382, Gas Severance Tax Return 2025-2026

What is the 382, Gas Severance Tax Return

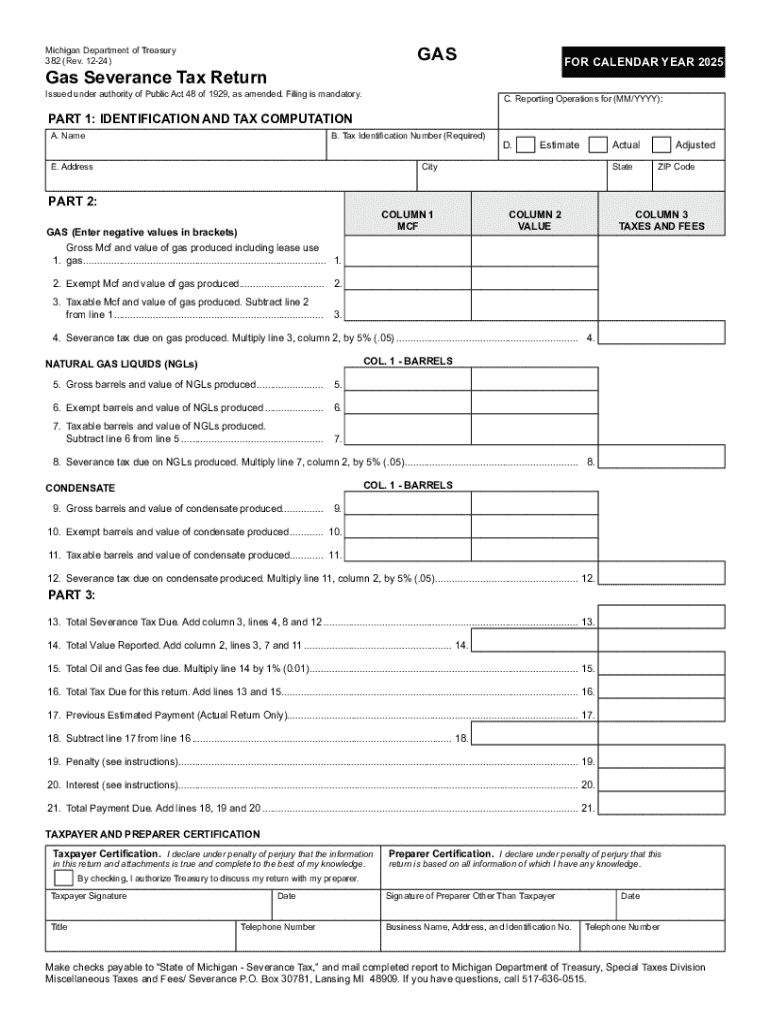

The 382, Gas Severance Tax Return is a tax form used by businesses and individuals engaged in the extraction of natural gas. This form is specifically designed to report the severance tax owed to the state based on the volume of gas extracted. Severance taxes are imposed on the removal of natural resources, and the 382 form ensures compliance with state tax regulations. It is essential for taxpayers in the gas industry to understand the requirements and implications of this form to avoid penalties and ensure accurate reporting.

How to use the 382, Gas Severance Tax Return

Using the 382, Gas Severance Tax Return involves several key steps. First, gather all necessary data regarding the quantity of gas extracted during the reporting period. Next, accurately calculate the severance tax owed based on state-specific rates. Once the calculations are complete, fill out the form with the required information, ensuring all figures are accurate and reflect the data collected. Finally, submit the completed form to the appropriate state tax authority by the established deadline to maintain compliance.

Steps to complete the 382, Gas Severance Tax Return

Completing the 382, Gas Severance Tax Return involves a systematic approach:

- Collect data on the volume of gas extracted during the reporting period.

- Determine the applicable severance tax rate for your state.

- Calculate the total severance tax owed based on the extraction volume and tax rate.

- Fill out the 382 form with the required information, including personal or business details and tax calculations.

- Review the completed form for accuracy before submission.

- Submit the form to the designated state tax authority, either electronically or by mail, as per state guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the 382, Gas Severance Tax Return vary by state, but typically align with quarterly or annual reporting periods. It is crucial to be aware of these deadlines to avoid late fees and penalties. Most states require the form to be filed within a specific timeframe following the end of the reporting period. Check with your state tax authority for the exact dates applicable to your situation, as timely submission is essential for compliance.

Required Documents

To complete the 382, Gas Severance Tax Return, certain documents are essential. These may include:

- Records of gas extraction volumes for the reporting period.

- Previous tax returns, if applicable, for reference.

- Documentation of any exemptions or deductions claimed.

- Payment records for any prior severance taxes paid.

Having these documents readily available can streamline the process of filling out the form and ensure accurate reporting.

Penalties for Non-Compliance

Failure to file the 382, Gas Severance Tax Return by the deadline can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action from state tax authorities. It is important to understand the consequences of non-compliance, as they can impact both financial standing and business operations. Regularly reviewing tax obligations and ensuring timely submissions can help mitigate these risks.

Create this form in 5 minutes or less

Find and fill out the correct 382 gas severance tax return 771975485

Create this form in 5 minutes!

How to create an eSignature for the 382 gas severance tax return 771975485

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 382, Gas Severance Tax Return?

The 382, Gas Severance Tax Return is a specific form used by businesses to report and pay gas severance taxes. This return is essential for compliance with state regulations and ensures that companies accurately report their gas production and associated taxes.

-

How can airSlate SignNow help with the 382, Gas Severance Tax Return?

airSlate SignNow simplifies the process of completing and submitting the 382, Gas Severance Tax Return by providing an easy-to-use platform for document management. With our eSigning capabilities, you can quickly gather necessary signatures and ensure timely submissions.

-

What are the pricing options for using airSlate SignNow for the 382, Gas Severance Tax Return?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solutions ensure that you can manage your 382, Gas Severance Tax Return without breaking the bank, with options for monthly or annual subscriptions.

-

Are there any features specifically designed for the 382, Gas Severance Tax Return?

Yes, airSlate SignNow includes features tailored for the 382, Gas Severance Tax Return, such as customizable templates and automated workflows. These features streamline the preparation and submission process, making it easier for businesses to stay compliant.

-

What benefits does airSlate SignNow provide for managing the 382, Gas Severance Tax Return?

Using airSlate SignNow for your 382, Gas Severance Tax Return offers numerous benefits, including increased efficiency, reduced errors, and enhanced compliance. Our platform allows for quick document access and secure eSigning, saving you time and resources.

-

Can airSlate SignNow integrate with other software for the 382, Gas Severance Tax Return?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your 382, Gas Severance Tax Return alongside your other financial documents. This integration helps streamline your workflow and ensures data consistency.

-

Is airSlate SignNow secure for handling the 382, Gas Severance Tax Return?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your 382, Gas Severance Tax Return and other sensitive documents are protected. Our platform uses advanced encryption and security protocols to safeguard your data at all times.

Get more for 382, Gas Severance Tax Return

- Letter landlord tenant notice 497322282 form

- Ohio about law form

- Oh tenant form

- Letter landlord rent template 497322285 form

- Oh landlord notice 497322286 form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase ohio form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant ohio form

- Letter tenant notice rent 497322289 form

Find out other 382, Gas Severance Tax Return

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe