PA Schedule UE Allowable Employee Business Expenses PA 40 UE 2024-2026

Understanding the PA Schedule UE

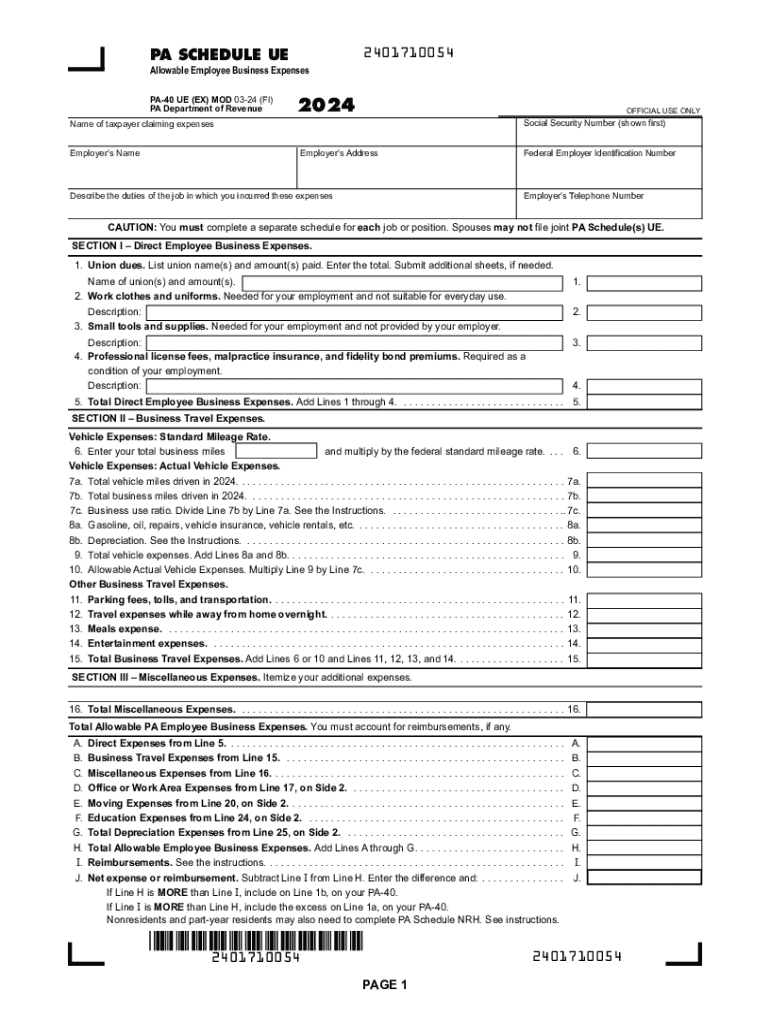

The PA Schedule UE is a form used by Pennsylvania taxpayers to report allowable employee business expenses. This form is specifically designed for individuals who incur expenses related to their employment but do not receive reimbursement from their employer. It allows taxpayers to deduct certain costs that are necessary for their job, thereby reducing their overall taxable income. The PA Schedule UE is typically filed alongside the PA-40, the state income tax return form.

Steps to Complete the PA Schedule UE

Completing the PA Schedule UE involves several key steps:

- Gather necessary documentation, including receipts and records of business expenses.

- Identify allowable expenses, such as travel, meals, and equipment costs.

- Fill out the form accurately, ensuring all expenses are documented and categorized correctly.

- Review the completed form for accuracy before submission.

- Submit the PA Schedule UE along with your PA-40 form by the filing deadline.

Allowable Employee Business Expenses

Taxpayers can deduct various types of employee business expenses on the PA Schedule UE. These may include:

- Travel expenses, such as mileage and lodging costs.

- Meals and entertainment expenses incurred while conducting business.

- Costs for tools and supplies necessary for job performance.

- Home office expenses, if applicable.

It's essential to keep detailed records and receipts for all expenses claimed to ensure compliance with state tax regulations.

Filing Deadlines for the PA Schedule UE

The PA Schedule UE must be filed by the same deadline as the PA-40 form, typically on April 15 for most taxpayers. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should plan ahead to ensure all necessary documentation is prepared and submitted on time to avoid penalties.

Obtaining the PA Schedule UE

The PA Schedule UE can be obtained from the Pennsylvania Department of Revenue's website or through various tax preparation software. Additionally, physical copies may be available at local tax offices or libraries. It is important to ensure that you are using the most current version of the form to avoid any issues during filing.

Legal Use of the PA Schedule UE

The PA Schedule UE is legally recognized for reporting employee business expenses in Pennsylvania. Taxpayers must ensure they meet the eligibility criteria and comply with all state tax laws when using this form. Accurate reporting is crucial, as any discrepancies may lead to audits or penalties from the Pennsylvania Department of Revenue.

Create this form in 5 minutes or less

Find and fill out the correct pa schedule ue allowable employee business expenses pa 40 ue

Create this form in 5 minutes!

How to create an eSignature for the pa schedule ue allowable employee business expenses pa 40 ue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pa schedule ue and how does it work with airSlate SignNow?

The pa schedule ue is a specific form used for reporting income and expenses in Pennsylvania. With airSlate SignNow, you can easily fill out, sign, and send this document electronically, streamlining your workflow and ensuring compliance with state regulations.

-

How can airSlate SignNow help me manage my pa schedule ue more efficiently?

airSlate SignNow offers features like document templates and automated workflows that simplify the process of managing your pa schedule ue. You can quickly access previous submissions, making it easier to update and resend documents as needed.

-

Is there a cost associated with using airSlate SignNow for my pa schedule ue?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan provides access to essential features for managing your pa schedule ue, ensuring you get the best value for your investment.

-

What features does airSlate SignNow provide for completing the pa schedule ue?

airSlate SignNow includes features such as eSignature capabilities, document sharing, and real-time collaboration, all of which enhance the process of completing your pa schedule ue. These tools help ensure accuracy and efficiency in your document management.

-

Can I integrate airSlate SignNow with other software for my pa schedule ue?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to connect your existing tools for a smoother workflow. This integration can help you manage your pa schedule ue alongside other financial documents and processes.

-

What are the benefits of using airSlate SignNow for my pa schedule ue?

Using airSlate SignNow for your pa schedule ue offers numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are signed and stored securely, giving you peace of mind.

-

How secure is airSlate SignNow when handling my pa schedule ue?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Your pa schedule ue and other sensitive documents are protected, ensuring that your information remains confidential and secure.

Get more for PA Schedule UE Allowable Employee Business Expenses PA 40 UE

- Gopher resources form

- America the story of us heartland worksheet pdf form

- Healerslibrary com what is the emotion code form

- Pdf form example

- Crti rto form

- Pmrf to philippine health insurance corporation dlsu edu form

- Lead hazard evaluation notice sample form

- Social work graduate student internship program application form

Find out other PA Schedule UE Allowable Employee Business Expenses PA 40 UE

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF