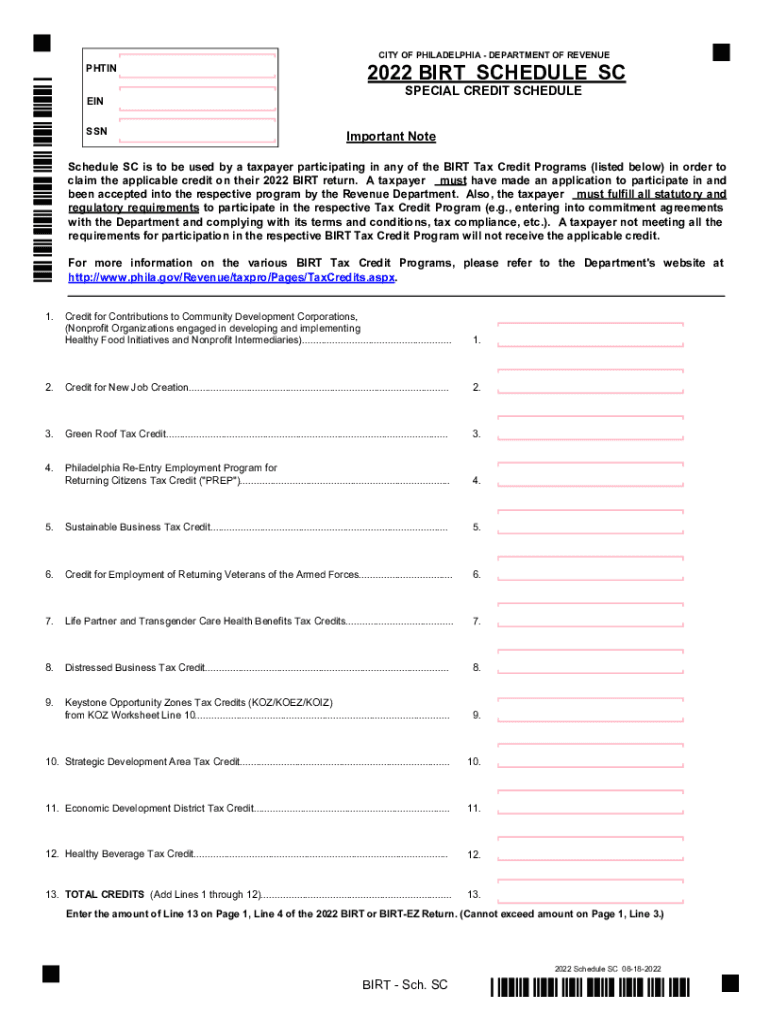

SPECIAL CREDIT SCHEDULE 2022

What is the special credit schedule?

The special credit schedule is a specific form used in Pennsylvania, particularly in Philadelphia, to document and process certain tax credits. This form is essential for individuals and businesses seeking to claim special credits that may reduce their overall tax liability. Understanding the details of this schedule is crucial for ensuring compliance and maximizing potential credits available under state law.

How to obtain the special credit schedule

To obtain the special credit schedule in Pennsylvania, individuals can visit the official state revenue website or contact the local tax office in Philadelphia. The form is typically available for download in a PDF format, allowing users to print and fill it out. Additionally, some tax preparation software may include this form, streamlining the process for users who prefer digital solutions.

Steps to complete the special credit schedule

Completing the special credit schedule involves several key steps:

- Gather necessary documentation, including previous tax returns and any relevant financial records.

- Download and print the special credit schedule form from the state revenue website.

- Carefully fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online, by mail, or in person at the local tax office.

Legal use of the special credit schedule

The legal use of the special credit schedule is governed by Pennsylvania tax law. It is important to ensure that all information provided on the form is truthful and accurate, as any discrepancies can lead to penalties or audits. The form must be submitted within the designated filing deadlines to be considered valid for the tax year in question.

Key elements of the special credit schedule

Key elements of the special credit schedule include:

- Taxpayer identification information, including Social Security numbers or Employer Identification Numbers.

- Details of the specific credits being claimed, including the amount and type of credit.

- Supporting documentation that verifies eligibility for the credits claimed.

- Signature and date to affirm the accuracy of the information provided.

Filing deadlines / Important dates

Filing deadlines for the special credit schedule are critical to ensure that claims are processed timely. Typically, the form must be submitted by the same deadline as the annual tax return. It is advisable to check the Pennsylvania Department of Revenue's website for specific dates, as they may vary from year to year.

Quick guide on how to complete special credit schedule

Complete SPECIAL CREDIT SCHEDULE effortlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals. It serves as an ideal environmentally friendly substitute for traditional printed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents promptly without delays. Manage SPECIAL CREDIT SCHEDULE on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to adjust and electronically sign SPECIAL CREDIT SCHEDULE with ease

- Find SPECIAL CREDIT SCHEDULE and click Obtain Form to begin.

- Utilize the resources we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Finished button to preserve your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign SPECIAL CREDIT SCHEDULE and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct special credit schedule

Create this form in 5 minutes!

How to create an eSignature for the special credit schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Pennsylvania Philadelphia BIRT SC Special Credit Trial?

The Pennsylvania Philadelphia BIRT SC Special Credit Trial is a unique financial initiative designed to support businesses in Philadelphia by providing them with special credit incentives. This trial specifically targets businesses looking to capitalize on special credit opportunities, enhancing their financial flexibility. For more details on combining it with airSlate SignNow, signNow out to our team.

-

How can airSlate SignNow assist with the Pennsylvania Philadelphia BIRT SC Special Credit Trial?

airSlate SignNow can streamline your document signing process related to the Pennsylvania Philadelphia BIRT SC Special Credit Trial, making it easier to manage any necessary paperwork. Our platform allows you to send, sign, and store documents securely, ensuring compliance with all local regulations. This can save you time and resources while enabling faster access to your credit opportunities.

-

What are the costs associated with using airSlate SignNow?

airSlate SignNow offers competitive pricing tailored to your business's needs. You can select from different subscription plans, ensuring that you can access all necessary features without overspending, especially if you are applying for the Pennsylvania Philadelphia BIRT SC Special Credit Trial. Contact our sales team to find the best plan suitable for your requirements.

-

Are there any features specific to the Pennsylvania Philadelphia BIRT SC Special Credit Trial?

While airSlate SignNow offers robust features for all users, you can customize document templates specifically for the Pennsylvania Philadelphia BIRT SC Special Credit Trial. Our features ensure you can easily create, send, and track documents that align with the trial's requirements. This customization enhances your efficiency and compliance during the process.

-

What benefits does airSlate SignNow provide for businesses participating in the trial?

Businesses utilizing airSlate SignNow for the Pennsylvania Philadelphia BIRT SC Special Credit Trial can benefit from simplified eSignature collection and document management. This can lead to faster approval times and a more streamlined workflow. Additionally, it minimizes the risks associated with document handling and enhances your audit trails.

-

How does airSlate SignNow integrate with other software for trial management?

airSlate SignNow seamlessly integrates with various software and tools that businesses frequently use, making it easy to manage all aspects of the Pennsylvania Philadelphia BIRT SC Special Credit Trial. Whether you need to connect with CRM systems, accounting software, or project management tools, our platform supports smooth data flow and operational efficiency. Check our integration list for specific options.

-

Is airSlate SignNow user-friendly for businesses new to digital signing?

Absolutely! airSlate SignNow is designed to be intuitive, making it accessible for businesses of all tech levels, especially for those involved in the Pennsylvania Philadelphia BIRT SC Special Credit Trial. Our user-friendly interface, along with comprehensive support documentation and customer service, ensures that you can get started quickly and efficiently without a steep learning curve.

Get more for SPECIAL CREDIT SCHEDULE

Find out other SPECIAL CREDIT SCHEDULE

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast