Pa Dept of Revenue4 What is Schedue Ue Expenses 2017

Understanding Pennsylvania Expenses

Pennsylvania expenses refer to the costs that residents or businesses incur while conducting activities within the state. These expenses can include various categories such as housing, transportation, healthcare, and education. Understanding these costs is crucial for effective budgeting and financial planning, especially for individuals filing taxes or managing business finances. The Pennsylvania Department of Revenue provides guidelines on what qualifies as allowable expenses, which can significantly impact tax filings.

Key Elements of Pennsylvania Schedule UE

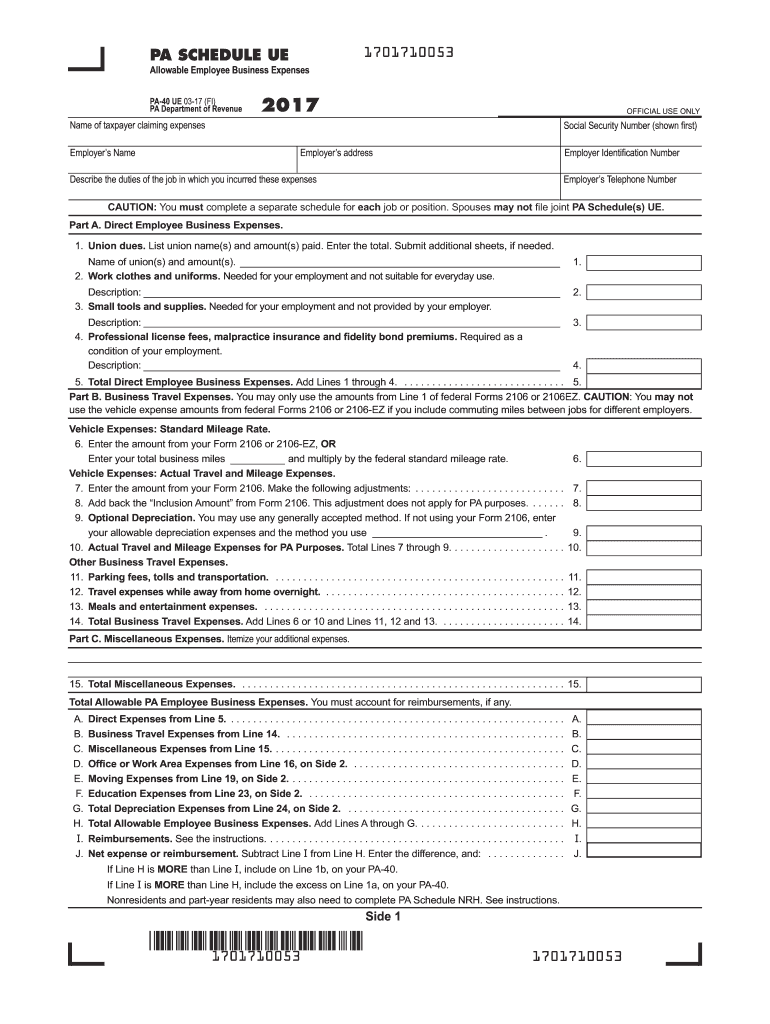

The Pennsylvania Schedule UE is a critical form for taxpayers claiming unreimbursed employee business expenses. Key elements include the types of expenses that can be deducted, such as travel, meals, and professional development costs. It is essential to maintain accurate records of these expenses to substantiate claims. Taxpayers should ensure that they are aware of the specific criteria for each expense category to maximize their deductions and comply with state regulations.

Steps to Complete the Pennsylvania Schedule UE Form

Completing the Pennsylvania Schedule UE form involves several steps to ensure accuracy and compliance. First, gather all necessary documentation, including receipts and records of expenses. Next, fill out the form by entering your personal information and detailing each expense category. Be sure to calculate totals accurately and review the form for any errors before submission. Finally, keep a copy of the completed form and all supporting documents for your records.

Filing Deadlines for Pennsylvania Expenses

Filing deadlines for Pennsylvania expenses are crucial for taxpayers to avoid penalties. Generally, individual income tax returns, including the Schedule UE, are due by April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be aware of any extensions that may apply and ensure that all forms are submitted timely to the Pennsylvania Department of Revenue.

Required Documents for Pennsylvania Schedule UE

When completing the Pennsylvania Schedule UE, specific documents are required to substantiate your claims. This includes receipts for all unreimbursed expenses, W-2 forms from employers, and any other documentation that verifies income and expenses. Keeping organized records will facilitate the completion of the form and support your claims in case of an audit by the Pennsylvania Department of Revenue.

Penalties for Non-Compliance with Pennsylvania Expense Reporting

Failure to comply with Pennsylvania expense reporting can result in significant penalties. Taxpayers may face fines, interest on unpaid taxes, and potential audits. It is essential to accurately report all expenses and adhere to the guidelines set forth by the Pennsylvania Department of Revenue to avoid these consequences. Understanding the implications of non-compliance can help taxpayers maintain good standing and avoid unnecessary financial burdens.

Quick guide on how to complete 2017 pa schedule ue pa department of revenue pagov

Prepare Pa Dept Of Revenue4 What Is Schedue Ue Expenses effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can find the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Pa Dept Of Revenue4 What Is Schedue Ue Expenses on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Pa Dept Of Revenue4 What Is Schedue Ue Expenses with ease

- Obtain Pa Dept Of Revenue4 What Is Schedue Ue Expenses and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight signNow sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Verify all the information and click on the Done button to save your changes.

- Select how you want to send your form, by email, SMS, or an invitation link, or download it to your computer.

No more concerns about lost or misfiled documents, tedious form searching, or mistakes that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Pa Dept Of Revenue4 What Is Schedue Ue Expenses and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 pa schedule ue pa department of revenue pagov

Create this form in 5 minutes!

How to create an eSignature for the 2017 pa schedule ue pa department of revenue pagov

How to generate an electronic signature for your 2017 Pa Schedule Ue Pa Department Of Revenue Pagov in the online mode

How to make an electronic signature for the 2017 Pa Schedule Ue Pa Department Of Revenue Pagov in Google Chrome

How to generate an electronic signature for signing the 2017 Pa Schedule Ue Pa Department Of Revenue Pagov in Gmail

How to generate an electronic signature for the 2017 Pa Schedule Ue Pa Department Of Revenue Pagov from your smart phone

How to generate an electronic signature for the 2017 Pa Schedule Ue Pa Department Of Revenue Pagov on iOS devices

How to make an electronic signature for the 2017 Pa Schedule Ue Pa Department Of Revenue Pagov on Android OS

People also ask

-

What are Pennsylvania expenses related to electronic signatures?

In Pennsylvania, expenses related to electronic signatures often include costs associated with implementing eSignature solutions like airSlate SignNow. These may encompass subscription fees, transaction costs, and any additional charges for integrations or support services. Utilizing an efficient platform can help businesses manage Pennsylvania expenses effectively while streamlining their document signing processes.

-

How does airSlate SignNow help reduce Pennsylvania expenses?

airSlate SignNow offers a cost-effective solution for businesses looking to manage Pennsylvania expenses efficiently. By automating document workflows and minimizing paper usage, companies can signNowly decrease operational costs. Additionally, the platform's straightforward pricing model allows organizations to budget for eSignature needs without unexpected charges.

-

What features does airSlate SignNow offer to manage Pennsylvania expenses?

airSlate SignNow includes features that allow users to create, send, and eSign documents seamlessly, helping businesses better manage Pennsylvania expenses. Features like customizable templates and bulk send options enable organizations to save time and reduce costs. Moreover, the solution provides tracking and reporting tools to enhance financial oversight.

-

Can airSlate SignNow integrate with other software to track Pennsylvania expenses?

Yes, airSlate SignNow offers integrations with popular software solutions like CRM and accounting tools that can assist businesses in tracking Pennsylvania expenses. By connecting these platforms, users can efficiently manage documentation and financial records. This integration streamlines workflows, ensuring that all expense data is accurate and up-to-date.

-

Is airSlate SignNow suitable for small businesses dealing with Pennsylvania expenses?

Absolutely. airSlate SignNow is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses facing Pennsylvania expenses. The platform's low-cost plans and intuitive interface enable small teams to manage their eSignature needs without the complexity of larger solutions. This helps reduce overhead while increasing productivity.

-

What benefits can businesses expect when using airSlate SignNow for Pennsylvania expenses?

Businesses can expect numerous benefits when using airSlate SignNow to handle Pennsylvania expenses. These include faster document turnaround times, reduced reliance on paper, and lower operational costs. The platform's ability to maintain compliance with legal standards for electronic signatures also ensures that businesses avoid potential penalties associated with improper documentation.

-

How can airSlate SignNow enhance workflow efficiency related to Pennsylvania expenses?

airSlate SignNow can dramatically enhance workflow efficiency related to Pennsylvania expenses through its automation features. By reducing the need for manual signatures and streamlining the document management process, businesses can respond to clients and partners more swiftly. This increased efficiency translates into reduced costs and improved cash flow for managing Pennsylvania expenses.

Get more for Pa Dept Of Revenue4 What Is Schedue Ue Expenses

Find out other Pa Dept Of Revenue4 What Is Schedue Ue Expenses

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement