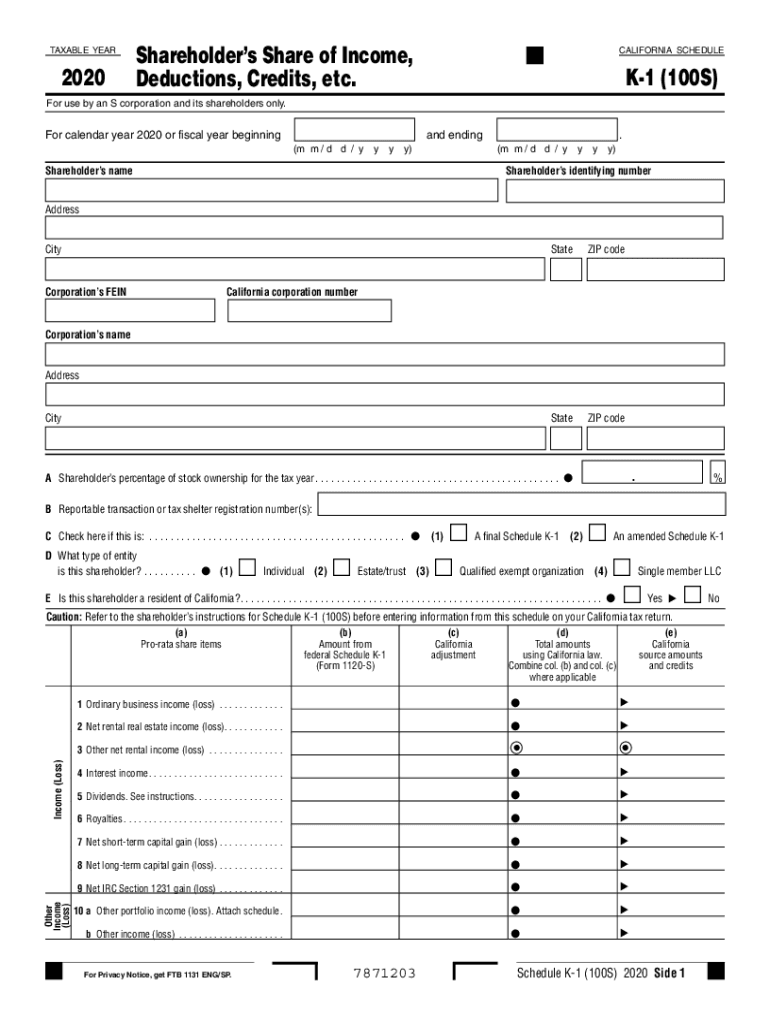

Schedule K 1 100S, Shareholder's Share of Income, Deductions, Credits, Etc , Schedule K 1 100S, Shareholder's Share of Income, D 2020

Understanding the Schedule K-1 100S

The Schedule K-1 100S, also known as the Shareholder's Share of Income, Deductions, Credits, Etc., is a crucial tax document for shareholders of S corporations in California. This form details each shareholder's share of the corporation's income, deductions, and credits, which must be reported on their individual tax returns. The information provided on the K-1 helps ensure that shareholders accurately report their income and comply with tax regulations.

Steps to Complete the Schedule K-1 100S

Completing the Schedule K-1 100S involves several key steps to ensure accuracy and compliance:

- Gather necessary information about the S corporation, including its federal and state identification numbers.

- Collect data on the corporation's income, deductions, and credits from the business records.

- Fill out the K-1 form, ensuring that each section is completed accurately, reflecting the shareholder's share of the corporation's financial activities.

- Review the completed form for any errors or omissions before submission.

Legal Use of the Schedule K-1 100S

The Schedule K-1 100S is legally binding and must be used in accordance with IRS guidelines. It serves as an official record of a shareholder's share of the S corporation's income and deductions. Properly completing and filing this form is essential for compliance with tax laws, and failure to do so can result in penalties or audits.

How to Obtain the Schedule K-1 100S

Shareholders can obtain the Schedule K-1 100S from the S corporation directly. The corporation is responsible for preparing and distributing the K-1 forms to its shareholders after the end of the tax year. It is important for shareholders to ensure they receive their K-1 in a timely manner to facilitate accurate tax reporting.

Key Elements of the Schedule K-1 100S

The Schedule K-1 100S includes several important elements that shareholders must understand:

- Shareholder Information: This section includes the name, address, and taxpayer identification number of the shareholder.

- Income and Deductions: Detailed breakdowns of the shareholder's share of the corporation's income, losses, and deductions.

- Credits: Any tax credits that the shareholder is entitled to based on their share of the corporation's activities.

Filing Deadlines for the Schedule K-1 100S

It is essential for shareholders to be aware of the filing deadlines for the Schedule K-1 100S. The S corporation must provide the K-1 forms to shareholders by the due date of the corporation's tax return, which is typically March 15 for calendar year filers. Shareholders must then use the information from the K-1 to complete their individual tax returns by the April 15 deadline.

Quick guide on how to complete 2020 schedule k 1 100s shareholders share of income deductions credits etc 2020 schedule k 1 100s shareholders share of income

Effortlessly Prepare Schedule K 1 100S, Shareholder's Share Of Income, Deductions, Credits, Etc , Schedule K 1 100S, Shareholder's Share Of Income, D on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule K 1 100S, Shareholder's Share Of Income, Deductions, Credits, Etc , Schedule K 1 100S, Shareholder's Share Of Income, D on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Schedule K 1 100S, Shareholder's Share Of Income, Deductions, Credits, Etc , Schedule K 1 100S, Shareholder's Share Of Income, D with Ease

- Find Schedule K 1 100S, Shareholder's Share Of Income, Deductions, Credits, Etc , Schedule K 1 100S, Shareholder's Share Of Income, D and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize essential sections of the documents or cover sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review the details carefully and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Schedule K 1 100S, Shareholder's Share Of Income, Deductions, Credits, Etc , Schedule K 1 100S, Shareholder's Share Of Income, D and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule k 1 100s shareholders share of income deductions credits etc 2020 schedule k 1 100s shareholders share of income

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule k 1 100s shareholders share of income deductions credits etc 2020 schedule k 1 100s shareholders share of income

The way to make an e-signature for your PDF file in the online mode

The way to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is an FTB K1 form?

The FTB K1 form is used to report income, deductions, and credits from partnerships and S corporations. If you're a business owner, understanding how to fill out the FTB K1 is crucial for accurate tax reporting. Proper management of your FTB K1 can simplify your tax processes and improve compliance.

-

How does airSlate SignNow facilitate the signing of FTB K1 forms?

airSlate SignNow offers an easy-to-use platform for electronically signing your FTB K1 forms. With just a few clicks, you can upload your document, prepare it for signing, and send it to your partners or stakeholders. This streamlines your workflow and ensures that your forms are signed quickly and securely.

-

What are the pricing options for using airSlate SignNow with FTB K1 forms?

airSlate SignNow offers flexible pricing plans designed to fit various business needs. Whether you’re a solo entrepreneur or part of a larger organization, you can find a plan that allows you to efficiently manage your FTB K1 forms. Contact us for detailed pricing information tailored to your usage.

-

What features does airSlate SignNow provide for managing FTB K1 forms?

airSlate SignNow provides a comprehensive suite of features for managing FTB K1 forms, including document templates, e-signatures, and secure cloud storage. These features help ensure that your forms are signed, stored, and organized effectively. Additionally, you can track the status of your FTB K1 forms in real-time.

-

Is airSlate SignNow secure for handling FTB K1 forms?

Yes, airSlate SignNow employs advanced security measures to protect your FTB K1 forms. Our platform uses encryption and complies with industry standards to ensure your documents are safe from unauthorized access. This allows you to focus on your business while we handle the safety of your sensitive information.

-

Can I integrate airSlate SignNow with other tools for my FTB K1 forms?

Absolutely! airSlate SignNow supports seamless integrations with various business tools and applications. This allows you to enhance your workflows and manage your FTB K1 forms without the hassle of switching between different platforms.

-

What benefits do I get from using airSlate SignNow for my FTB K1?

Using airSlate SignNow for your FTB K1 offers numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy in your tax filings. The platform streamlines the e-signing process, saving you time and minimizing errors. Take advantage of our intuitive interface for a hassle-free experience.

Get more for Schedule K 1 100S, Shareholder's Share Of Income, Deductions, Credits, Etc , Schedule K 1 100S, Shareholder's Share Of Income, D

Find out other Schedule K 1 100S, Shareholder's Share Of Income, Deductions, Credits, Etc , Schedule K 1 100S, Shareholder's Share Of Income, D

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later