MICHIGAN Adjustments of Capital Gains and Losses MI 1040D Form

Understanding the Michigan Adjustments of Capital Gains and Losses MI 1040D

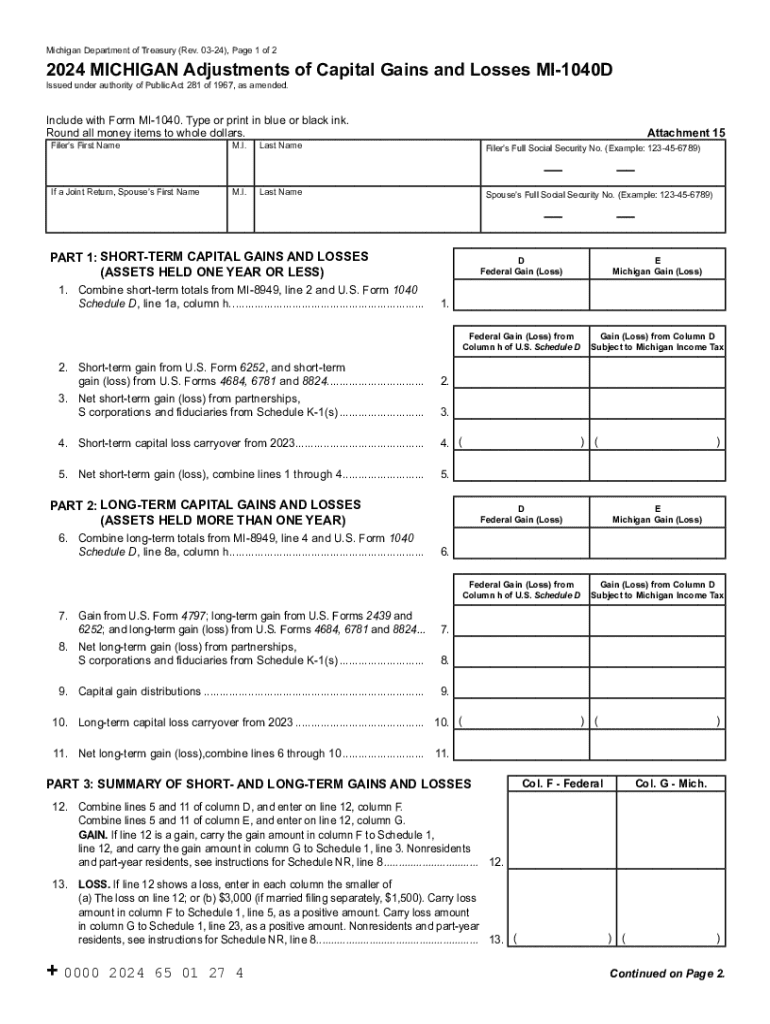

The Michigan Adjustments of Capital Gains and Losses MI 1040D is a tax form used by residents of Michigan to report adjustments related to capital gains and losses. This form allows taxpayers to calculate the amount of capital gains that are subject to state taxation, as well as any losses that can be deducted. Understanding this form is essential for accurately filing your state taxes and ensuring compliance with Michigan tax laws.

Steps to Complete the Michigan Adjustments of Capital Gains and Losses MI 1040D

Completing the MI 1040D involves several steps:

- Gather necessary financial documents, including records of capital gains and losses from the previous year.

- Fill out the personal information section, ensuring accuracy in your name, address, and Social Security number.

- Calculate your total capital gains and losses using the provided worksheets.

- Enter the adjustments on the form, indicating any applicable deductions or exemptions.

- Review the form for accuracy before submission.

Make sure to keep copies of all documents and the completed form for your records.

Legal Use of the Michigan Adjustments of Capital Gains and Losses MI 1040D

The MI 1040D is legally required for Michigan residents who have capital gains or losses to report. Failing to file this form can lead to penalties and interest on unpaid taxes. It is important to understand the legal implications of this form, including the requirements for reporting and the potential consequences of non-compliance.

State-Specific Rules for the Michigan Adjustments of Capital Gains and Losses MI 1040D

Michigan has specific rules regarding capital gains and losses that differ from federal regulations. For instance, certain types of gains may be exempt from state taxation, while others may be subject to different rates. Familiarizing yourself with these state-specific rules can help ensure that you are accurately reporting your financial situation and taking advantage of any available deductions.

Examples of Using the Michigan Adjustments of Capital Gains and Losses MI 1040D

Consider a scenario where an individual sold stock for a profit of $5,000. This gain must be reported on the MI 1040D. If the individual also incurred a loss of $2,000 from another investment, they can report this loss to offset the gain, resulting in a taxable capital gain of $3,000. This example illustrates how the MI 1040D can be used to accurately report capital gains while taking losses into account.

Filing Deadlines and Important Dates for the Michigan Adjustments of Capital Gains and Losses MI 1040D

It is crucial to be aware of the filing deadlines for the MI 1040D to avoid penalties. Typically, the form must be submitted by April 15 of the year following the tax year. If you are unable to meet this deadline, consider filing for an extension to ensure compliance with state regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan adjustments of capital gains and losses mi 1040d 771784754

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for 2024 Michigan gains?

airSlate SignNow offers a range of features designed to enhance your document management process. With eSigning, document templates, and real-time collaboration, businesses can streamline their workflows effectively. These features are particularly beneficial for maximizing 2024 Michigan gains by reducing turnaround times and improving efficiency.

-

How does airSlate SignNow help in achieving 2024 Michigan gains?

By utilizing airSlate SignNow, businesses can signNowly improve their document handling processes, which directly contributes to 2024 Michigan gains. The platform's automation capabilities reduce manual errors and save time, allowing teams to focus on strategic initiatives that drive growth.

-

What is the pricing structure for airSlate SignNow in relation to 2024 Michigan gains?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it a cost-effective solution for achieving 2024 Michigan gains. Each plan includes essential features that can be tailored to meet specific business needs, ensuring you get the best value for your investment.

-

Can airSlate SignNow integrate with other tools to enhance 2024 Michigan gains?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing your ability to achieve 2024 Michigan gains. Whether you use CRM systems, cloud storage, or project management tools, these integrations help streamline your processes and improve overall productivity.

-

What benefits does airSlate SignNow provide for small businesses aiming for 2024 Michigan gains?

For small businesses, airSlate SignNow offers an affordable and user-friendly solution that can signNowly contribute to 2024 Michigan gains. The platform's ease of use allows teams to quickly adopt eSigning and document management, leading to faster transactions and improved customer satisfaction.

-

Is airSlate SignNow secure for handling sensitive documents related to 2024 Michigan gains?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that all documents, especially those related to 2024 Michigan gains, are handled securely, giving businesses peace of mind when managing sensitive information.

-

How can I get started with airSlate SignNow to maximize my 2024 Michigan gains?

Getting started with airSlate SignNow is simple. You can sign up for a free trial to explore its features and see how it can help you achieve 2024 Michigan gains. Once you're ready, choose a pricing plan that fits your needs and start streamlining your document processes today.

Get more for MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D

Find out other MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document