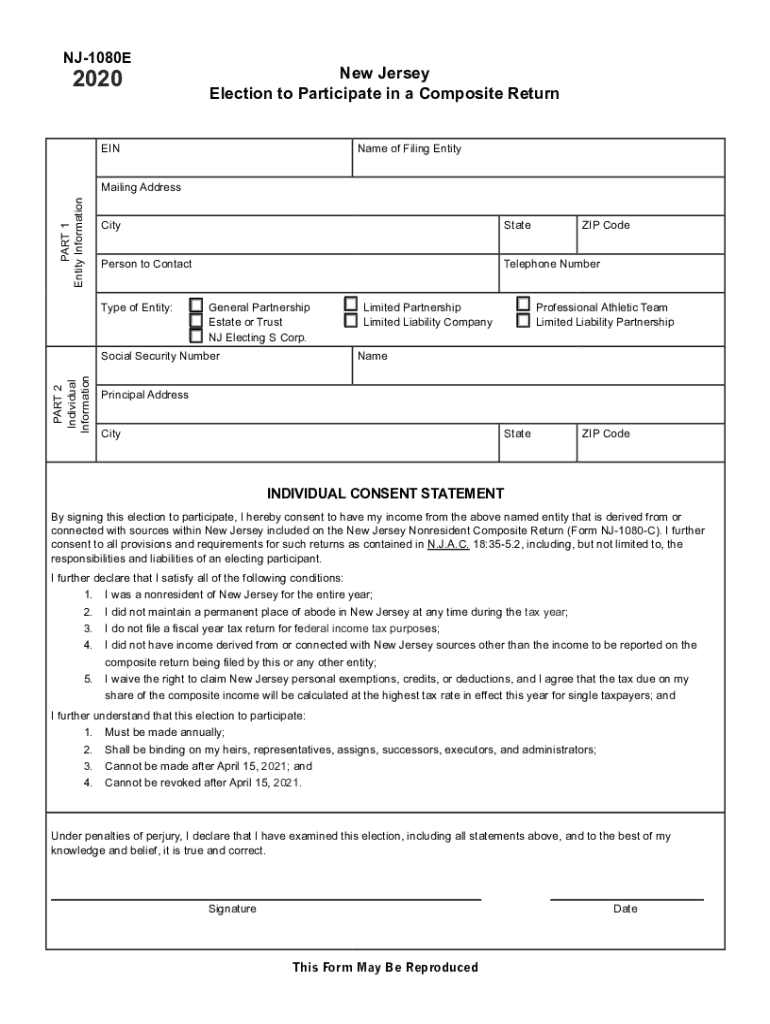

The New Jersey Election To Participate In A Composite Return, Form NJ 1080E, is a tax document that allows certain non-resident partners of a New Jersey partnership to elect to have their income taxed at the partnership level. This form simplifies the tax filing process for non-residents by enabling them to avoid filing individual New Jersey tax returns. Instead, the partnership files a composite return on behalf of these partners, consolidating their tax obligations into a single submission.

How to use the New Jersey Election To Participate In A Composite Return, Form NJ 1080E

Using Form NJ 1080E involves several steps. First, eligible partners must ensure that they meet the criteria for participation in a composite return. Next, the partnership must complete the form accurately, providing necessary details about the partners and their respective shares of income. Once completed, the form should be submitted along with the partnership's composite tax return. This process not only streamlines tax obligations but also minimizes the administrative burden on individual partners.

Steps to complete the New Jersey Election To Participate In A Composite Return, Form NJ 1080E

Completing Form NJ 1080E involves the following steps:

- Gather required information, including the names and addresses of all non-resident partners.

- Determine each partner's share of income from the partnership.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the completed form along with the partnership's composite return by the specified deadline.

Eligibility Criteria

To qualify for using Form NJ 1080E, partners must be non-residents of New Jersey and must have income derived from a New Jersey partnership. Additionally, the partnership must elect to file a composite return on behalf of its partners. It is important for partners to confirm their eligibility to ensure compliance with New Jersey tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for Form NJ 1080E typically align with the due date for the partnership's tax return. Generally, partnerships must file their composite returns by the fifteenth day of the fourth month following the close of the tax year. For partnerships operating on a calendar year basis, this means the deadline is April 15. Partners should be aware of these dates to avoid penalties for late filing.

Penalties for Non-Compliance

Failure to comply with the requirements of Form NJ 1080E can result in significant penalties. Non-resident partners who do not elect to participate in a composite return may be subject to individual tax filing requirements, which can lead to additional tax liabilities and penalties. Additionally, partnerships that fail to file the composite return on time may incur late fees and interest on unpaid taxes. It is crucial for both partners and partnerships to adhere to the filing requirements to avoid these consequences.

Quick guide on how to complete 2020 new jersey election to participate in a composite return form nj 1080e

Complete New Jersey Election To Participate In A Composite Return, Form NJ 1080E effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and manually signed papers, allowing you to access the correct template and securely keep it online. airSlate SignNow provides you with all the essential tools to create, modify, and electronically sign your documents promptly without delays. Manage New Jersey Election To Participate In A Composite Return, Form NJ 1080E on any system with airSlate SignNow Android or iOS applications and streamline any document-related workflow today.

The easiest way to modify and electronically sign New Jersey Election To Participate In A Composite Return, Form NJ 1080E without hassle

- Locate New Jersey Election To Participate In A Composite Return, Form NJ 1080E and then click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of the documents or redact confidential information with tools that airSlate SignNow offers specifically for this function.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and electronically sign New Jersey Election To Participate In A Composite Return, Form NJ 1080E and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 new jersey election to participate in a composite return form nj 1080e

Create this form in 5 minutes!

People also ask

-

What is the 1080e and how does it work with airSlate SignNow?

The 1080e is an advanced electronic signature solution that integrates seamlessly with airSlate SignNow. It allows users to send, sign, and manage documents quickly and efficiently, ensuring compliance and security in the signing process. With the 1080e, businesses can streamline their workflows and enhance productivity.

-

How much does airSlate SignNow charge for using the 1080e?

Pricing for airSlate SignNow varies based on the plan selected, but it remains cost-effective, especially for businesses utilizing the 1080e. You can choose from various subscription options that best fit your needs, with transparent pricing that includes all the necessary features to use the 1080e effectively.

-

What features does the 1080e offer within airSlate SignNow?

The 1080e offers a range of powerful features within airSlate SignNow, such as customizable templates, multi-party signing, and real-time tracking. These features enable users to enhance document management and ensure a smooth signing experience. The intuitive interface of the 1080e also simplifies the entire process.

-

What are the benefits of using the 1080e for my business?

Utilizing the 1080e with airSlate SignNow can signNowly increase your business's efficiency by reducing document turnaround times. It also helps in minimizing errors and ensuring that all documents are securely signed and stored. Moreover, the 1080e enhances customer satisfaction by providing a quick and convenient signing experience.

-

Can I integrate the 1080e with other software solutions?

Yes, the 1080e can be easily integrated with a wide range of software solutions, including CRM systems and document management tools. airSlate SignNow supports numerous integrations, allowing businesses to create a cohesive workflow that includes the 1080e. This flexibility enhances productivity while eliminating repetitive tasks.

-

Is the 1080e compliant with legal standards?

The 1080e is fully compliant with various legal and regulatory standards, ensuring that all electronic signatures are valid and enforceable. airSlate SignNow adheres to laws such as ESIGN and UETA, providing peace of mind to businesses that utilize the 1080e for their documentation needs. This compliance is crucial for maintaining trust and integrity in business operations.

-

How quickly can I get started with the 1080e on airSlate SignNow?

Getting started with the 1080e on airSlate SignNow is easy and can be done within minutes. Simply create an account, choose your desired plan, and you will have immediate access to the 1080e features. The user-friendly interface allows for quick learning, enabling you to send and sign documents right away.

Get more for New Jersey Election To Participate In A Composite Return, Form NJ 1080E

- Health information privacy statement

- Bureau of infectious disease control nh covid 19 employer form

- Et2325pdf wisconsin department of employee trust funds form

- Insurancemarylandgovconsumerdocumentsmedicalliability rate guide maryland insurance administration form

- Nc dhhs food and nutrition services food stamps form

- Get the free physician assistant shadowing patient contact form

- The praxis tests information bulletin 202122

- Fillable online vegasdermatology aesthetic services our form

Find out other New Jersey Election To Participate In A Composite Return, Form NJ 1080E

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF