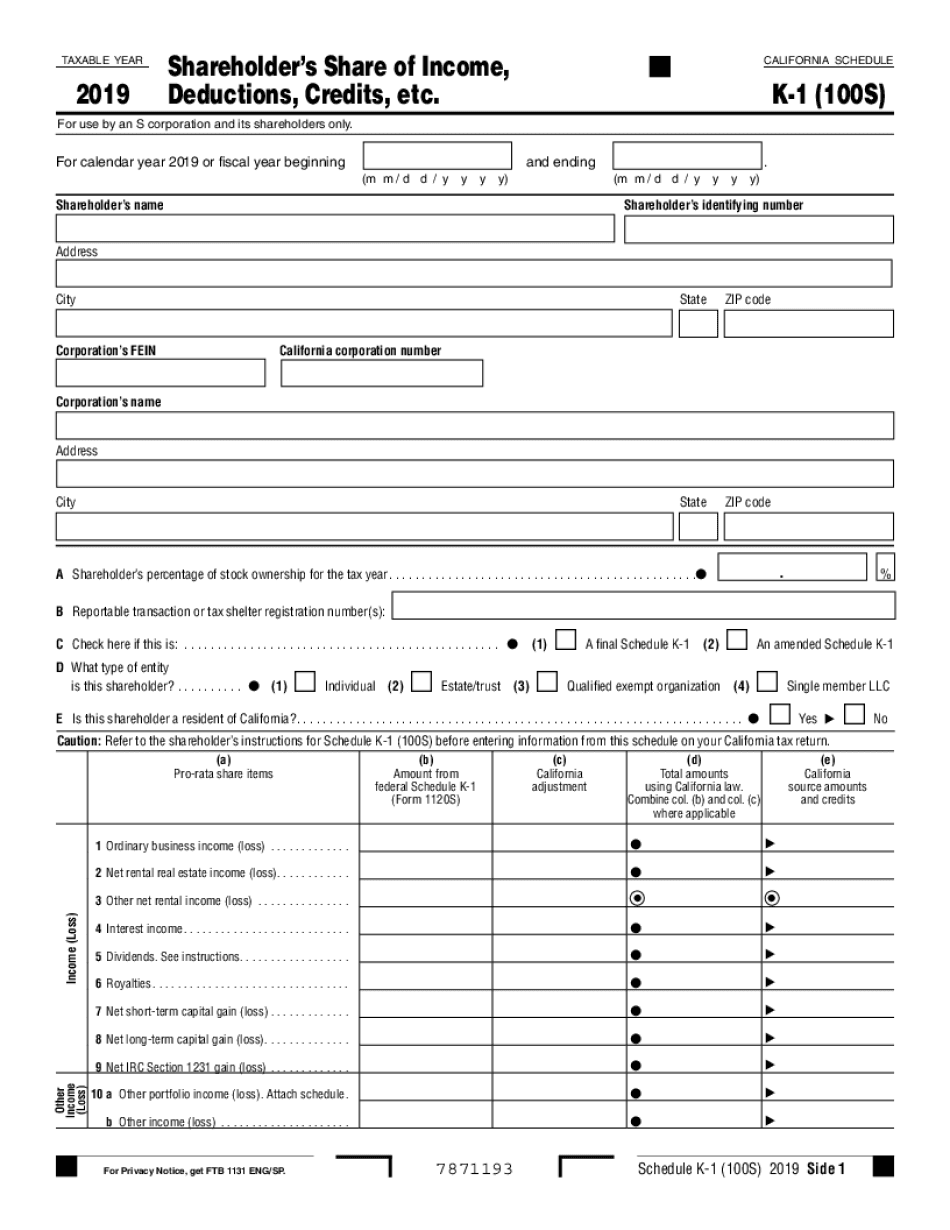

California Shareholder's Share of Income, Deductions, Credits 2019

What is the California Shareholder's Share Of Income, Deductions, Credits

The California Shareholder's Share Of Income, Deductions, Credits refers to the portion of a corporation's income, deductions, and credits that is allocated to each shareholder. This allocation is crucial for shareholders as it affects their individual tax liabilities. The form captures the financial performance of the corporation and distributes it among shareholders based on their ownership percentage. It is essential for accurate reporting on personal income tax returns, ensuring that shareholders report their share of the corporation's financial activities correctly.

Steps to complete the California Shareholder's Share Of Income, Deductions, Credits

Completing the California Shareholder's Share Of Income, Deductions, Credits involves several steps:

- Gather necessary financial documents from the corporation, including income statements and balance sheets.

- Determine your ownership percentage in the corporation to accurately allocate income, deductions, and credits.

- Fill out the form by entering your share of the corporation's income, deductions, and credits as reported.

- Review the completed form for accuracy and ensure all calculations are correct.

- Submit the form to the appropriate tax authority, either electronically or via mail, depending on your preference.

Key elements of the California Shareholder's Share Of Income, Deductions, Credits

Understanding the key elements of the California Shareholder's Share Of Income, Deductions, Credits is vital for accurate tax reporting. Key elements include:

- Income Allocation: The total income of the corporation is divided among shareholders based on their ownership stakes.

- Deductions: Shareholders can claim their proportionate share of the corporation's deductions, which can lower their taxable income.

- Credits: Tax credits that the corporation earns can also be passed through to shareholders, reducing their tax liabilities.

- Filing Requirements: Shareholders must report their allocated shares on their personal tax returns, adhering to state and federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the California Shareholder's Share Of Income, Deductions, Credits are critical to avoid penalties. Generally, the form must be filed by the same deadline as the corporation's tax return. Important dates include:

- Corporation tax return due date: Typically the 15th day of the third month after the end of the corporation's fiscal year.

- Extension deadlines: If an extension is filed, the deadline may be extended by six months.

Required Documents

To accurately complete the California Shareholder's Share Of Income, Deductions, Credits, specific documents are necessary. Required documents include:

- Corporation's financial statements, including income statements and balance sheets.

- Prior year tax returns for reference and consistency.

- Any additional documentation supporting income, deductions, and credits claimed.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the California Shareholder's Share Of Income, Deductions, Credits can lead to significant penalties. Common penalties include:

- Late filing penalties, which can accumulate based on how late the form is submitted.

- Interest on unpaid taxes, which accrues from the original due date until paid in full.

- Potential audits by tax authorities, which can result in further scrutiny of financial records.

Quick guide on how to complete california shareholders share of income deductions credits

Complete California Shareholder's Share Of Income, Deductions, Credits effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, adjust, and eSign your documents quickly and without delays. Manage California Shareholder's Share Of Income, Deductions, Credits on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign California Shareholder's Share Of Income, Deductions, Credits with ease

- Find California Shareholder's Share Of Income, Deductions, Credits and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign California Shareholder's Share Of Income, Deductions, Credits and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california shareholders share of income deductions credits

Create this form in 5 minutes!

How to create an eSignature for the california shareholders share of income deductions credits

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What are the California Schedule K-1 100S instructions?

The California Schedule K-1 100S instructions provide detailed guidance on how to report income, deductions, and credits for S corporations in California. It outlines the necessary steps for completing the schedule, ensuring compliance with state tax regulations. Understanding these instructions is crucial for S corporations to accurately file their taxes.

-

How can airSlate SignNow help with California Schedule K-1 100S documentation?

airSlate SignNow offers an easy-to-use platform to send and eSign documents related to California Schedule K-1 100S instructions. With its user-friendly interface, businesses can prepare, sign, and manage their K-1 forms efficiently, reducing errors and saving time. This streamlines the process of tax documentation for S corporations.

-

Are there any fees associated with airSlate SignNow for managing California Schedule K-1 100S forms?

airSlate SignNow offers various pricing plans to cater to different business needs. While some features may come at a cost, the platform’s overall pricing structure remains competitive and cost-effective. Investing in airSlate SignNow can save you time and provide a reliable solution for managing California Schedule K-1 100S forms.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features, including customizable templates, eSigning capabilities, and document tracking. These functionalities are designed to enhance the management of California Schedule K-1 100S instructions and other tax-related documents. Users can also collaborate in real-time, improving overall efficiency.

-

Can airSlate SignNow integrate with other accounting software for California Schedule K-1 100S?

Yes, airSlate SignNow offers integration capabilities with various accounting and financial software. This allows for seamless import and export of data related to California Schedule K-1 100S instructions, helping businesses streamline their workflow and improve accuracy in their tax filings. It's a convenient feature for handling tax documents.

-

What are the benefits of using airSlate SignNow for California Schedule K-1 100S forms?

Using airSlate SignNow simplifies the process of preparing and eSigning California Schedule K-1 100S forms. Its efficient workflow reduces time spent on administrative tasks and minimizes the risk of errors. Ultimately, airSlate SignNow can help businesses ensure compliance while saving valuable resources.

-

Is support available for questions about California Schedule K-1 100S instructions?

airSlate SignNow provides customer support to assist users with any questions regarding California Schedule K-1 100S instructions. Whether you need help with the features or specific compliance questions, their support team is readily available. This enhances user experience and ensures proper handling of tax-related documents.

Get more for California Shareholder's Share Of Income, Deductions, Credits

- Pro hac vice 497426577 form

- Contingency retainer form

- Attorney hourly rate form

- Injury intake form

- Checklist short of sequential activities to organize automobile action form

- Checklist long of sequential activities to organize automobile action form

- Affidavit custodian form

- Authorization employment information

Find out other California Shareholder's Share Of Income, Deductions, Credits

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer