PA BIRT Schedule SC 2019

What is the PA BIRT Schedule SC

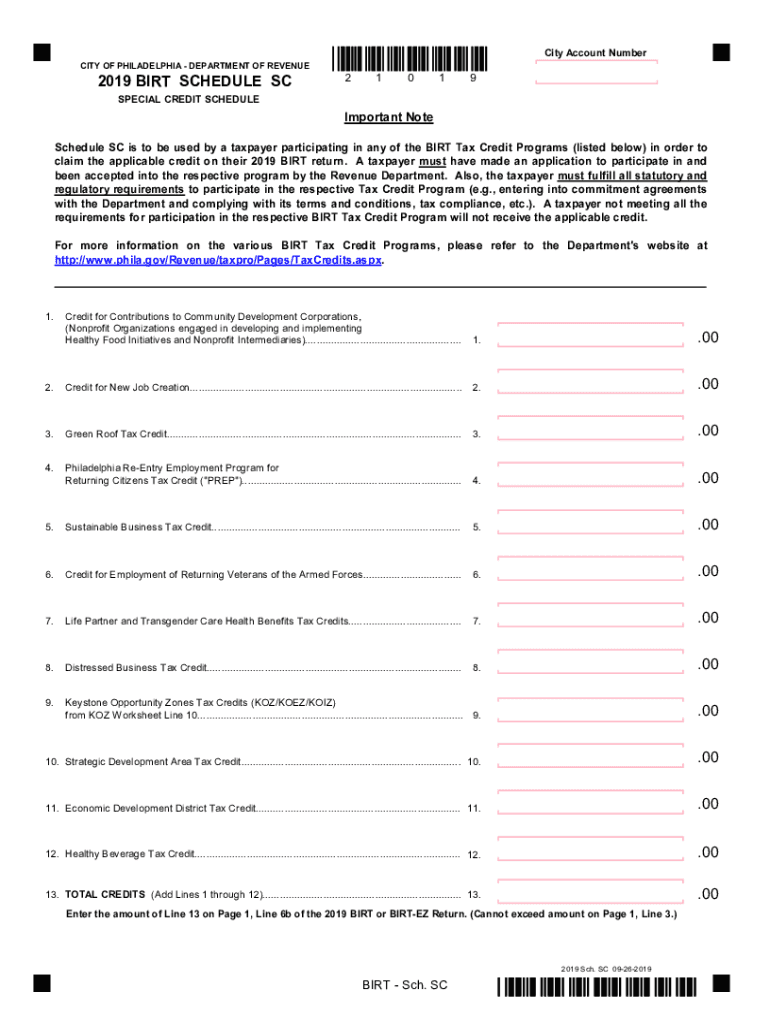

The PA BIRT Schedule SC is a form used by businesses operating in Pennsylvania to report their business income and receipts for the Business Income and Receipts Tax (BIRT). This tax applies to various business entities, including corporations and partnerships. The schedule is essential for accurately calculating the tax owed based on the business's gross receipts and net income, ensuring compliance with state tax regulations.

How to use the PA BIRT Schedule SC

To use the PA BIRT Schedule SC, businesses must first gather relevant financial information, including total gross receipts and allowable deductions. The form requires detailed reporting of income sources and expenses to determine the taxable amount. After completing the schedule, it must be submitted along with the business's tax return to the Pennsylvania Department of Revenue. Accurate completion is crucial to avoid penalties and ensure proper tax assessment.

Steps to complete the PA BIRT Schedule SC

Completing the PA BIRT Schedule SC involves several key steps:

- Gather financial records, including income statements and receipts.

- Calculate total gross receipts from all business activities.

- Determine allowable deductions, such as business expenses.

- Fill out the schedule, ensuring all sections are completed accurately.

- Review the form for errors and ensure all calculations are correct.

- Submit the completed schedule with your tax return by the due date.

Filing Deadlines / Important Dates

Filing deadlines for the PA BIRT Schedule SC typically align with the business tax return due dates. Businesses must submit their returns by the fifteenth day of the fourth month following the end of their fiscal year. For calendar year filers, this means the deadline is April 15. It is important to stay informed about any changes to deadlines or requirements to avoid late fees.

Required Documents

When completing the PA BIRT Schedule SC, businesses need to prepare several documents:

- Financial statements, including profit and loss statements.

- Records of gross receipts from all business activities.

- Documentation for any deductions claimed, such as invoices and receipts.

- Previous year's tax returns for reference, if applicable.

Penalties for Non-Compliance

Failure to comply with the requirements of the PA BIRT Schedule SC can result in significant penalties. Businesses may face fines for late submissions, inaccuracies, or failure to file altogether. Additionally, interest may accrue on any unpaid taxes, increasing the overall financial burden. It is crucial for businesses to adhere to filing requirements and deadlines to avoid these penalties.

Quick guide on how to complete 2019 pa birt schedule sc

Effortlessly complete PA BIRT Schedule SC on any device

Digital document management has become widely embraced by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents swiftly without delays. Handle PA BIRT Schedule SC on any device through airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and eSign PA BIRT Schedule SC stress-free

- Locate PA BIRT Schedule SC and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically designed for that function by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your edits.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from your chosen device. Modify and eSign PA BIRT Schedule SC to ensure exceptional communication throughout your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 pa birt schedule sc

Create this form in 5 minutes!

How to create an eSignature for the 2019 pa birt schedule sc

The best way to make an eSignature for a PDF document online

The best way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the SC schedule for BIRT return?

The SC schedule for BIRT return is the specific timeline established by the South Carolina Department of Revenue for filing Business Income Tax returns. Understanding this schedule is crucial for businesses to avoid penalties and ensure compliance with tax regulations.

-

How does airSlate SignNow simplify the SC schedule for BIRT return process?

airSlate SignNow streamlines the SC schedule for BIRT return process by allowing businesses to electronically sign and send required documents quickly. This efficient method reduces paperwork and helps ensure timely submissions in line with state deadlines.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers various pricing plans to fit different business needs, starting from a basic plan to comprehensive packages for larger enterprises. Each plan provides features that support the SC schedule for BIRT return process, ensuring you get the necessary tools without overspending.

-

What features does airSlate SignNow offer that assist with tax documentation?

AirSlate SignNow includes features like customizable templates, cloud storage integration, and document tracking. These tools help businesses manage their tax documents more effectively, simplifying compliance with the SC schedule for BIRT return.

-

Are there any integrations available with airSlate SignNow for accounting software?

Yes, airSlate SignNow integrates with popular accounting software, allowing businesses to seamlessly prepare their documentation for the SC schedule for BIRT return. This integration streamlines the process, ensuring that all tax-related documents are easily accessible and manageable.

-

What benefits does airSlate SignNow provide for businesses managing BIRT returns?

Using airSlate SignNow provides numerous benefits, including improved efficiency, reduced costs, and enhanced document security for businesses managing BIRT returns. By leveraging our electronic signature solution, you can ensure that your SC schedule for BIRT return is submitted accurately and on time.

-

Is airSlate SignNow easy to use for businesses unfamiliar with electronic documentation?

Absolutely! airSlate SignNow is designed for ease of use, even for those unfamiliar with electronic documentation. Our user-friendly interface and helpful resources make it simple for you to comply with the SC schedule for BIRT return.

Get more for PA BIRT Schedule SC

Find out other PA BIRT Schedule SC

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe