PA 34 Form 2024-2026

What is the PA 34 Form

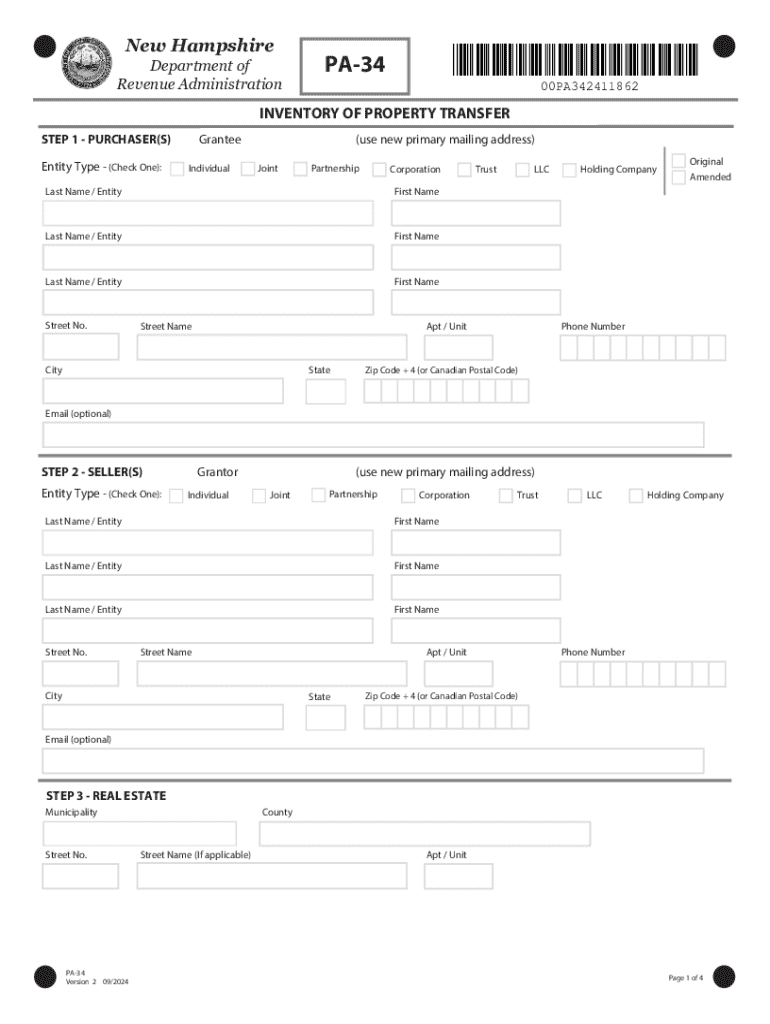

The PA 34 Form, also known as the New Hampshire PA 34 Property Transfer Form, is a legal document used for the transfer of real estate ownership in New Hampshire. This form is essential for recording property transactions and must be filed with the local municipality. It provides necessary information such as the names of the buyer and seller, property description, and the sale price. The PA 34 Form is crucial for ensuring that property records are updated accurately, which helps maintain the integrity of public records.

How to use the PA 34 Form

Using the PA 34 Form involves several steps to ensure that the property transfer is executed correctly. First, both the buyer and seller must fill out the form with accurate details regarding the transaction. This includes providing information about the property, such as its location, parcel number, and the names of all parties involved. After completing the form, it should be signed by both parties. Finally, the form must be submitted to the appropriate local government office for recording. It is advisable to keep a copy for personal records.

Steps to complete the PA 34 Form

Completing the PA 34 Form requires careful attention to detail. Follow these steps:

- Obtain the PA 34 Form from the New Hampshire Department of Revenue Administration or your local municipality.

- Fill in the required information, including the seller's and buyer's names, property description, and sale price.

- Ensure that all parties sign the form where indicated.

- Review the completed form for accuracy and completeness.

- Submit the form to the local municipal office for recording, either in person or by mail.

Legal use of the PA 34 Form

The PA 34 Form serves a legal purpose in property transactions in New Hampshire. It is required by law to document the transfer of real estate ownership. By filing this form, both parties fulfill their legal obligations and protect their rights in the transaction. Failure to submit the PA 34 Form may result in complications regarding property ownership and could affect future transactions involving the property.

Required Documents

When completing the PA 34 Form, certain documents may be required to support the transfer of property. These typically include:

- A copy of the purchase and sale agreement.

- Proof of identity for both the buyer and seller, such as a driver's license or passport.

- Any existing property deeds or titles.

- Documentation related to any liens or encumbrances on the property.

Form Submission Methods (Online / Mail / In-Person)

The PA 34 Form can be submitted through various methods, depending on the local municipality's regulations. Common submission methods include:

- In-Person: Many municipalities allow individuals to submit the form directly at their offices.

- By Mail: The completed form can often be mailed to the local government office for processing.

- Online: Some municipalities may offer online submission options through their official websites, allowing for a more convenient process.

Create this form in 5 minutes or less

Find and fill out the correct pa 34 form

Create this form in 5 minutes!

How to create an eSignature for the pa 34 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA 34 form and why is it important?

The PA 34 form is a crucial document used for various administrative purposes in Pennsylvania. It serves as a formal request for specific information or actions from state agencies. Understanding the PA 34 form is essential for ensuring compliance and facilitating smooth business operations.

-

How can airSlate SignNow help with the PA 34 form?

airSlate SignNow simplifies the process of completing and submitting the PA 34 form by providing an intuitive eSignature platform. Users can easily fill out the form, sign it electronically, and send it directly to the relevant authorities. This streamlines the workflow and reduces the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for the PA 34 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and reflects the value of features provided, such as unlimited eSignatures and document storage. Investing in airSlate SignNow can save time and resources when managing the PA 34 form.

-

What features does airSlate SignNow offer for managing the PA 34 form?

airSlate SignNow provides features like customizable templates, automated workflows, and secure cloud storage, all of which enhance the management of the PA 34 form. Users can track document status in real-time and receive notifications when actions are required. These features ensure a seamless experience.

-

Can I integrate airSlate SignNow with other applications for the PA 34 form?

Absolutely! airSlate SignNow offers integrations with various applications, including CRM systems and cloud storage services. This allows users to manage the PA 34 form alongside their existing tools, enhancing productivity and ensuring that all documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the PA 34 form?

Using airSlate SignNow for the PA 34 form provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. The platform's user-friendly interface makes it easy for anyone to navigate, while its compliance features ensure that your documents meet legal standards.

-

Is airSlate SignNow secure for handling the PA 34 form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the PA 34 form. The platform uses advanced encryption and secure data storage to protect sensitive information. Users can confidently manage their documents knowing that their data is secure.

Get more for PA 34 Form

Find out other PA 34 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors