Schedule K 1 100S, Shareholder's Share of Income, Deductions, Credits, Etc 2024-2026

What is the Schedule K-1 (100S)

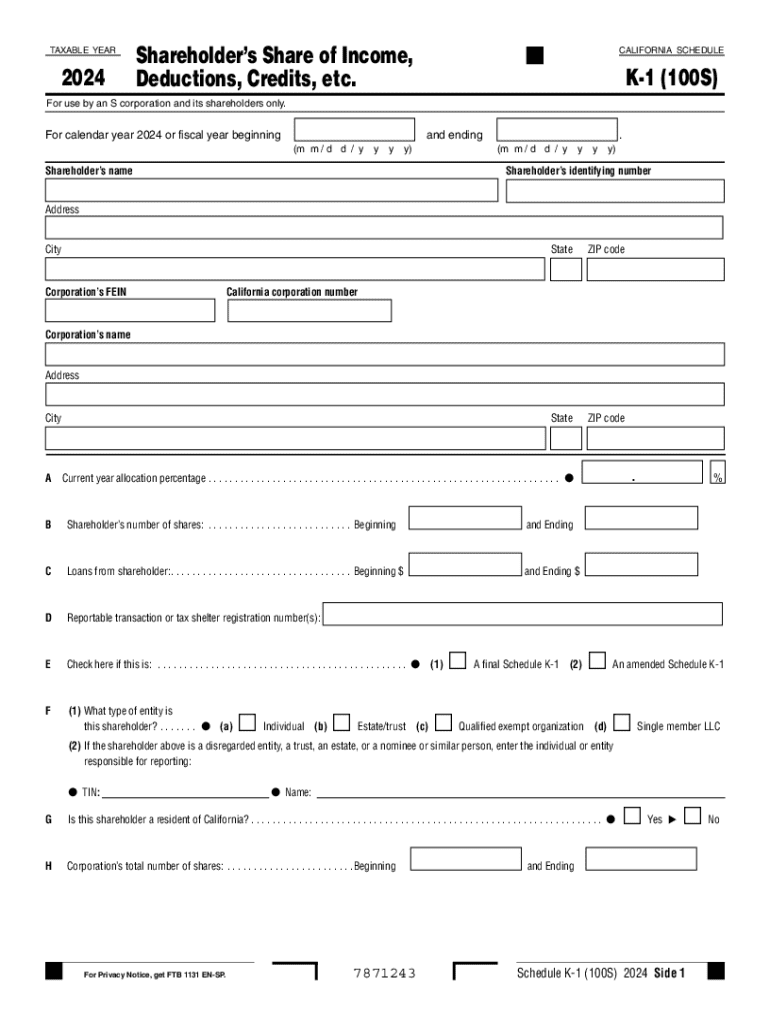

The Schedule K-1 (100S) is a tax form used in the United States for S corporations. It reports each shareholder's share of the corporation's income, deductions, credits, and other tax-related items. This form is essential for shareholders as it provides the necessary information to accurately report their share of the corporation's financial results on their personal tax returns. Each shareholder receives a K-1, which details their portion of the corporation's earnings and losses, ensuring that income is taxed at the individual level rather than at the corporate level.

How to Use the Schedule K-1 (100S)

Using the Schedule K-1 (100S) involves several steps. Shareholders must first receive their K-1 from the S corporation, which outlines their specific share of income, deductions, and credits. Once received, shareholders should carefully review the form for accuracy and ensure that all amounts are correctly reported. The information from the K-1 is then transferred to the shareholder's personal tax return, typically on Form 1040. It is crucial to report this information accurately to avoid potential issues with the IRS.

Steps to Complete the Schedule K-1 (100S)

Completing the Schedule K-1 (100S) requires attention to detail. The process typically includes the following steps:

- Gather necessary financial documents from the S corporation.

- Review the K-1 for accuracy, ensuring all amounts align with the corporation's records.

- Transfer the reported income, deductions, and credits to the appropriate sections of your personal tax return.

- Consult with a tax professional if there are any discrepancies or questions regarding the form.

Key Elements of the Schedule K-1 (100S)

The Schedule K-1 (100S) includes several key elements that are important for shareholders. These elements typically consist of:

- Shareholder's name and identification information.

- Corporation's name and Employer Identification Number (EIN).

- Shareholder's percentage of ownership in the corporation.

- Details of income, deductions, and credits allocated to the shareholder.

Understanding these components is vital for accurate tax reporting and compliance.

Filing Deadlines for the Schedule K-1 (100S)

Filing deadlines for the Schedule K-1 (100S) are aligned with the S corporation's tax return deadlines. Generally, S corporations must file their tax returns by the fifteenth day of the third month after the end of their tax year. For most corporations following the calendar year, this means the K-1 forms should be issued to shareholders by March 15. Shareholders should ensure they receive their K-1 in a timely manner to meet their personal tax filing deadlines.

IRS Guidelines for the Schedule K-1 (100S)

The IRS provides specific guidelines for the completion and submission of the Schedule K-1 (100S). It is essential for both the S corporation and its shareholders to adhere to these guidelines to ensure compliance. Key points include:

- Accurate reporting of all income and deductions.

- Timely issuance of K-1 forms to shareholders.

- Proper filing of the S corporation's tax return, including the K-1s.

Following these guidelines helps prevent penalties and ensures smooth processing of tax returns.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 100s shareholders share of income deductions credits etc

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 100s shareholders share of income deductions credits etc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ftb k 1 100s form and why is it important?

The ftb k 1 100s form is a crucial document used for reporting income, deductions, and credits for partnerships and S corporations in California. It ensures that all partners receive their share of the income and can report it accurately on their tax returns. Understanding this form is essential for compliance and maximizing tax benefits.

-

How can airSlate SignNow help with the ftb k 1 100s form?

airSlate SignNow simplifies the process of preparing and signing the ftb k 1 100s form by providing an intuitive platform for document management. Users can easily create, send, and eSign the form, ensuring that all necessary parties can review and approve it quickly. This streamlines the workflow and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for ftb k 1 100s?

airSlate SignNow offers flexible pricing plans that cater to various business needs, making it cost-effective for managing the ftb k 1 100s form. Plans typically include features like unlimited document signing and templates, ensuring you get the best value. You can choose a plan that fits your budget and requirements.

-

Are there any integrations available for managing the ftb k 1 100s form?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage the ftb k 1 100s form. You can connect it with popular tools like Google Drive, Salesforce, and more, allowing for efficient document storage and retrieval. This integration helps streamline your workflow and improve productivity.

-

What features does airSlate SignNow offer for the ftb k 1 100s form?

airSlate SignNow provides a range of features specifically designed to assist with the ftb k 1 100s form, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your documents are handled efficiently and securely, making the process of completing the form much easier.

-

Can I use airSlate SignNow on mobile devices for the ftb k 1 100s form?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to manage the ftb k 1 100s form on the go. Whether you need to send, sign, or track documents, you can do it all from your smartphone or tablet, providing flexibility and convenience.

-

What are the benefits of using airSlate SignNow for the ftb k 1 100s form?

Using airSlate SignNow for the ftb k 1 100s form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, which speeds up the process signNowly. Additionally, it helps ensure compliance with legal requirements.

Get more for Schedule K 1 100S, Shareholder's Share Of Income, Deductions, Credits, Etc

- Koswip online form

- Natwest mortgage application form

- Pesticide sign up form

- Modle ouverture de compte client word 305014489 form

- Semi structured interview questions for a parentguardian of a child wacsep form

- Rental parking agreement waterloo student residences form

- British heart foundation donation form

- Please copy and paste any of the fundraising templates form

Find out other Schedule K 1 100S, Shareholder's Share Of Income, Deductions, Credits, Etc

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy