Fillin 8283 Form 2023

What is the Fillin 8283 Form

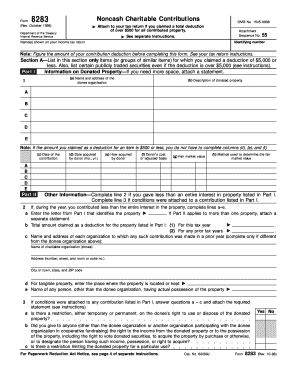

The Fillin 8283 Form is a tax form used in the United States for reporting noncash charitable contributions. This form is typically required by the Internal Revenue Service (IRS) when a taxpayer claims a deduction for property donated to qualified charitable organizations. The form helps ensure transparency and compliance with IRS regulations regarding the valuation and reporting of noncash donations.

How to obtain the Fillin 8283 Form

Taxpayers can obtain the Fillin 8283 Form directly from the IRS website or through tax preparation software that includes IRS forms. Additionally, physical copies may be available at local IRS offices or through tax professionals. It is essential to ensure that the latest version of the form is used to comply with current tax laws.

Steps to complete the Fillin 8283 Form

Completing the Fillin 8283 Form involves several key steps:

- Gather documentation for the donated property, including receipts and appraisals if necessary.

- Provide personal information, including your name, Social Security number, and address.

- Detail the donated property, including its description, date of contribution, and fair market value.

- Indicate the method of appraisal if the value exceeds a certain threshold, and include any required signatures.

- Review the form for accuracy before submission to avoid delays or penalties.

Legal use of the Fillin 8283 Form

The Fillin 8283 Form is legally required for taxpayers who wish to claim a deduction for noncash charitable contributions exceeding $500. Proper use of this form ensures compliance with IRS regulations and helps prevent potential audits. Taxpayers must adhere to the guidelines set forth by the IRS regarding the valuation and documentation of donated property.

IRS Guidelines

The IRS provides specific guidelines for completing the Fillin 8283 Form. Taxpayers must follow these guidelines closely to ensure that their deductions are valid. This includes maintaining accurate records of donations, obtaining appraisals for high-value items, and submitting the form along with the annual tax return. Failure to comply with IRS guidelines can result in disallowed deductions and potential penalties.

Filing Deadlines / Important Dates

The Fillin 8283 Form must be filed along with your annual tax return, which is typically due on April 15. If you file for an extension, be aware that the form must still be submitted by the extended deadline. It is crucial to keep track of these dates to ensure compliance and avoid penalties associated with late submissions.

Create this form in 5 minutes or less

Find and fill out the correct fillin 8283 form

Create this form in 5 minutes!

How to create an eSignature for the fillin 8283 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fillin 8283 Form and why is it important?

The Fillin 8283 Form is a tax form used to report noncash charitable contributions. It is important for individuals and businesses to accurately complete this form to ensure compliance with IRS regulations and to maximize potential tax deductions.

-

How can airSlate SignNow help me Fillin 8283 Form?

airSlate SignNow provides an intuitive platform that simplifies the process of filling out the Fillin 8283 Form. With our eSignature capabilities, you can easily complete and send the form securely, ensuring that all necessary parties can sign it without hassle.

-

Is there a cost associated with using airSlate SignNow to Fillin 8283 Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can efficiently Fillin 8283 Form without breaking the bank, with options for both individuals and teams.

-

What features does airSlate SignNow offer for filling out forms?

airSlate SignNow includes features such as customizable templates, drag-and-drop form fields, and secure cloud storage. These features make it easy to Fillin 8283 Form accurately and efficiently, streamlining your document management process.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to easily access and Fillin 8283 Form directly from your preferred tools, enhancing your workflow.

-

What are the benefits of using airSlate SignNow for the Fillin 8283 Form?

Using airSlate SignNow to Fillin 8283 Form provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform ensures that your documents are handled with care, allowing you to focus on what matters most.

-

Is airSlate SignNow user-friendly for beginners?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for beginners to navigate. Whether you need to Fillin 8283 Form or manage other documents, our straightforward interface ensures that you can get started quickly and easily.

Get more for Fillin 8283 Form

- Tenant deposit return form

- Letter from tenant to landlord containing request for permission to sublease florida form

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages florida form

- Fl tenant form

- Fl landlord form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration florida form

- Tenant vacating premises form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement florida form

Find out other Fillin 8283 Form

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online