PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications 2019

Understanding the PA Schedule UE

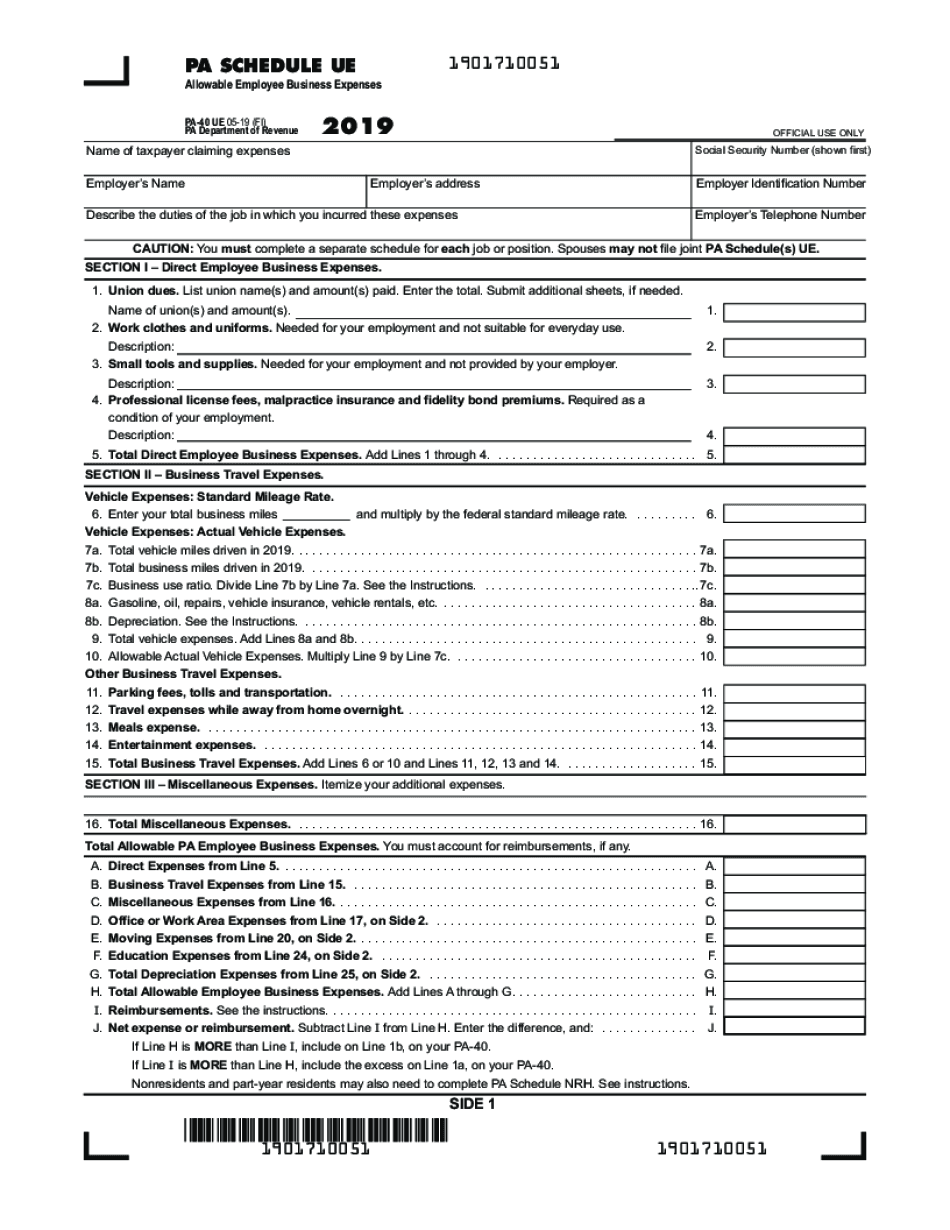

The PA Schedule UE is a form used by employees in Pennsylvania to report allowable business expenses incurred while performing their job duties. This form is essential for individuals who wish to claim deductions on their state income tax returns. The PA Schedule UE allows employees to detail expenses related to travel, meals, lodging, and other necessary costs that are not reimbursed by their employers. Understanding this form is crucial for ensuring compliance with Pennsylvania tax regulations and maximizing potential deductions.

Steps to Complete the PA Schedule UE

Completing the PA Schedule UE involves several key steps:

- Gather all relevant documentation, including receipts and records of expenses.

- Fill out personal information, including your name, address, and Social Security number.

- Detail each allowable expense in the appropriate sections of the form, ensuring accuracy in amounts claimed.

- Calculate the total expenses and ensure they align with the guidelines provided by the Pennsylvania Department of Revenue.

- Review the completed form for any errors before submission.

Legal Use of the PA Schedule UE

The PA Schedule UE is legally binding when completed accurately and submitted in compliance with Pennsylvania tax laws. To ensure that the form is recognized by state authorities, it is important to adhere to the specific instructions provided by the Pennsylvania Department of Revenue. This includes using the correct form version for the tax year and ensuring that all claimed expenses are legitimate and substantiated by proper documentation.

Key Elements of the PA Schedule UE

Several key elements are essential when filling out the PA Schedule UE:

- Employee Information: Personal details must be accurately entered to identify the taxpayer.

- Expense Categories: The form includes specific sections for different types of expenses, such as travel and meals.

- Total Expenses: A summary of all claimed expenses is required to calculate the total deduction.

- Signature: The form must be signed to validate the information provided.

Filing Deadlines for the PA Schedule UE

Filing deadlines for the PA Schedule UE align with the Pennsylvania state income tax deadlines. Typically, the form must be submitted by April 15 of the following year after the tax year ends. It is advisable to check for any extensions or changes to deadlines that may occur due to specific circumstances or legislative changes.

Examples of Using the PA Schedule UE

Employees can utilize the PA Schedule UE in various scenarios, such as:

- Claiming travel expenses incurred while attending work-related conferences.

- Reporting costs for meals during business trips that are not reimbursed by the employer.

- Documenting necessary supplies purchased for job functions that were not covered by the employer.

Obtaining the PA Schedule UE

The PA Schedule UE can be obtained through the Pennsylvania Department of Revenue's website or by contacting their offices directly. It is available in both digital and paper formats, allowing for flexibility in how individuals choose to complete and submit their forms. Ensuring that you have the correct version for the applicable tax year is important for compliance.

Quick guide on how to complete 2019 pa schedule ue allowable employee business expenses pa 40 ue formspublications

Complete PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers a great eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, alter, and eSign your documents quickly and easily. Manage PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications with ease

- Obtain PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 pa schedule ue allowable employee business expenses pa 40 ue formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2019 pa schedule ue allowable employee business expenses pa 40 ue formspublications

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

What is the pa schedule ue and how does it work with airSlate SignNow?

The pa schedule ue is a crucial form for Pennsylvania resident individuals to report their income and taxes effectively. With airSlate SignNow, you can easily prepare, send, and eSign your pa schedule ue documents, ensuring compliance and accuracy. Our user-friendly platform simplifies the process so you can focus on your financial obligations.

-

How much does airSlate SignNow cost for managing pa schedule ue documents?

airSlate SignNow offers competitive pricing plans tailored for individuals and businesses alike. Depending on your needs, our pricing is designed to provide an affordable solution for managing your pa schedule ue documents efficiently. Explore our different plans to find the one that best fits your budget.

-

What features does airSlate SignNow provide for eSigning pa schedule ue?

airSlate SignNow offers robust features for eSigning pa schedule ue documents, including customizable templates, reusable links, and secure storage. With our advanced tracking system, you can monitor the signing progress seamlessly. These features ensure that your documents are signed and sent promptly.

-

Can I integrate airSlate SignNow with other applications for my pa schedule ue needs?

Yes, airSlate SignNow integrates effortlessly with various third-party applications, allowing you to streamline your workflow when managing pa schedule ue paperwork. Whether you use CRM systems, cloud storage, or productivity tools, our integrations enhance your overall efficiency. This makes it even easier to handle your tax documents.

-

Is airSlate SignNow secure for handling sensitive pa schedule ue information?

Absolutely! airSlate SignNow prioritizes the security of your documents, including sensitive pa schedule ue data. We use state-of-the-art encryption technology to protect your information throughout the signing process. Rest assured that your data remains confidential and secure.

-

What benefits does airSlate SignNow offer for small businesses handling pa schedule ue filings?

For small businesses, airSlate SignNow simplifies the process of managing pa schedule ue filings, saving time and reducing administrative overhead. Our platform enhances collaboration by enabling multiple signers to review and complete documents swiftly. This results in a smoother workflow and helps your business meet tax deadlines efficiently.

-

How can I get started with airSlate SignNow for my pa schedule ue needs?

Getting started with airSlate SignNow for your pa schedule ue needs is simple. Sign up for an account on our website, choose the plan that suits you best, and start uploading or creating your documents. Our intuitive interface and customer support will guide you through the process.

Get more for PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications

- Mutual wills package with last wills and testaments for married couple with adult children vermont form

- Mutual wills package with last wills and testaments for married couple with no children vermont form

- Mutual wills package with last wills and testaments for married couple with minor children vermont form

- Vt will form

- Legal last will and testament form for civil union partner with adult children vermont

- Legal last will and testament form for a married person with no children vermont

- Legal last will and testament form for a civil union partner with no children vermont

- Legal last will and testament form for married person with minor children vermont

Find out other PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast