CITY of PHILADELPHIA DEPARTMENT of REVENUEPHTIN EI 2023-2026

Understanding the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI

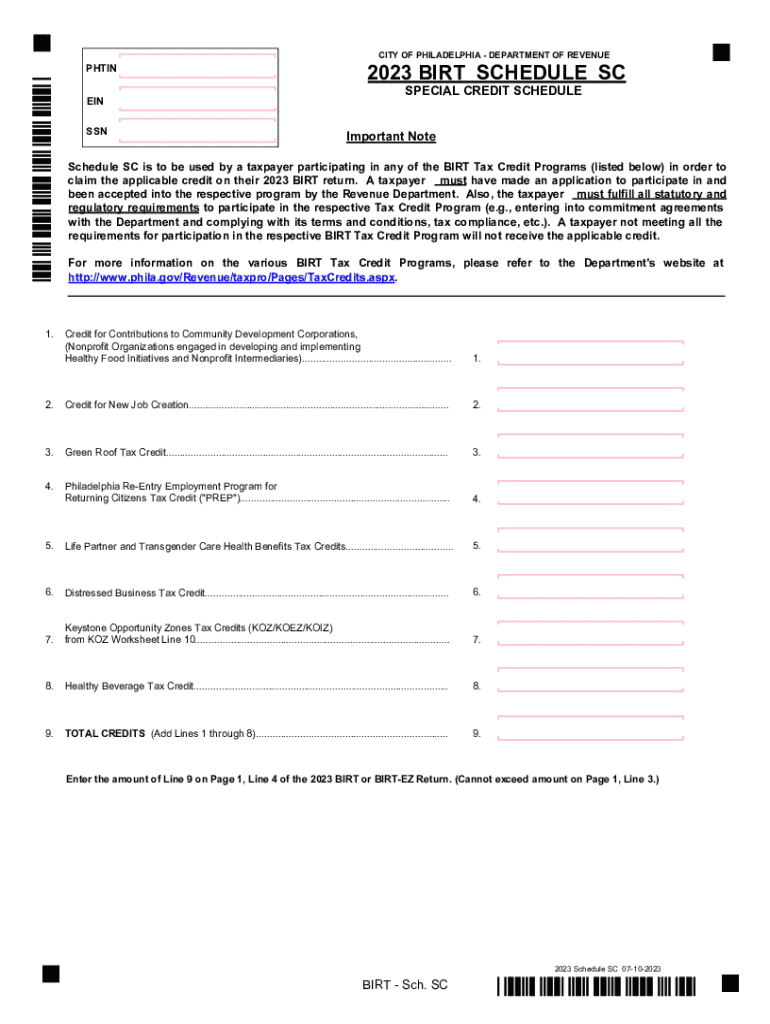

The CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI is a critical form used for tax purposes within the city of Philadelphia. This form is designed to collect information necessary for the assessment of local taxes, ensuring compliance with city regulations. It plays a vital role in the city’s revenue system, allowing for accurate tracking of taxpayer obligations and contributions. Understanding this form is essential for individuals and businesses operating in Philadelphia to meet their financial responsibilities effectively.

Steps to Complete the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI

Completing the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI involves several key steps:

- Gather necessary documentation, including identification and financial records.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy to avoid potential penalties.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Following these steps can help ensure a smooth filing process and compliance with local tax laws.

Required Documents for the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI

When preparing to submit the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI, it is important to have the following documents ready:

- Proof of identity, such as a driver's license or state ID.

- Financial statements or income records relevant to the tax year.

- Previous tax returns, if applicable, to ensure consistency.

- Any additional documentation requested by the Department of Revenue.

Having these documents on hand will facilitate the completion of the form and help avoid delays.

Form Submission Methods for the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI

The CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI can be submitted through various methods to accommodate different preferences:

- Online submission via the official Philadelphia Department of Revenue website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local revenue offices for immediate processing.

Choosing the right method can enhance convenience and ensure timely compliance with tax obligations.

Legal Use of the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI

The CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI serves a legal purpose in the context of municipal tax regulations. It is essential for individuals and businesses to use this form correctly to fulfill their legal responsibilities. Misuse or failure to submit the form can result in penalties, including fines or legal action by the city. Understanding the legal implications of this form helps taxpayers navigate their obligations and avoid potential issues.

Eligibility Criteria for the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI

Eligibility for using the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI typically includes:

- Residents of Philadelphia who are subject to local taxes.

- Businesses operating within the city limits.

- Individuals who have earned income that is taxable under city regulations.

Meeting these criteria is crucial for ensuring that the form is applicable to the taxpayer's situation.

Create this form in 5 minutes or less

Find and fill out the correct city of philadelphia department of revenuephtin ei

Create this form in 5 minutes!

How to create an eSignature for the city of philadelphia department of revenuephtin ei

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI?

The CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI is a vital service that helps businesses manage their tax obligations efficiently. It provides essential resources and guidance for compliance with local tax regulations, ensuring that businesses can operate smoothly within Philadelphia.

-

How can airSlate SignNow assist with the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI?

airSlate SignNow streamlines the process of sending and eSigning documents related to the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI. Our platform allows businesses to quickly prepare, sign, and submit necessary documents, reducing the time spent on administrative tasks.

-

What are the pricing options for airSlate SignNow in relation to the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solutions ensure that you can manage your documentation needs related to the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI without breaking the bank.

-

What features does airSlate SignNow provide for the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These features are designed to enhance your experience with the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI, making document management more efficient.

-

What are the benefits of using airSlate SignNow for the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI?

Using airSlate SignNow for the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI allows for faster processing of documents, improved compliance, and reduced paperwork. Our solution empowers businesses to focus on their core operations while ensuring that all tax-related documents are handled efficiently.

-

Can airSlate SignNow integrate with other tools for the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI?

Yes, airSlate SignNow offers integrations with various business tools and software that can enhance your workflow related to the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI. This ensures that you can seamlessly connect your existing systems for a more streamlined experience.

-

Is airSlate SignNow secure for handling CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI documents?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all documents related to the CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI are protected with advanced encryption and security protocols. Your sensitive information is safe with us.

Get more for CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI

- Harley davidson loan application form

- Govt of goa agriculture department farmer registration form

- Oregon tax form 2312

- Lumber order form

- Carefirst blue rewards health screening form

- Owner retained report error the texas department of motor bb ftp txdmv form

- How to fill perform application

- Employers annual federal tax return file irs form 944

Find out other CITY OF PHILADELPHIA DEPARTMENT OF REVENUEPHTIN EI

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple