S Corporation State Business Tax Filing Software TaxAct 2022

IRS Guidelines

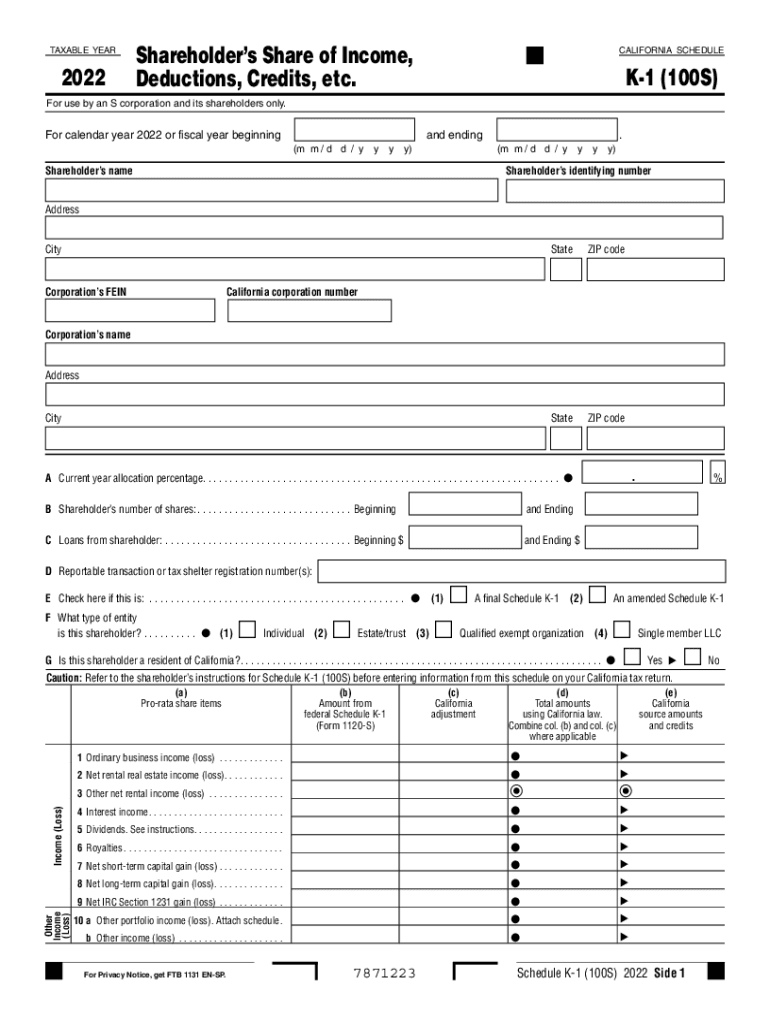

The IRS provides specific guidelines for completing the 2022 Schedule K-1 form. This form is essential for reporting income, deductions, and credits from partnerships and S corporations. Taxpayers should ensure that they follow the IRS instructions closely to avoid errors. The guidelines detail how to report various types of income, including ordinary business income, rental income, and capital gains. Understanding these guidelines is crucial for accurate tax reporting and compliance.

Filing Deadlines / Important Dates

For the 2022 Schedule K-1 form, the filing deadlines align with the tax return deadlines for partnerships and S corporations. Typically, these entities must file their returns by March 15 of the following year. If an extension is filed, the deadline may be extended to September 15. Taxpayers receiving a K-1 should be aware of these dates to ensure timely reporting of their income on their personal tax returns.

Required Documents

To accurately complete the 2022 Schedule K-1 form, several documents are necessary. Taxpayers should gather their partnership or S corporation agreement, prior year tax returns, and any relevant financial statements. These documents will provide the necessary information regarding the taxpayer's share of income, deductions, and credits. Ensuring all required documentation is available will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

The 2022 Schedule K-1 form can be submitted through various methods. Taxpayers may choose to file electronically using approved tax software, which often simplifies the process and reduces errors. Alternatively, the form can be mailed to the IRS or state tax authorities. In-person submissions are generally not common for K-1 forms, but taxpayers can consult with tax professionals for assistance. Each method has its own advantages, such as speed and convenience, making it essential to choose the best option for individual circumstances.

Penalties for Non-Compliance

Failure to file the 2022 Schedule K-1 form accurately and on time may result in penalties. The IRS imposes fines for late filings, which can accumulate over time. Additionally, incorrect information reported on the K-1 can lead to further scrutiny and potential audits. It is vital for taxpayers to ensure compliance with all filing requirements to avoid these penalties and maintain good standing with the IRS.

Eligibility Criteria

The eligibility to receive a 2022 Schedule K-1 form typically pertains to individuals who are partners in a partnership or shareholders in an S corporation. To qualify, one must have a vested interest in the business and receive a share of the profits or losses. Understanding the eligibility criteria is essential for taxpayers to determine their obligations and rights regarding income reporting.

Digital vs. Paper Version

When completing the 2022 Schedule K-1 form, taxpayers have the option to use either a digital or paper version. The digital version, often completed through tax software, offers advantages such as ease of use and automatic calculations. Conversely, the paper version may be preferred by individuals who are more comfortable with traditional methods. Regardless of the format chosen, accuracy in reporting is paramount.

Quick guide on how to complete s corporation state business tax filing software taxact

Effortlessly prepare S Corporation State Business Tax Filing Software TaxAct on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and efficiently. Manage S Corporation State Business Tax Filing Software TaxAct on any platform using the airSlate SignNow apps for Android or iOS, simplifying any document-related process today.

The easiest method to modify and electronically sign S Corporation State Business Tax Filing Software TaxAct effortlessly

- Find S Corporation State Business Tax Filing Software TaxAct and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive details using tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, either by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Edit and electronically sign S Corporation State Business Tax Filing Software TaxAct to ensure excellent communication throughout your document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct s corporation state business tax filing software taxact

Create this form in 5 minutes!

How to create an eSignature for the s corporation state business tax filing software taxact

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 Schedule K-1 form?

The 2022 Schedule K-1 form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information about an individual's share of the entity's income, which must be reported on their personal tax return. Understanding how to properly handle the 2022 Schedule K-1 form can signNowly affect your tax filings.

-

How can airSlate SignNow assist with the 2022 Schedule K-1 form?

airSlate SignNow simplifies the process of managing the 2022 Schedule K-1 form by enabling users to send and eSign the document securely and efficiently. The platform ensures that all parties involved can easily review and approve the form, reducing the hassle of physical document management. With SignNow, you can streamline your tax preparation process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. With options ranging from basic to advanced features, users can select a plan that best meets their needs while managing important documents like the 2022 Schedule K-1 form. Pricing is transparent, and each plan includes essential tools for efficient document management.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSignatures?

Yes, airSlate SignNow is designed with ease of use in mind, making it accessible even for those unfamiliar with eSignatures. The interface is intuitive, allowing users to quickly navigate through the process of preparing and sending the 2022 Schedule K-1 form. Comprehensive tutorials and support are available to assist new users.

-

Can I track the status of my 2022 Schedule K-1 form with airSlate SignNow?

Absolutely! airSlate SignNow features a robust tracking system that allows users to monitor the status of their 2022 Schedule K-1 form in real time. You will receive notifications when the document is opened, signed, and completed, ensuring you stay informed throughout the process.

-

What integrations does airSlate SignNow offer?

airSlate SignNow integrates seamlessly with a variety of other applications, enhancing your business workflows. Whether you’re using accounting software, CRM tools, or cloud storage services, these integrations allow for a smooth experience when managing documents like the 2022 Schedule K-1 form. This connectivity helps centralize all your important processes.

-

Are electronic signatures legally binding for the 2022 Schedule K-1 form?

Yes, electronic signatures gathered through airSlate SignNow are legally binding, in compliance with federal and state regulations. This means your executed 2022 Schedule K-1 form holds the same legal weight as a handwritten signature. This capability can streamline tax filing and ensure that all documents are properly executed.

Get more for S Corporation State Business Tax Filing Software TaxAct

- South dakota name change form

- Petition for name change south dakota form

- South dakota name change 497326390 form

- Sd name change form

- Sd name change form

- South dakota installments fixed rate promissory note secured by residential real estate south dakota form

- South dakota note form

- South dakota installments fixed rate promissory note secured by commercial real estate south dakota form

Find out other S Corporation State Business Tax Filing Software TaxAct

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now